Ethereum’s (ETH) worth is eyeing a big rebound after dropping practically 9% of its worth within the final seven days. Because the altcoin builds momentum for the potential surge, shorts, who anticipate ETH’s worth to maintain reducing, may face elevated strain.

On this evaluation, BeInCrypto seems to be on the components that might drive Ethereum’s worth greater. It additionally highlights the doable influence on merchants seeking to revenue from the cryptocurrency’s worth motion.

Ethereum Targets Comeback, Shorts Below Strain

In anticipation of “Uptober,” a time period used to explain a bullish October, a number of analysts predicted that ETH may attain $3,000. However after a sorry begin to the month, Ethereum’s worth fell from $2,600 to $2,360, driving large-scale liquidation in lengthy positions.

Nevertheless, current knowledge reveals that the desk may be capable of flip, and shorts may be in danger. One key metric forecasting that is Ethereum’s Coin Holding Time. This metric measures how lengthy a coin has been held with out being transacted or offered.

A lower in holding time means that extra holders are promoting their belongings, which usually indicators bearish sentiment. Such exercise usually precedes downward worth strain, indicating that confidence in holding the coin could also be waning.

Learn extra: Tips on how to Purchase Ethereum (ETH) and All the pieces You Have to Know

Nevertheless, on this case, the Cash Holding Time has surged by 58% throughout the identical interval as Ethereum’s current worth decline. This improve is a bullish indicator for ETH, because it means that long-term holders are accumulating or sustaining their positions regardless of the value drop.

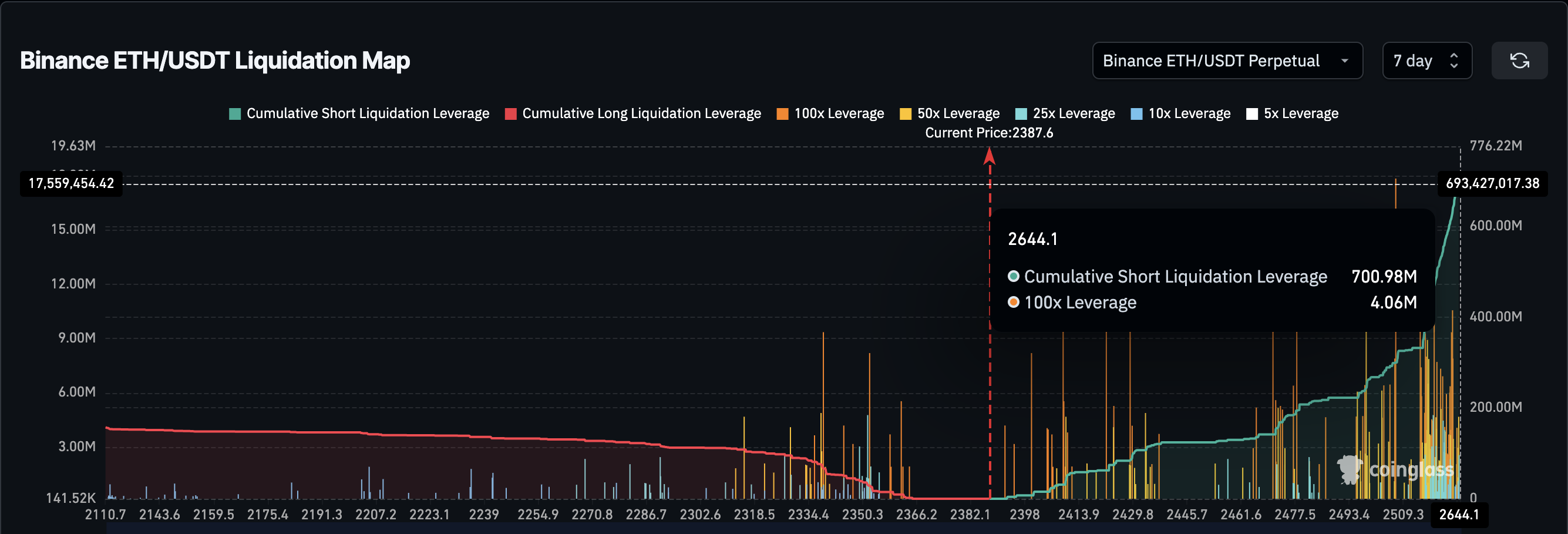

Such habits might be essential in serving to the cryptocurrency get better and doubtlessly erase a few of its current losses. If this continues, ETH’s worth may bounce towards $2,600. In line with Coinglass, a rise to $2,644 may drive over $700 million briefly liquidations

If validated, this growth may additionally result in a brief squeeze. For these unfamiliar, a brief squeeze occurs when a cryptocurrency’s worth strikes considerably greater, prompting merchants who guess on a lower to shut their positions.

ETH Worth Prediction: Bull Market Might Return

Regardless of ETH’s decline, bulls look like defending the value because the swing lows nonetheless fashioned an ascending line. So long as this stays the identical, then it may not take an extended interval for ETH to rebound and resume its uptrend.

Nevertheless, it is very important word that vital shopping for strain is required to carry this prediction to life. From the day by day chart beneath, Ethereum’s worth may climb to $2,450 if the uptrend line stays intact.

Ought to shopping for strain intensify, the altcoin’s worth may additionally climb to $2,690. In that situation, Ethereum would now not bid goodbye to the bull market, which may assist drive the value towards $3,202.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Then again, a breakdown beneath the part trendline may invalidate this forecast. In that situation, ETH’s worth may drop beneath $2,300 to $2,295.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.