Toncoin’s (TON) worth has remained comparatively steady over the previous week. Buying and selling between $5.96 and $5.37, the altcoin has maintained this vary regardless of broader market fluctuations.

Nonetheless, this pattern might quickly be disrupted as two key on-chain metrics level to a possible quick squeeze. This evaluation explores what TON holders ought to anticipate as this unravels.

Toncoin Is at Crossroads

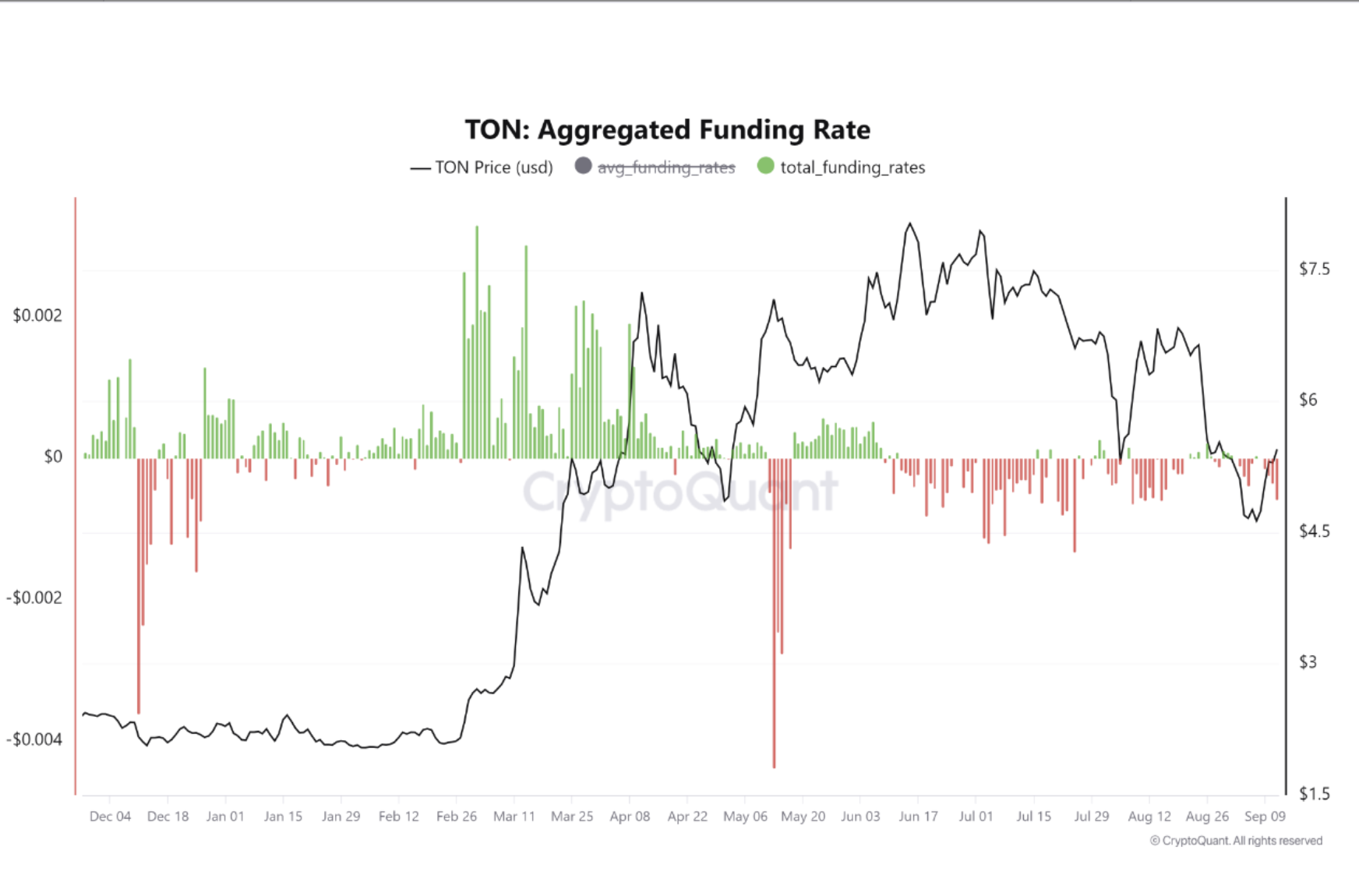

A brief squeeze happens when a pointy rise in an asset’s worth forces merchants who’ve wager in opposition to a cryptocurrency by taking quick positions to purchase it again at larger costs, additional driving it up and rising market volatility. In a brand new report, CryptoQuant contributor Joao Wedson famous that the mixed studying of Toncoin’s 30-day open curiosity delta and its detrimental funding fee alerts that the altcoin could also be headed in that path.

“This can be interpreted as a sign that investors are betting on an upward price trend for TON, as they are willing to hold their positions rather than liquidate them. This increase in confidence can be a precursor to ascending price movements, especially if accompanied by growing volumes,” the researcher stated.

Toncoin’s open curiosity delta measures the adjustments in its open curiosity over a set interval. It helps merchants decide whether or not new cash is coming into the market or if present positions are being closed. 30-day open curiosity delta not too long ago turned constructive, indicating elevated market exercise.

Learn extra: What Are Telegram Bot Cash?

Nonetheless, whereas Toncoin’s open curiosity delta is constructive, its detrimental funding fee throughout cryptocurrency exchanges presents an attention-grabbing scenario that will impression Toncoin’s worth within the close to time period.

Funding charges are periodic charges to make sure an asset’s contract worth stays near its spot worth. A detrimental fee signifies that merchants are paying to maintain quick positions open, signaling a bearish outlook.

A mixed studying of those metrics presents a scenario wherein, on the one hand, traders are assured that Toncoin’s worth will proceed to rally, whereas on the opposite, many merchants nonetheless count on the worth to fall. In response to Wedson, this state of affairs may end in a “potential short squeeze, a shift in sentiment, and increased volatility.”

TON Value Prediction: Uptrend Is Sturdy, However There Is a Catch

Toncoin is at the moment buying and selling at $5.88, with its Aroon Up Line exhibiting a robust uptrend at 92.86%. This indicator, which measures the power of a worth rally, means that Toncoin’s latest excessive was reached not way back.

When the Aroon Up Line approaches 100%, it alerts a strong upward pattern.

Learn extra: What Are Telegram Mini Apps? A Information for Crypto Freshmen

If Toncoin’s rally continues, it may achieve 51%, pushing its worth previous the important thing resistance shaped at $8.02 at securing the brand new all-time-high. Nonetheless, if market sentiment turns detrimental, Toncoin’s worth may drop to $4.44, negating the present bullish outlook.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.