Cryptocurrency costs are doing properly this yr, with most of them outperforming conventional belongings just like the S&P 500, Nasdaq 100, and the Dow Jones. These indices have all jumped by over 15%, whereas Bitcoin has risen by nearly 60%, and is hovering close to its all-time excessive.

MEW and Popcat tokens are hovering

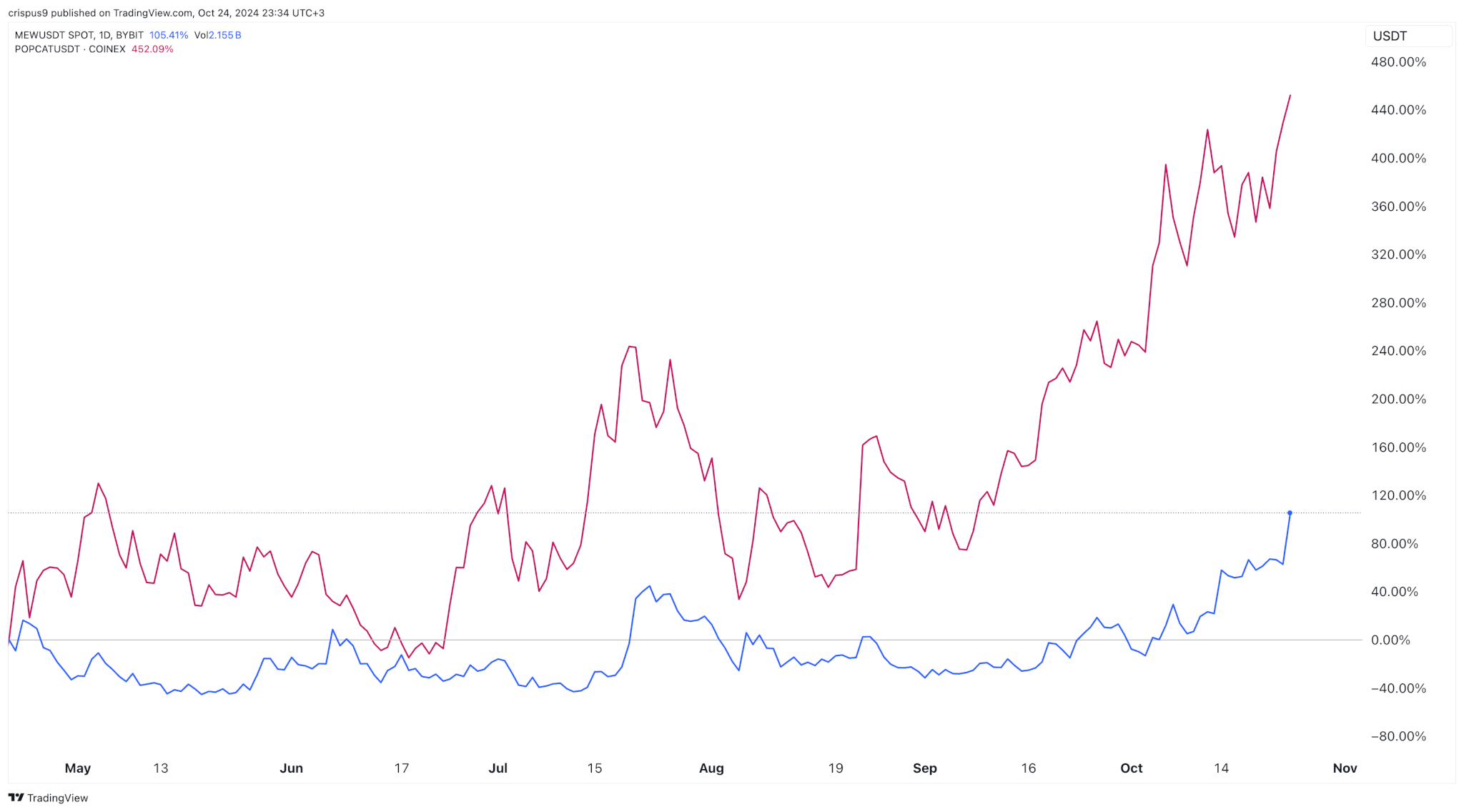

Cat in a canine world (MEW) and Popcat (POPCAT) have soared by over 1,000% this yr, giving them a market cap of over $1 billion. Analysts imagine that these tokens have extra upside within the coming months due to their deep liquidity, worry of lacking out (FOMO), and their substantial volumes within the spot and futures market.

MEW and Popcat even have constructive technicals, with the 2 of them rising above their short-term and medium-term transferring averages. On prime of this, there are indicators that Bitcoin could also be about to have a bullish breakout, which may see it bounce to a file excessive.

It has remained under the important thing resistance degree at $70,000 this week, that means that it solely wants one catalyst to have this breakout. Many specialists imagine that this rally is feasible. For instance, analysts at Bernstein have predicted that it’ll rise above $200,000 in 2025. John Paulson, a billionaire investor, has additionally expressed optimism in Bitcoin.

A powerful Bitcoin breakout can be a constructive factor for meme cash like Cat in a canine world and Popcat. Traditionally, as we noticed earlier this yr, meme cash do higher than Bitcoin when it makes a bullish breakout.

Vantard would be the subsequent massive factor

Crypto analysts and buyers are actually betting on Vantard, an upcoming meme coin impressed by the success of Vanguard, the second-biggest asset supervisor on this planet with over $7 trillion in belongings underneath administration.

Vantard began its pre-sale occasion this week and has raised $163,000 from international buyers in its first stage. The preliminary value was $0.00010, and can enhance throughout the ten phases, with the subsequent value being $0.00011, a ten% enhance.

In response to its white paper, 75% of the devoted treasury funds can be allotted to fundraising. 5 billion tokens went to the pre-seed spherical, whereas the continuing seed fund may have a restrict of 40 billion tokens, equal to 55.56% of the whole. The opposite 40 billion tokens will go to sequence A and sequence B.

Vantard’s key to success is what it calls the first-ever Meme Index Fund (MIF), which goals to offer buyers entry to the best-performing meme cash in a single asset.

The fund can be absolutely decentralized, with its earnings being distributed to holders via the $VTARD token. This fund is impressed by in style Vanguard exchange-traded funds (ETF) just like the one monitoring the S&P 500 index, which has added over $60 billion in belongings this yr.

Vatard’s MIF fund may even have a surge pricing mannequin, the place buyers can pay a 0% charge in periods of low exercise and as much as 50% throughout high-peak demand intervals. The aim of this charge is to discourage mass redemptions.

The opposite prime profit is that it’ll give buyers entry to the very best meme cash within the business. As such, as an alternative of shopping for tens tokens hoping to catch the subsequent massive factor, an investor within the fund may have entry to the very best of them. You’ll be able to study extra about Vantard right here.