BeInCrypto sat down with members of the LBank workforce to investigate the doable resurgence of the meme coin market as a number one crypto narrative and what their fusion with synthetic intelligence (AI) can have on their attain.

LBank additionally mentioned the affect of the four-month-old Markets in Crypto-Belongings (MiCA) regulation on its operations throughout Europe. They described a elementary change in investor confidence in gentle of larger regulatory readability and simplified accessibility.

Have Meme Coin Highs Given Technique to Devastating Lows?

Lately, the meme coin market has largely been characterised by overwhelming highs and devastating lows. The primary few months of 2025 have additional confirmed the risky nature of those tokens, to the purpose {that a} vocal a part of the crypto group believes that their current lows have marked the top of the meme coin lifecycle.

These claims aren’t unfounded, particularly now that the US President has develop into a meme coin participant. When Trump launched his meme coin in mid-January, TRUMP reached a market capitalization of practically $8.8 billion, a quantity by no means earlier than seen by a meme coin launch.

When insider merchants capitalized on the surge to unload their holdings and retain thousands and thousands of {dollars} in features, retail buyers bore the brunt of the huge sell-off, struggling a whole lot of 1000’s of {dollars} in losses.

“The decline in meme coin market cap since January can be attributed to a combination of market dynamics and sentiment shifts. A key driver was the rapid rise and subsequent crash of the TRUMP token, which drew significant market capital due to its viral appeal but collapsed sharply, eroding investor confidence and triggering a broader risk-off sentiment,” Eric He, Neighborhood Angel Officer and Threat Management Adviser at LBank instructed BeInCrypto.

After related experiences with the MELANIA token and the LIBRA launch, a few of these retail buyers realized that meme cash —as unregulated and unpredictable as they’re— will not be the very best investments.

Is the Meme Coin Frenzy Coming to a Halt?

Given the devastating results that these episodes have had on the meme coin market, buying and selling has diminished considerably. The crypto group appears to have develop into saturated with information of pump-and-dump schemes and rug pulls, possible contributing to a halt in the meme coin frenzy.

The complete meme coin market capitalization has been free-falling since January’s peak following the presidential token launches. Now, its ranges resemble these of September 2024. The larger financial downturn that conventional and crypto markets skilled over the previous a number of weeks has solely worsened prospects.

“Meme coins rely heavily on memetic premium, or value driven by cultural relevance and community-driven hype.—and waning retail enthusiasm amid macroeconomic pressures, such as rising interest rates, has reduced momentum. Finally, the exit of “normies” (informal retail buyers) throughout this bearish part has additional drained liquidity and consideration, exacerbating the decline,” He defined.

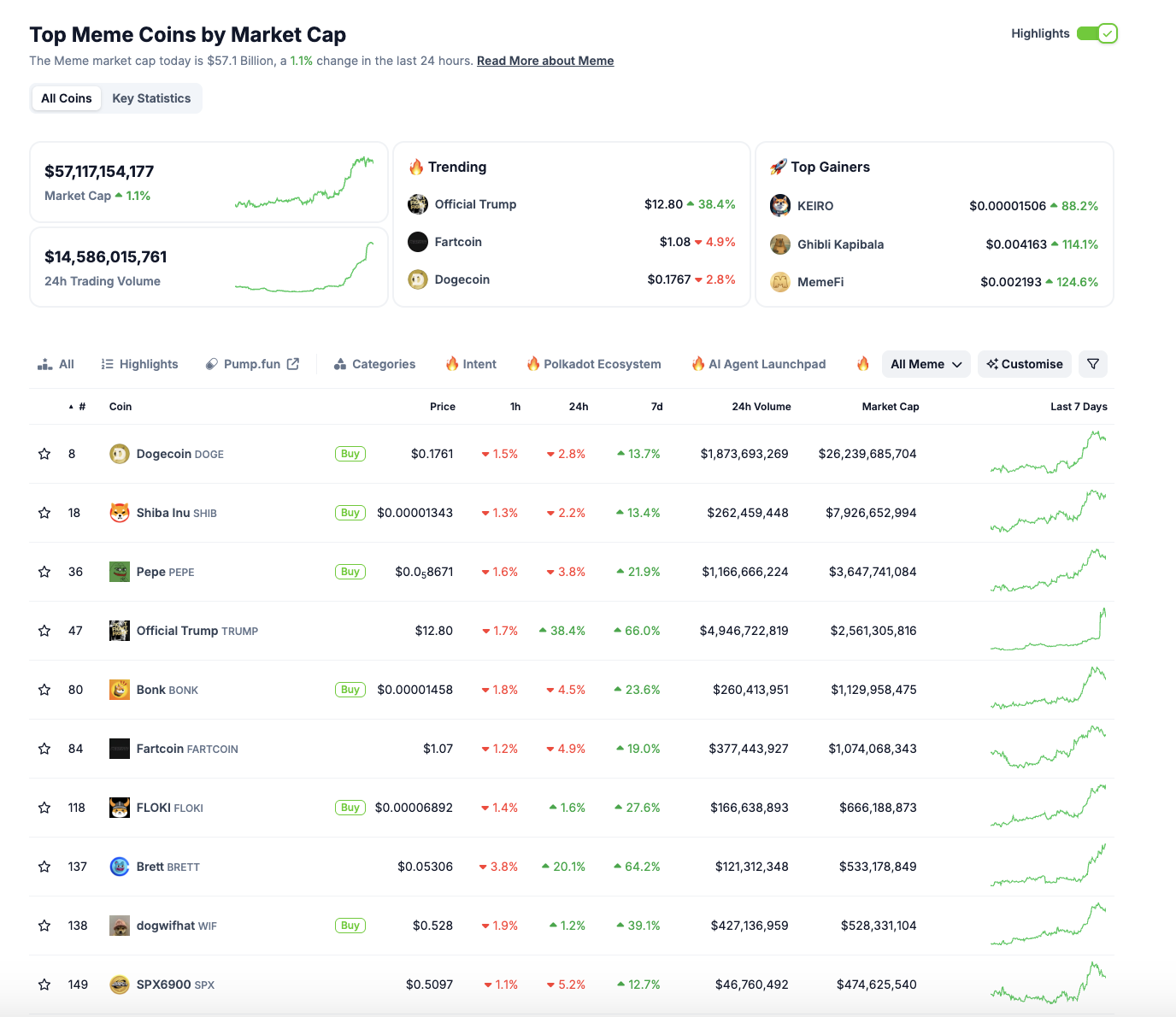

But, regardless of this downward strain, the market nonetheless experiences a excessive degree of exercise. It has a $14.5 billion buying and selling quantity and a $57 billion market capitalization.

In line with the LBank workforce, the meme coin trade is due for a revival.

LBank’s Perception within the Revival of the Meme Coin Market

Although the decline in meme coin efficiency has been important, the LBank workforce expressed that these circumstances are removed from surprising. Meme cash are inherently tied to group assist and social momentum.

The sustained buying and selling volumes and enormous market capitalization function tangible indicators that, even in a downturn, the market is seeing lively group engagement and liquidity. Traders nonetheless see worth within the tokens’ cultural and speculative enchantment.

“We see it as a healthy market correction rather than a fundamental shift. Meme coins have always been volatile, but the fact that trading volumes remain high shows continued interest. What’s happening now is not the end of the trend—it’s just a recalibration before the next wave,” Mario Iemma, Head of Spanish Markets at LBank, instructed BeInCrypto.

The truth is, Iemma believes that meme cash is not going to be dying out anytime quickly.

“Meme coins are here to stay. The numbers speak for themselves—there’s deep liquidity and strong community backing. Their resilience shows they’re becoming a permanent part of the ecosystem,” he mentioned.

Iemma additionally ventured to guess what areas he believed would drive the subsequent meme coin frenzy.

“Meme coins tend to surge when narratives align—whether it’s a viral moment, a celebrity tweet, or a new community movement. We believe the next big catalyst could come from gaming integrations, real-world use cases, or simply the return of retail interest in the next bull cycle,” Iemma added.

The quickly evolving integration of AI expertise has additionally develop into a growth to look intently after.

The Potential of AI for Token Creation

A number of cryptocurrency initiatives now use synthetic intelligence to refine their merchandise and improve consumer utility.

AI brokers represented the primary important shift within the evolution of the cryptocurrency trade. These autonomous programs proved that they may make choices and carry out duties independently. This expertise enhances intelligence, adaptability, and equity in monetary mechanisms.

Now, builders have unlocked synthetic intelligence’s potential on tokens. Techniques like Grok have already made information by utilizing AI to robotically and independently design and launch tokens.

These programs are now not simply analyzing or buying and selling tokens; they are actively concerned in their creation and deployment with out direct human intervention.

For LBank, there’s large potential on this growth.

How AI-Generated Tokens May Affect the Crypto Trade

In line with Iemma and He, AI-generated tokens carry important alternatives to the crypto trade. Their autonomous nature may significantly affect innovation and effectivity.

“AI-driven token creation could unleash a wave of experimentation, making it possible to quickly build new token economics, governance structures, or hybrid assets. This could lead to new DeFi primitives or community-driven projects,” He mentioned, including that “Automation simplifies the token creation process, reducing time, cost, and technical barriers for developers and the community. AI can dynamically adjust staking rewards to balance liquidity and demand.”

For Iemma, these benefits display monumental potential for the way forward for AI-generated tokens.

“It could start as a niche, but the potential is huge. Just like meme coins started as a joke and became a force, AI tokens could redefine how we think about token creation. It has the potential to remove technical barriers and democratize tokenization. Imagine creators launching tokens without needing to write a single line of code,” he mentioned.

Nonetheless, with a nascent expertise like AI, the LBank workforce emphasised the necessity for accountable and thorough deployment for the long-lasting success of AI-generated tokens. This success hinges on two specific components: accessibility and safety.

Safety and Accessibility Challenges for AI-Generated Tokens

The idea of safety is steadily related to any rising expertise. Synthetic intelligence isn’t any exception, particularly in a very unregulated trade like crypto.

In line with He, AI-generated token initiatives’ diploma of safety and transparency will decide their success.

“The speed of AI-driven creation may also exceed the speed of supervision by the community or regulators, resulting in scams or low-quality projectsflooding the market. In addition, the ‘black box’ nature of AI decision-making may erode trust, especially when there is a lack of transparency in token economics or governance logic,” He instructed BeInCrypto.

Iemma agreed, including that if AI-generative tokens develop into extensively accessible, this growth will even require extra layers of oversight.

“That same accessibility demands better filters, vetting, and AI-based security audits—areas where exchanges like LBank are already investing resources,” he mentioned.

Whereas reflecting on the safety dangers related to synthetic intelligence and the breaches in client belief that meme cash have had on the crypto group, the LBank workforce additionally emphasised the necessity for larger regulation within the trade.

The event of cryptocurrency laws varies considerably throughout the globe. Notably, the European Union applied complete guidelines nearly 5 months in the past, whereas key markets similar to the US are nonetheless establishing sufficient frameworks.

MiCA’s Impact on the European Crypto Market

Final December, with the implementation of the Markets in Crypto-Belongings (MiCA) regulation, the European Union turned the primary jurisdiction to ascertain a complete and unified regulatory framework for crypto-assets throughout all its member states, marking a major milestone.

Following this, distinguished corporations similar to Commonplace Chartered, MoonPay, BitStaete, Crypto.com, and OKX have obtained licenses, granting them entry to a considerable European market.

In line with the LBank workforce, MiCA provides customers and establishments a reliable framework. This growth has confirmed important for trade progress throughout the area.

“MiCA has forced firms to become more transparent and compliant, which is a good thing for long-term trust. We’ve seen exchanges accelerate their legal and operational upgrades. For users, it creates a safer, more predictable environment,” Iemma mentioned, including, “With clearer rules, banks and investment firms are more willing to explore crypto partnerships, custody solutions, and even tokenized assets. Regulation reduces reputational risk, and MiCA is helping bridge that gap.”

Nonetheless, this expertise might be largely attributed to established companies within the trade and buyers with entry to substantial assets. Different gamers, nevertheless, have struggled to collect the necessities to use for a MiCA license.

Future Lodging for Smaller Crypto Companies

In discussing the affect of MiCA since its enactment final December, He highlighted how completely different trade gamers have responded to the landmark regulation. He famous that startups wrestle probably the most to acquire an operational license.

“Startups see MiCA as a gateway to access the European market more confidently, though some are understandably cautious about compliance costs and reporting obligations in early-stage development. Institutional investors, on the other hand, overwhelmingly welcome the regulation—they value predictability and see MiCA as a green light to deploy capital into this sector,” He instructed BeInCrypto.

When evaluating the cost-effectiveness of an operational license, He’s conclusions make sense.

MiCA is an costly regulation. It mandates minimal capital necessities based mostly on the crypto companies supplied. These necessities vary from €50,000 for advisory and order-related companies to €125,000 for change and buying and selling platforms and as much as €150,000 for custody companies. Companies should keep this capital as a monetary safeguard.

Past minimal capital necessities, corporations should think about authorities and authorized charges, native presence prices, financial institution setups, and ongoing operational prices. However for distinguished exchanges like LBank, the advantages outweigh the prices.

“LBank’s experience underscores that embracing regulation strategically can unlock significant market opportunities,” He concluded.

Future MiCA updates may handle the excessive compliance prices for smaller companies. In the meantime, different areas growing their crypto laws ought to contemplate this side to keep away from creating related obstacles.

Disclaimer

Following the Belief Mission tips, this characteristic article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.