Bitcoin worth’s ongoing rally has the cryptocurrency chief on the point of surpassing and forming ATH past $90,000. Though as we speak’s pause within the uptrend prompted some investor issues, Glassnode’s newest report signifies that BTC’s rise will not be over simply but.

Whereas there’s room for additional progress in Bitcoin’s worth, all eyes are on the place the brand new all-time excessive can be established.

Bitcoin Has Assist

In response to a report from Glassnode, Bitcoin ETFs are seeing document inflows, indicating rising confidence from mainstream buyers. Not too long ago, spot Bitcoin ETF property have outpaced these of gold ETFs, highlighting sturdy institutional curiosity. This surge elevates Bitcoin’s standing as a reputable asset in conventional finance, suggesting that ETF-driven liquidity will play a big function in influencing market tendencies and worth dynamics.

Institutional demand for Bitcoin publicity has surged, with whole property managed throughout all BTC ETFs now reaching a market worth of $70.9 billion. These ETFs collectively maintain roughly 4.97% of Bitcoin’s circulating provide, reflecting substantial curiosity from institutional buyers.

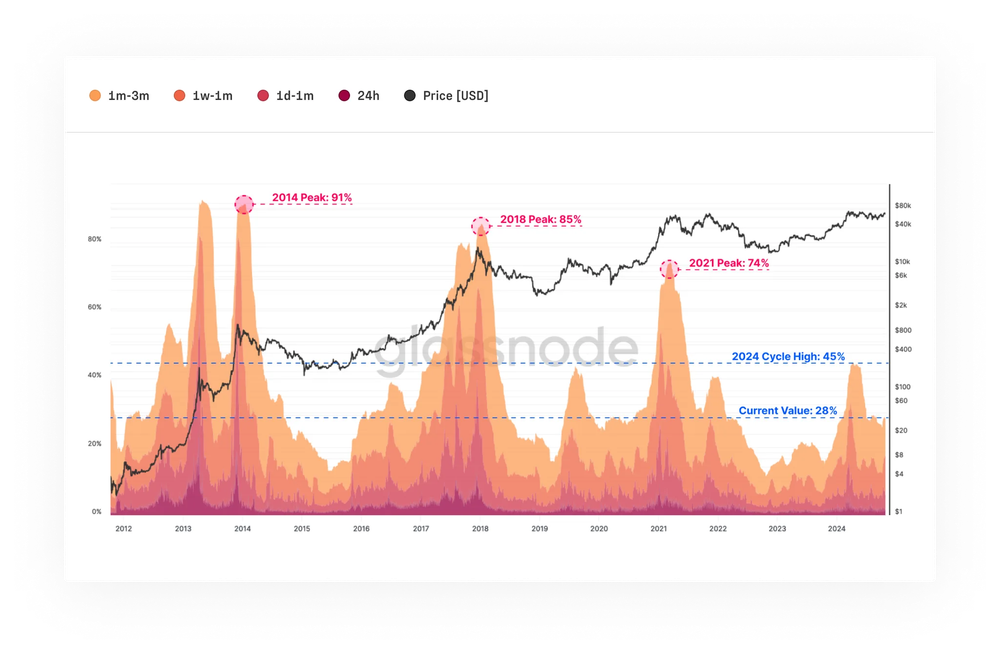

Moreover, Previous tendencies counsel a robust chance for continued progress. Evaluation of market cycles reveals that, following earlier Bitcoin all-time highs, crypto markets have usually entered extended durations of enlargement. With Bitcoin’s newest peak, present indicators suggest the same stage within the cycle, presenting a great entry alternative for establishments aiming to leverage ongoing bullish momentum.

This pattern is obvious throughout each established and rising markets, as seasoned buyers distribute holdings to newcomers attracted by speedy worth features. In contrast to earlier all-time excessive distribution phases, the share of wealth held by new buyers has not reached previous peak ranges, indicating this cycle should have room to run.

BTC Value Prediction: Aiming at The Goal

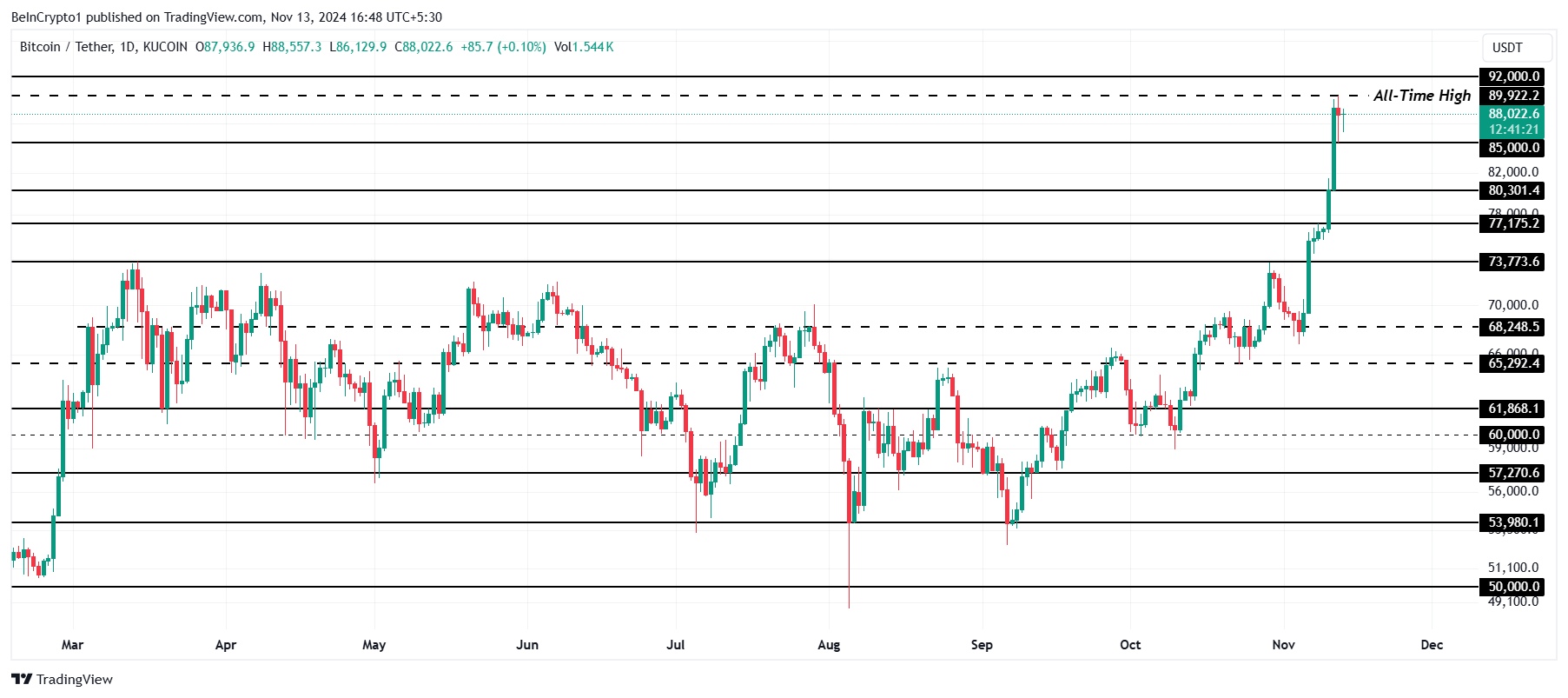

Bitcoin is at present buying and selling at $88,022, reaching a brand new all-time excessive (ATH) of $89,922 in latest days. Regardless of some hypothesis a few doable decline, Bitcoin’s trajectory stays sturdy.

Market indicators level to a constructive macro outlook for Bitcoin, with the following important goal set at $90,000. Reaching this degree might present insights into BTC’s future worth route and stability.

Nonetheless, if Bitcoin encounters promoting strain and profit-taking begins, the worth might dip to $85,000. Failing to carry at this degree might result in additional declines, doubtlessly reaching $80,301 and invalidating the present bullish outlook.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.