- Berachain surged 12% to $4.71 however fell to $3.85 as bears dominated.

- The Relative Energy Index (RSI), the ADX, and the MACD sign bearish momentum.

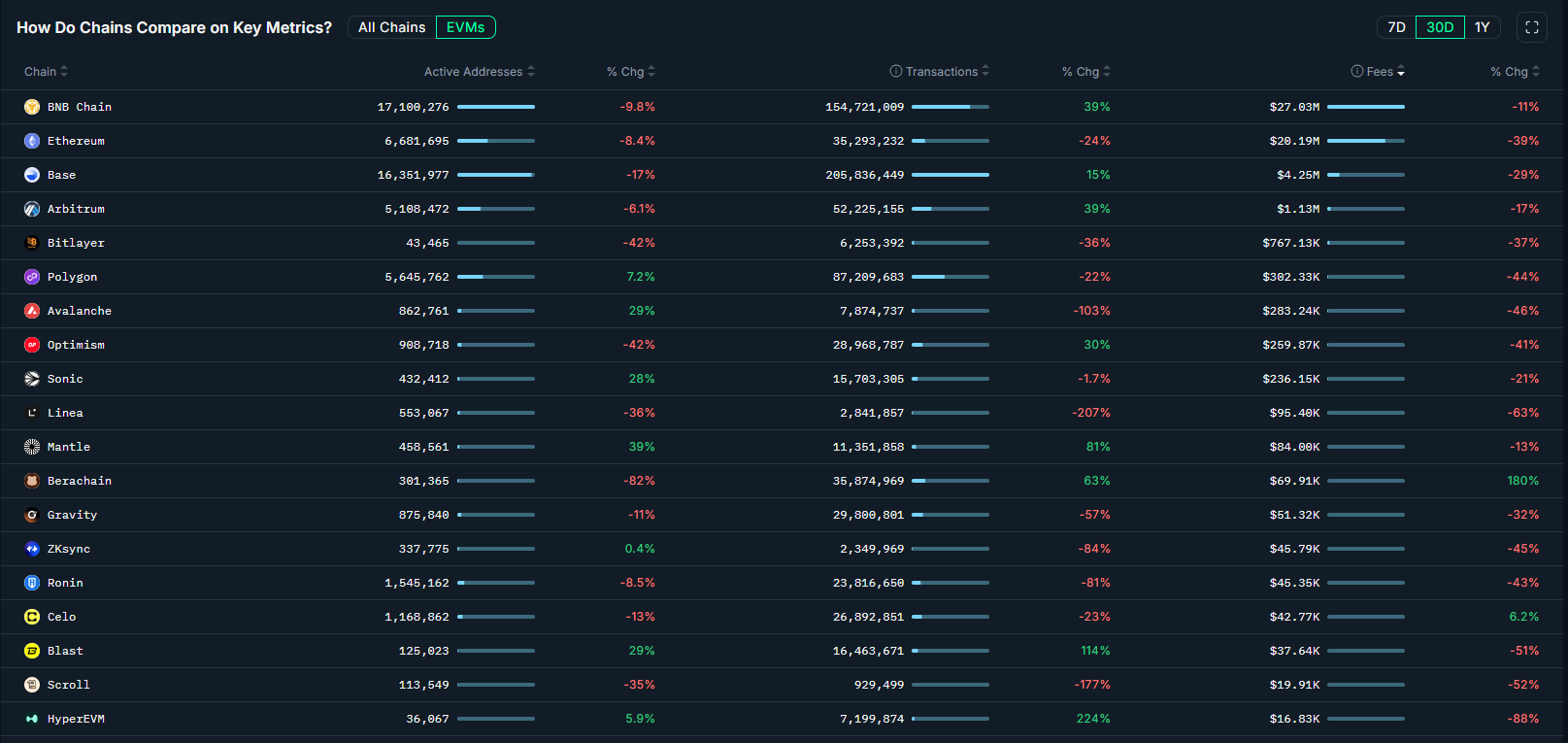

- Berachain Community income is up 180% over the previous month regardless of the value dropping by 33% over the identical interval.

Berachain value jumped by over 12% earlier as we speak, hitting an intraday excessive of $4.71, but it surely has since pulled again to round $3.85 at press time on April 10, 2025.

This transient rally supplied a glimmer of hope for traders after a brutal 52.9% decline over the previous two weeks.

The token has now fallen again right into a bearish channel on the 4-hour chart, unable to maintain momentum regardless of a broader crypto market restoration spurred by Trump’s tariff pause.

Notably, bears stay firmly in management, with technical indicators warning of additional draw back, overshadowing the community’s spectacular 450% income surge.

Technical indicators flash warning indicators

Berachain’s Relative Energy Index (RSI) on the 4-hour chart just lately dropped to an alarming 16.97, signaling excessive oversold situations.

Whereas it has bounced again above the oversold area, the bullish momentum has been minimize quick, and it now sits at round 42, which means bears are nonetheless in management.

The Directional Motion Index (DMI) reveals an ADX of 46.7, reflecting a very sturdy bearish development.

Sellers keep a chokehold with DMI readings of fifty (+DI) and 16.9 (-DI), leaving little room for bullish intervention.

The MACD, regardless of seeing a crossover, stays beneath 0, underscoring persistent adverse momentum.

As well as, widening Bollinger Bands, now at 86% width, trace at escalating volatility that might set off a technical bounce or a sharper drop.

Berachain Community development clashes with value woes

In accordance with knowledge from Nansen, the Berachain ecosystem has skilled sharp development in latest weeks.

Community price income surged 180% month-on-month to $69,910, whereas transaction quantity climbed 63% throughout the identical interval.

Notably, this development got here regardless of an 82% decline in lively addresses, indicating rising engagement or bigger common exercise per person inside the community.

Berachain’s ecosystem has seen explosive development, with community price income skyrocketing 180% to $69.91k in a month, with transactions rising by 63% regardless of lively addresses dropping by 82% over the identical interval.

Notably, MEV-related operations account for 34.97% of charges, whereas the core protocol and native DEX BEX contribute 18.64% and 17.38%, respectively.

Curiously, this surge in exercise contrasts starkly with the token’s 37.9% weekly loss and 62.44% drop from its $14.99 all-time excessive in February.

Key BERA value ranges to observe amid the bearish stress

Merchants eye fast help at $3.06, with $2.71 because the final line of protection if promoting intensifies.

The pivot level at $3.74 stays an important threshold for any reversal affirmation.

Additionally, the resistance at $4.44 and $4.78 looms as a formidable barrier to restoration.

Presently, low liquidity at 58.43% amplifies the danger of sharp value swings, and merchants might most likely watch for an RSI divergence and quantity spikes earlier than making an attempt counter-trend trades.

The submit Berachain value restoration minimize quick as bears overpower bulls appeared first on CoinJournal.