Starknet (STRK) not too long ago launched the primary part of its staking program, triggering a 10% worth surge in simply in the future. This sudden worth motion has attracted the eye of merchants, because the token approaches key resistance ranges. Regardless of the sturdy momentum, technical indicators are portray a combined image of the asset’s outlook.

The Relative Energy Index (RSI) is signaling an overbought situation, which means that STRK might wrestle to keep up its upward trajectory. On the identical time, the Chaikin Cash Movement (CMF) exhibits solely reasonable shopping for stress, elevating questions in regards to the sustainability of the present rally.

Starknet RSI Is Exhibiting an Overbought State

Starknet’s RSI has surged to 77, up from 48 simply two days in the past, indicating that the value has seen a major improve in a brief interval. This sharp rise means that Starknet is now in overbought territory, probably signaling a worth correction.

RSI, or Relative Energy Index, is a technical indicator that measures the pace and magnitude of worth modifications. It operates on a scale of 0 to 100, with ranges above 70 thought-about overbought and ranges beneath 30 thought-about oversold.

Learn extra: A Deep Dive Into Starkware, StarkNet, and StarkEx

If Starknet’s RSI decreases from its present stage, it might present a cooling-off interval, giving the value room to stabilize and probably appeal to new patrons at decrease ranges. Nonetheless, if the RSI stays at 77 or above 70, it’d point out that purchasing stress has peaked, which can restrict additional upward motion and even immediate a sell-off.

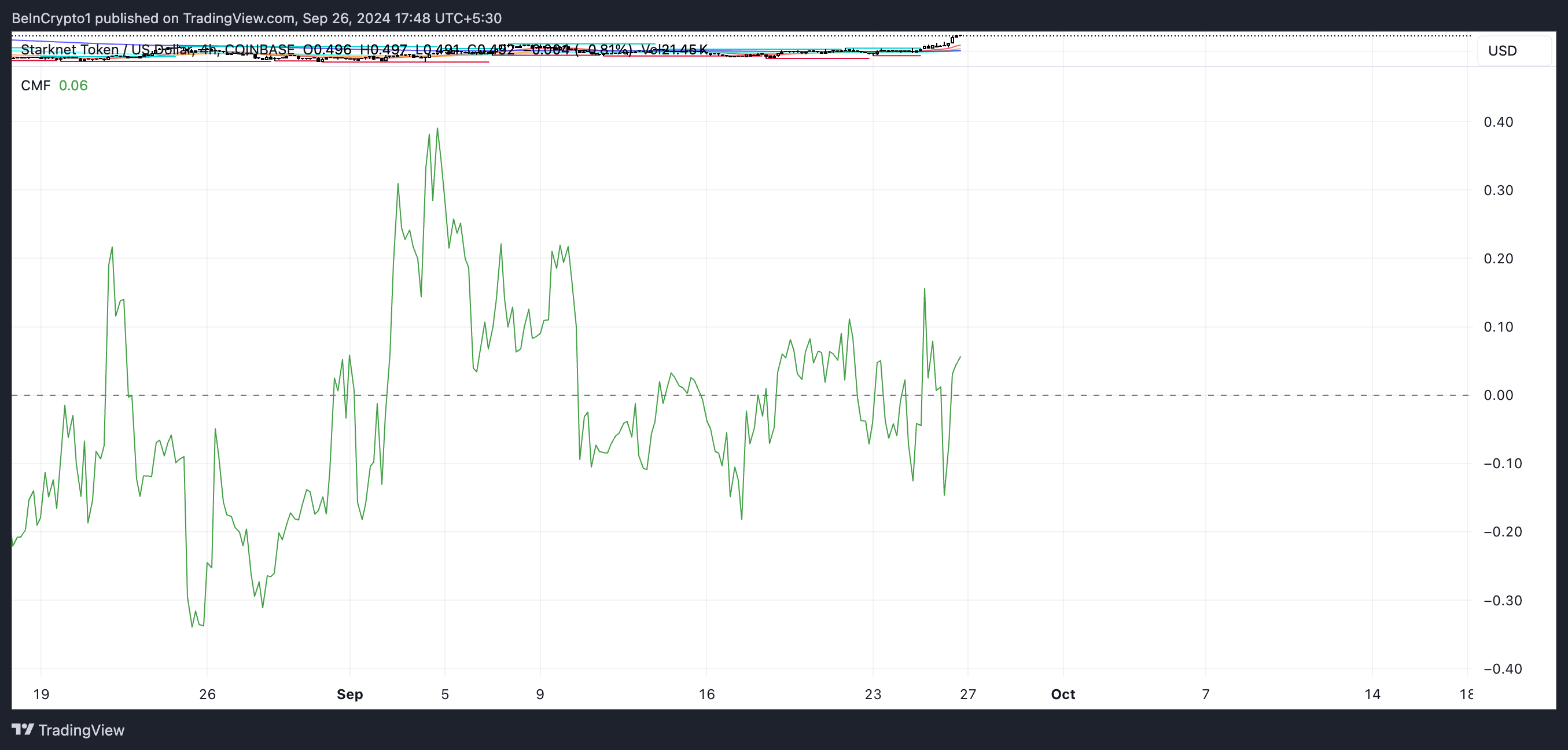

STRK Chaikin Cash Movement Is At the moment Reasonably Optimistic

STRK Chaikin Cash Movement (CMF) is at the moment at 0.06, exhibiting a light however noticeable constructive shopping for stress. Whereas this means that there’s some curiosity within the asset, the shopping for stress isn’t significantly sturdy, that means the influx of capital is modest.

The CMF is a broadly used technical indicator that mixes each worth and quantity information to find out whether or not cash is flowing into or out of an asset. It operates on a scale from -1 to +1, with values above 0 exhibiting web shopping for stress and values beneath 0 indicating web promoting stress.

A studying nearer to +1 alerts sturdy shopping for curiosity, whereas nearer to -1 suggests vital promoting. With STRK’s present CMF at 0.06, the market is exhibiting some help from patrons, but it surely’s not overwhelmingly bullish.

For STRK worth to keep up a gentle improve and even proceed rising considerably, stronger shopping for stress would usually be needed. A CMF worth of 0.06 might point out that whereas there may be some demand, it’s not sufficient to gas a breakout or shield the value from falling if promoting stress begins to rise.

Starknet Worth Prediction: Robust Resistance Forward

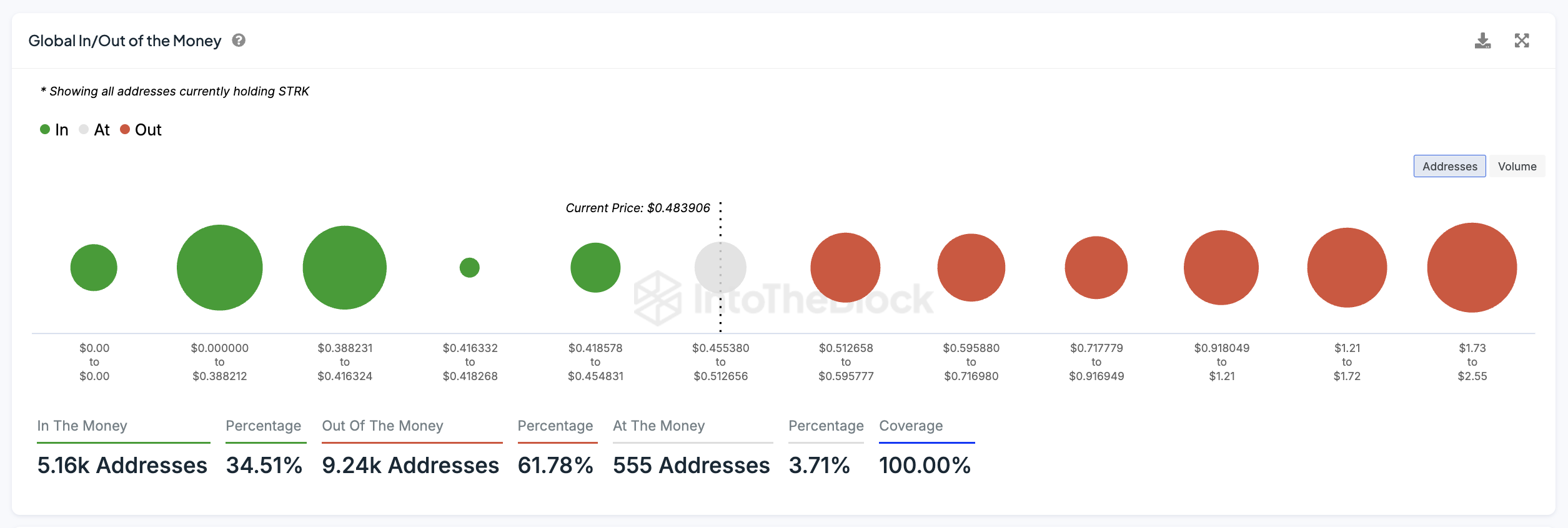

There are sturdy resistance ranges for Starknet (STRK) at $0.51 and $0.59, the place a major variety of addresses are holding tokens at larger costs, probably resulting in promoting stress.

If these resistance zones are damaged, STRK might see an upward transfer towards the subsequent main resistance at $0.91, the place fewer addresses are holding cash permitting for the potential for a faster worth rise if shopping for stress continues.

Learn extra: What Is Crypto Staking? A Information to Incomes Passive Earnings

The International In/Out of the Cash metric presents a helpful view of the addresses holding STRK at numerous revenue ranges. Addresses categorized as “In the Money” (holding STRK at a revenue) are more likely to take income when the value rises, contributing to resistance at key worth ranges. Then again, addresses “Out of the Money” (holding STRK at a loss) might improve promoting stress as they give the impression of being to attenuate their losses.

On the draw back, the help zone between $0.41 and $0.45 is comparatively weak, suggesting this stage might be examined quickly. If patrons don’t step in to help the value on this vary, STRK might expertise an extra drop, probably as little as $0.38, the place a stronger focus of holders is current. This cluster might act as a extra dependable help stage, offering some stability if the value retreats.

Disclaimer

Consistent with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.