Crypto US shares are displaying renewed energy, with Circle (CRCL), Coinbase (COIN), and Robinhood (HOOD) all posting notable developments. CRCL is up over 18% at the moment and 404% since its IPO, fueled by surging USDC adoption and cross-chain development.

COIN is gaining momentum after new product launches and regulatory progress in Europe, whereas HOOD continues to pattern close to all-time highs with a 102% acquire year-to-date. With every firm approaching key technical ranges, traders are intently watching to see if bullish momentum can maintain.

Circle Web Group (CRCL)

Circle continues increasing its stablecoin dominance on two key fronts: community integration and cross-chain development. The corporate just lately launched native USDC help on the XRP Ledger (XRPL), eliminating the necessity for bridges and permitting builders and establishments to leverage quick straight, low-cost USDC transactions on XRPL.

On the similar time, Circle’s Cross-Chain Switch Protocol (CCTP) hit a report $7.7 billion in stablecoin bridging quantity in Might—an 83% surge from April.

These developments come amid booming efficiency from Circle’s newly listed inventory, CRCL, which opened at the moment up greater than 18%, pushing its post-IPO features to an eye catching 404%.

The corporate’s refusal of Ripple’s $5 billion acquisition provide, mixed with its increasing institutional partnerships, has fueled bullish sentiment.

Presently buying and selling round $158, some analysts have set a goal worth as excessive as $300, citing the agency’s sturdy positioning within the stablecoin area. Nevertheless, if momentum stalls, CRCL’s nearest sturdy technical help lies close to $120.

Coinbase World (COIN)

Coinbase (COIN) is gaining renewed consideration because it continues to strengthen each its product choices and world regulatory presence.

In a significant improvement, Coinbase partnered with Shopify and Stripe to allow USDC stablecoin funds on Shopify’s Base-integrated checkout system. This characteristic permits retailers to simply accept crypto funds while not having new infrastructure, providing settlement in both USDC or native fiat currencies.

On the similar time, Coinbase is reportedly nearing approval for a full EU crypto license by Luxembourg—an necessary milestone beneath the MiCA framework—which might grant the alternate regulatory entry throughout the European Union. T

COIN shares are up 2.7% on the time of writing, reflecting rising investor optimism. Following a 76% year-over-year income surge and up to date product bulletins throughout its State of Crypto Summit, analysts like Rosenblatt Securities proceed to charge the inventory a “Buy,” with a $300 goal.

If Coinbase regains the bullish momentum seen earlier in Might, it might quickly problem the $265 resistance degree, with $277 as the following key upside goal. Nevertheless, momentum might want to maintain, particularly as buying and selling volumes stay delicate within the close to time period—one thing analysts see as a possible shopping for alternative quite than a crimson flag.

Robinhood Markets (HOOD)

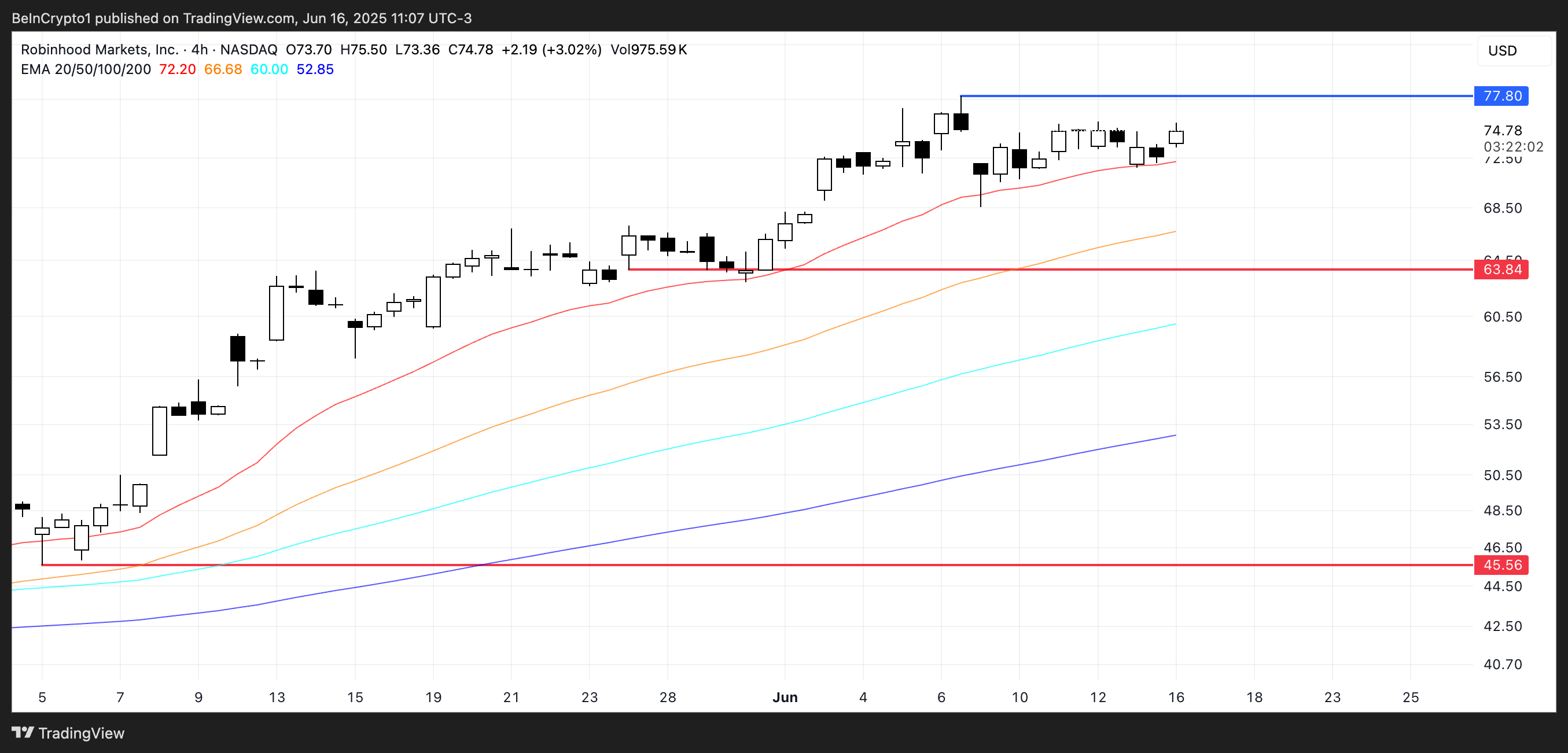

Robinhood (HOOD) continues to commerce close to its all-time excessive, with the replenish almost 102% year-to-date—a standout efficiency within the fintech sector.

Its Exponential Transferring Averages (EMAs) stay firmly bullish, with short-term averages properly above the long-term ones, signaling sturdy underlying momentum.

If this pattern holds, HOOD might quickly check the resistance at $77.8, and a breakout above that degree might open the trail towards $80, marking a brand new all-time excessive and additional validating the inventory’s upward trajectory.

Nevertheless, regardless of the bullish construction, traders ought to monitor key help ranges intently.

The $63.84 help zone is crucial—if damaged, it might probably sign a lack of momentum and a possible pattern reversal.

In that case, HOOD might decline sharply, with $45.56 as the following vital draw back goal.

Disclaimer

In step with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.