Ondo (ONDO), Parcl (PRCL), Mantra (OM), OriginTrail (TRAC), and Clearpool (CPOOL) are 5 RWA altcoins value keeping track of in April 2025.

ONDO holds a $2.4 billion market cap regardless of a 7% drop this week, whereas PRCL has fallen practically 40% amid broader market weak spot. Mantra is down simply 1.5% over the identical interval, exhibiting relative power, although its precise on-chain influence continues to be debated. TRAC and CPOOL are each in correction phases, however key help and resistance ranges may outline their subsequent strikes.

Ondo (ONDO)

Regardless of a 7% decline over the previous seven days, ONDO stays one of many main RWA altcoins in crypto. It holds a powerful place with a market cap close to $2.4 billion.

If the downtrend persists, ONDO may first take a look at key help at $0.73. A breakdown beneath that stage might set off additional losses towards $0.66, and if promoting strain accelerates, the token may slide beneath $0.60 — a stage not seen since early 2024.

Nonetheless, if bulls regain management and reverse the present development, ONDO may start climbing towards resistance at $0.82. A profitable breakout may result in a retest of $0.90 and $0.95, and if the momentum holds, the token may even rally as much as $1.23 — signaling a powerful return of bullish sentiment.

Parcl (PRCL)

Parcl, a decentralized actual property buying and selling platform, present has a market cap nearing $16 billion.

Nonetheless, the final seven days have been tough for PRCL, with its worth plummeting practically 40% amid a broader altcoin correction and waning market sentiment.

If PRCL can recuperate from its present downturn, the primary key resistance stage to observe is $0.073.

A break above that might open the door for a transfer towards $0.10, probably signaling a shift in momentum and restoring some confidence amongst traders on the lookout for a rebound within the RWA house.

On the flip facet, if bearish strain continues, PRCL might slide down to check essential help at $0.050.

Mantra (OM)

Mantra has emerged as one of many standout RWA altcoins in latest months, with its market cap reaching a formidable $6 billion. Not like a lot of its friends, OM has held up comparatively properly in the course of the newest market correction, dropping simply 1.5% over the previous seven days — a a lot smaller decline in comparison with different RWA altcoins. Not too long ago, Binance Analysis printed that RWA altcoins stay safer than Bitcoin throughout tariffs.

Nonetheless, in accordance with Marcos Viriato, CEO of Parfin, it’s too early to declare Mantra because the winner of this cycle:

“It’s still too early to declare a definitive winner. Mantra has executed well and gained momentum, but the RWA space is vast and still maturing. We’re likely to see a multi-platform landscape, with different players excelling in different segments, whether it’s institutional custody, yield generation, or settlement infrastructure. The winners will be those who combine regulatory readiness, composability, and real-world utility and there’s still a lot of room for innovation,” Viriato informed BeInCrypto.

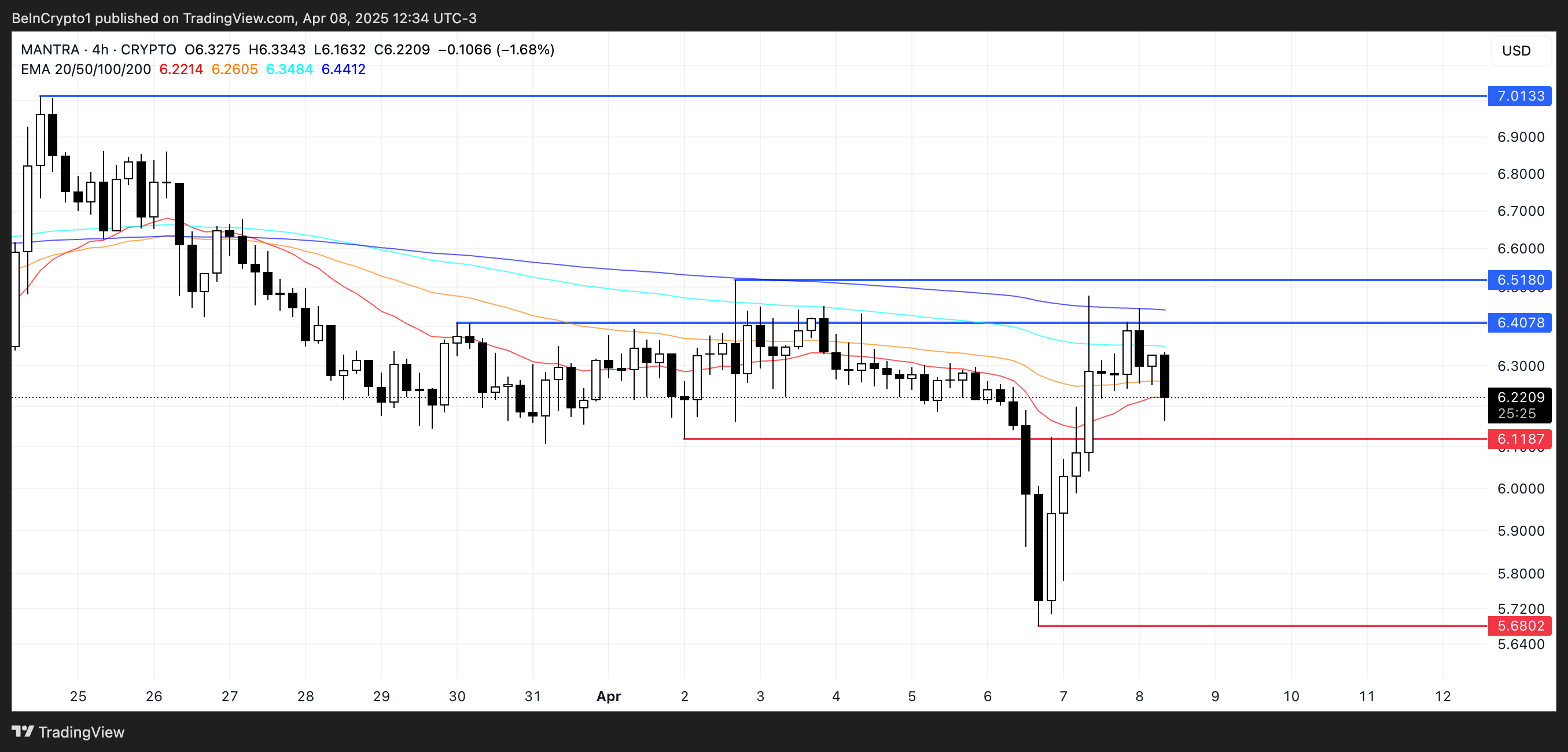

OM continues to be technically in a short-term downtrend. If the correction continues, the token may retest help at $6.11, and a break beneath that stage may push costs right down to $5.68. A lack of that help might sign weakening momentum, particularly if broader market sentiment stays bearish.

Nonetheless, if patrons regain management and the development reverses, Mantra may start shifting increased towards key resistance at $6.40 and $6.51. A profitable breakout above these ranges may set off a stronger rally, probably taking OM again to $7 — a stage that may reinforce its bullish long-term outlook.

Kevin Rusher, founding father of DeFi RWA lending and borrowing ecosystem RAAC.io, defends that regardless of worth motion, Mantra’s worth to the entire RWA ecosystem isn’t that large:

“I think it’s definitely too soon to say that Mantra has cornered the RWA market. If you want to talk about price action, you might declare them the winner so far, but the value they have actually brought on-chain is minimal. According to DeFi Llama, Mantra’s current TVL is just $4.3m – this does not even place it within even the top 45 of RWA projects by TVL,” Rusher informed BeInCrypto.

OriginTrail (TRAC)

TRAC is the native token of OriginTrail, a decentralized ecosystem targeted on constructing a trusted data infrastructure for synthetic intelligence. Its mission is to create a Verifiable Internet for decentralized AI.

Regardless of being down 8.6% over the previous seven days, TRAC is exhibiting indicators of restoration, bouncing 7.6% within the final 24 hours. If this rebound good points momentum, the token may quickly take a look at resistance at $0.37.

A breakout above that stage may pave the way in which for a transfer towards $0.44, signaling a stronger bullish reversal and renewed curiosity within the OriginTrail challenge.

Nonetheless, merchants are intently watching the $0.31 help stage, which stays a essential zone for sustaining the present construction. If TRAC drops and fails to carry that help, the worth may slip beneath $0.30, probably triggering one other wave of draw back strain.

Clearpool (CPOOL)

Clearpool is a decentralized capital markets ecosystem that permits institutional debtors to entry unsecured loans straight from the DeFi apps. In a significant improvement, the challenge just lately launched Ozean — a brand new blockchain initiative targeted on enabling real-world asset (RWA) yield.

CPOOL, Clearpool’s native token, has declined by 7.5% over the previous seven days, dropping beneath the $0.12 mark.

If the present correction continues, the token might take a look at help at $0.106, and a breakdown from that stage may push CPOOL beneath $0.10 — a psychologically important threshold that will improve bearish sentiment.

Nonetheless, if the development reverses and bullish momentum round RWA cash returns, CPOOL may goal for resistance at $0.137. A breakout above that might open the trail towards $0.154 and probably $0.174, relying on the power of the restoration.

Disclaimer

In keeping with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.