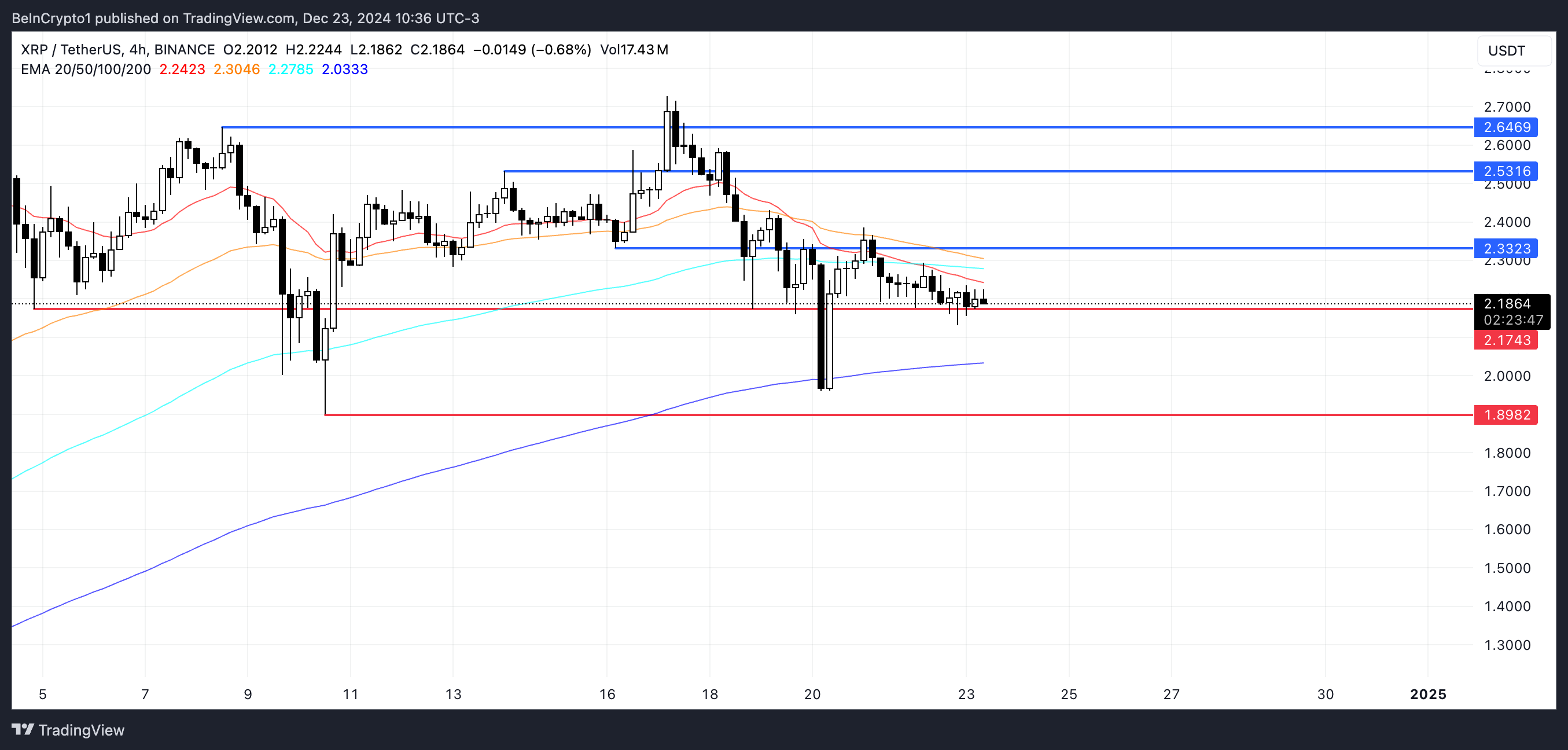

XRP worth has confronted a notable downturn, dropping greater than 8% over the previous seven days after reaching its highest ranges in six years on December 17. The current decline has introduced XRP nearer to a important help degree at $2.17, a key worth level that would decide its short-term trajectory.

Regardless of this pullback, momentum indicators like RSI and CMF counsel combined alerts, with some indicators of restoration however not sufficient to verify a powerful bullish pattern. As merchants watch carefully, XRP’s capability to carry its help or reclaim its December uptrend can be pivotal in shaping its subsequent strikes.

XRP RSI Is Presently Impartial

The Relative Energy Index (RSI) for XRP has surged to 43.12, climbing sharply from beneath 20 simply three days in the past. This important enhance suggests a powerful shift in momentum. When the RSI is beneath 20, it usually signifies that an asset is deeply oversold, probably signaling excessive bearish sentiment or capitulation amongst market members.

The rebound to 43.12 displays a restoration in shopping for curiosity, suggesting that merchants could also be stepping in at decrease costs, perceiving them as a possibility.

RSI is a momentum oscillator used to guage the pace and magnitude of current worth modifications. It ranges from 0 to 100, with key thresholds usually at 30 and 70. Readings beneath 30 point out an oversold situation, the place costs might have fallen too rapidly and may very well be due for a reversal or bounce.

Conversely, readings above 70 counsel an overbought situation, the place costs might have risen excessively and will face downward stress. XRP RSI at 43.12 locations it inside a impartial vary, neither oversold nor overbought.

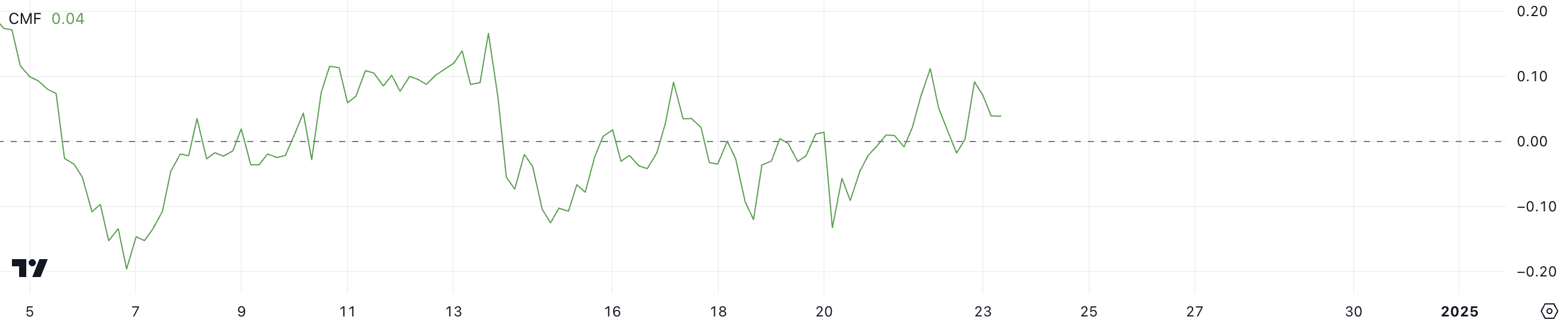

XRP CMF Is Optimistic, However Not That Robust

The Chaikin Cash Movement (CMF) for XRP is at present at 0.04, a reasonable degree reflecting a slight dominance of shopping for stress. This comes after it reached a excessive of 0.11 only a day in the past, signaling stronger accumulation at that time, and a notable restoration from -0.13 on December 20, when promoting stress was dominant.

The development from detrimental to optimistic values highlights a shift in market sentiment, with capital move leaning in direction of consumers over the previous few days. Nevertheless, the drop from 0.11 to 0.04 means that whereas shopping for curiosity stays, it has considerably tapered off, probably indicating a part of consolidation for XRP within the brief time period.

CMF is an indicator used to evaluate the power of shopping for or promoting stress by analyzing each worth and quantity over a particular interval. It ranges between -1 and +1, with optimistic values indicating internet shopping for stress and detrimental values reflecting internet promoting stress. A CMF above 0 usually means that extra money is flowing into the asset, indicating accumulation, whereas a CMF beneath 0 suggests distribution.

XRP present CMF of 0.04, being barely above zero, signifies marginally stronger shopping for exercise than promoting. Whereas it suggests ongoing curiosity from consumers, the lower from 0.11 might indicate a weakening of bullish momentum, which might lead to sideways worth motion or a necessity for stronger quantity to maintain any upward trajectory.

XRP Worth Prediction: Can XRP Worth Go Under $2?

The help degree at $2.17 is important for XRP present worth stability. If this degree fails to carry, it might set off a major draw back transfer, with the following robust help recognized at $1.89. This might signify a possible 13% correction, suggesting that market sentiment might flip bearish and result in additional promoting stress.

Help ranges like $2.17 usually act as psychological and technical limitations that consumers defend to stop deeper declines.

However, if XRP worth can regain the uptrend it skilled at first of December, when it surged to its highest ranges in six years, the outlook might grow to be far more optimistic.

A restoration of bullish momentum might see XRP first testing $2.33, a close-by resistance degree. Ought to the uptrend strengthen, extra targets at $2.53 and $2.66 might come into play.

Disclaimer

In keeping with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.