March 2025 may carry important value actions amongst prime Actual-World Property (RWA) altcoins. ONDO is trying a restoration after a pointy decline, whereas TRADE struggles at its lowest ranges since November 2023.

In the meantime, OM is surging to new all-time highs, solidifying its place as a dominant drive within the RWA ecosystem. XDC is displaying indicators of a rebound after buying and selling under $0.1, and BKN is gaining momentum with a 20% enhance, pushed by its asset tokenization platform.

Ondo (ONDO)

ONDO has been down virtually 20% within the final seven days, though it’s tried a restoration within the final 24 hours. Its market cap now stands at $3 billion, a major drop from the greater than $5 billion it reached within the final days of January.

Even with this correction, ONDO stays one of many greatest RWA cash, though Mantra lately surpassed its market cap.

If ONDO can regain its momentum from earlier months, it may take a look at the resistance at $1.09. Breaking by this degree may see it rising to $1.25 subsequent, and if the uptrend features sufficient energy, it’d even attain $1.44.

This potential rally might be fueled by ONDO’s stronghold in tokenized credit score markets, a dominance famous by Dave Rademacher, Co-Founding father of OilXCoin, who emphasised ONDO’s strategic place.

“ONDO has carved out a dominant role in tokenized credit markets, securing backing from major players,” Rademacher informed BeInCrypto.

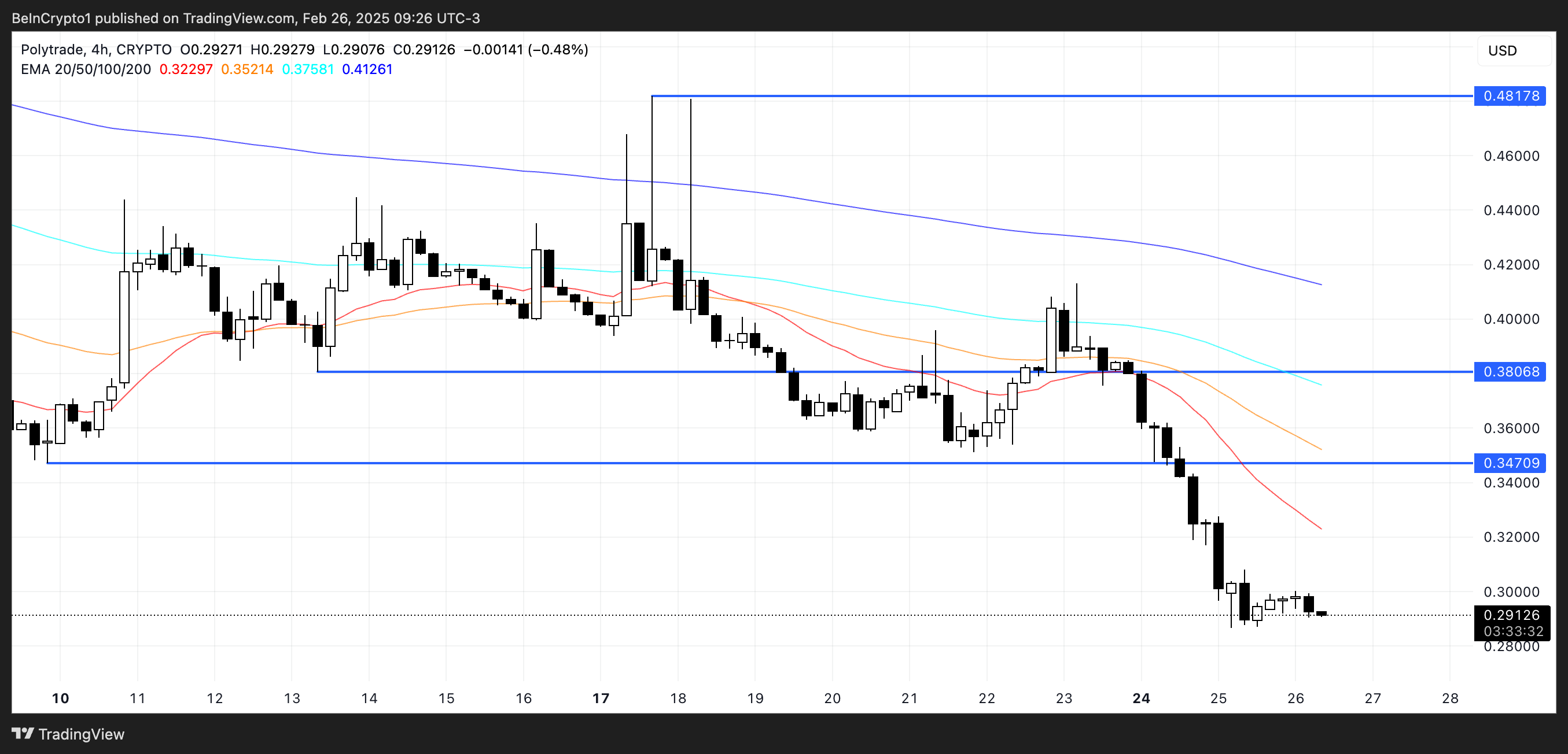

Polytrade (TRADE)

TRADE is down greater than 43% within the final 30 days, with its market cap now standing at $12 million. It’s at the moment buying and selling at its lowest degree since November 2023, reflecting a major loss in momentum.

Polytrade gives a platform for customers to search out, purchase, and commerce RWA property throughout greater than 10 chains. In accordance with their web site, {the marketplace} hosts over 5,000 property.

If TRADE can regain an uptrend, it may take a look at resistances at $0.34 and $0.38. If the bullish momentum is powerful sufficient, breaking by these ranges may push TRADE to as excessive as $0.48.

Though Polytrade stays a small participant and some main gamers dominate the RWA ecosystem, there may be appreciable room for disruption coming from different gamers.

Pat Zhang, Head of WOO X Analysis, highlights this potential:

“Leading RWA projects will likely evolve into infrastructure, while innovation in RWAFi will drive new opportunities. The biggest players are positioned to maintain dominance, but challengers will continuously push for disruption. Whether market share remains concentrated or becomes more distributed will depend on the pace of innovation and overall RWA growth,” Zhang informed BeInCrypto.

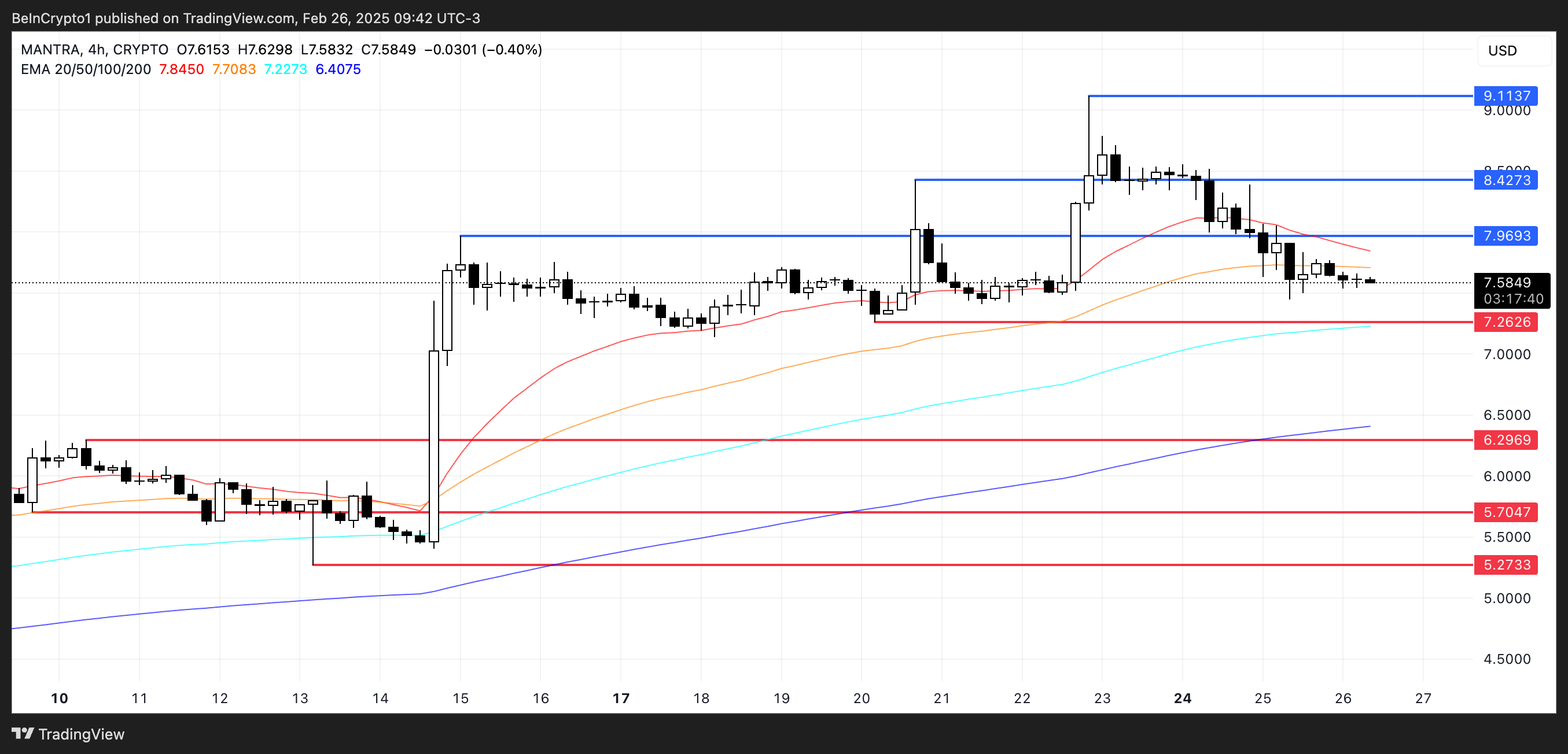

Mantra (OM)

OM is the clear winner within the RWA ecosystem during the last 30 days, with its value surging practically 60% and its market cap reaching a brand new all-time excessive of $8.66 billion on February 22.

This spectacular rally has positioned OM as a dominant drive inside the sector, attracting important consideration from buyers. Nonetheless, regardless of this momentum, questions stay about its sustainability.

If OM’s uptrend continues, it may take a look at the resistances at $7.96 and $8.42. Breaking by these ranges may push OM to new highs above $9 for the primary time, solidifying its place as a pacesetter within the RWA area.

Nonetheless, if the momentum fades, OM may take a look at the assist at $7.26, and if that degree is misplaced, it may decline additional to $6.29. Within the occasion of sturdy promoting strain, the worth may drop as little as $5.70 and even $5.27.

“OM has strong momentum, but its sustainability is uncertain. Quantitative firms like Manifold Trading accumulated OM at lower prices, and if they take profits, the price could decline sharply. OM’s long-term growth depends on whether these early large-scale buyers hold or exit,” mentioned Zhang.

XDC Community (XDC)

XDC is a mainnet that powers a few of the most related RWA functions out there. Regardless of buying and selling under $0.1 for the final two weeks, it made a robust rebound try within the final 24 hours, displaying indicators of renewed momentum.

Nonetheless, XDC value continues to be down roughly 14% during the last 30 days, reflecting the broader market’s volatility.

With this latest rebound, XDC’s market cap is again above $1.3 billion, signaling that investor curiosity stays sturdy.

If the uptrend continues, XDC may take a look at the resistance at $0.098. Ought to this degree be damaged, XDC may push above $1 once more, probably sparking a extra sustained rally.

Nonetheless, if the earlier downtrend resumes, XDC may take a look at the primary assist at $0.072. If this assist is misplaced, the worth may decline additional to $0.059.

Brickken (BKN)

Brickken is a platform for asset tokenization, with greater than $250 million in Whole Tokenized Worth. It permits corporations to tokenize franchises, actual property, enterprise capital, and extra. As establishments more and more enter the RWA ecosystem, regulation is predicted to play a pivotal function in shaping its future.

“Regulatory uncertainty has been the biggest anchor holding back institutional adoption of RWAs in the US. But now, we’re seeing signs that the tide is shifting. Pair that with a new US administration that’s signaling a more pro-crypto stance, and we could be looking at a much-needed regulatory reset,” mentioned Dave Rademacher, Co-Founding father of OilXCoin.

Rademacher additionally identified the significance of regulation in addressing sector-specific challenges:

“If multiple jurisdictions create supportive frameworks for RWAs, the sector will diversify, with new entrants competing across different asset classes. In the end, RWAs are shaping up to be more like traditional finance – where a handful of major players lead, but there’s plenty of room for sector-specific challengers.”

BKN has been up greater than 20% within the final 24 hours, reaching its highest ranges because the starting of February. If this bullish momentum continues, BKN may rise to check the subsequent resistance at $0.33.

Breaking by this degree may see it climb to $0.38 and probably attain $0.43, which might push it above $0.4 for the primary time since January 14.

Nonetheless, if the optimistic momentum fades and a correction happens, BKN may take a look at the assist at $0.24. If that assist is breached, the worth may drop to $0.21 and even as little as $0.18, marking its first dip under $0.20 since September 2024.

Disclaimer

In step with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.