Pi Community has confronted a major setback not too long ago, registering one of many few declines among the many high tokens. At present, Pi is buying and selling at $0.6077, reflecting a 15% drop over the previous month.

This poor efficiency has left many buyers questioning its future, particularly because it struggles to point out indicators of enchancment.

Pi Community Wants To Notice Inflows

Regardless of the decline, the Chaikin Cash Circulation (CMF) indicator reveals that Pi Community has noticed some inflows. Nonetheless, this improve continues to be caught within the destructive zone, underneath the zero line. This means that whereas there are occasional inflows, the outflows stay dominant, conserving the altcoin subdued.

The destructive CMF studying signifies that promoting stress nonetheless largely controls the altcoin value motion. Despite the fact that there’s some constructive market exercise, it’s not sufficient to beat the dominant outflows.

The shortage of assist from buyers is pushed by elementary points with Pi Community, which Alvin Kan, COO, Bitget Pockets, agreed with, responding to BeInCrypto.

“Pi Network’s initial surge was largely driven by anticipation and years of community mining, but the follow-through has been more muted. As early users began realizing gains, increased token supply met limited exchange listings and a still-developing ecosystem. Without strong utility or broader liquidity, investor demand naturally tapered off. Like many new tokens, Pi is now facing the challenge of transitioning from early hype to long-term value delivery,” Kan instructed BeInCrypto.

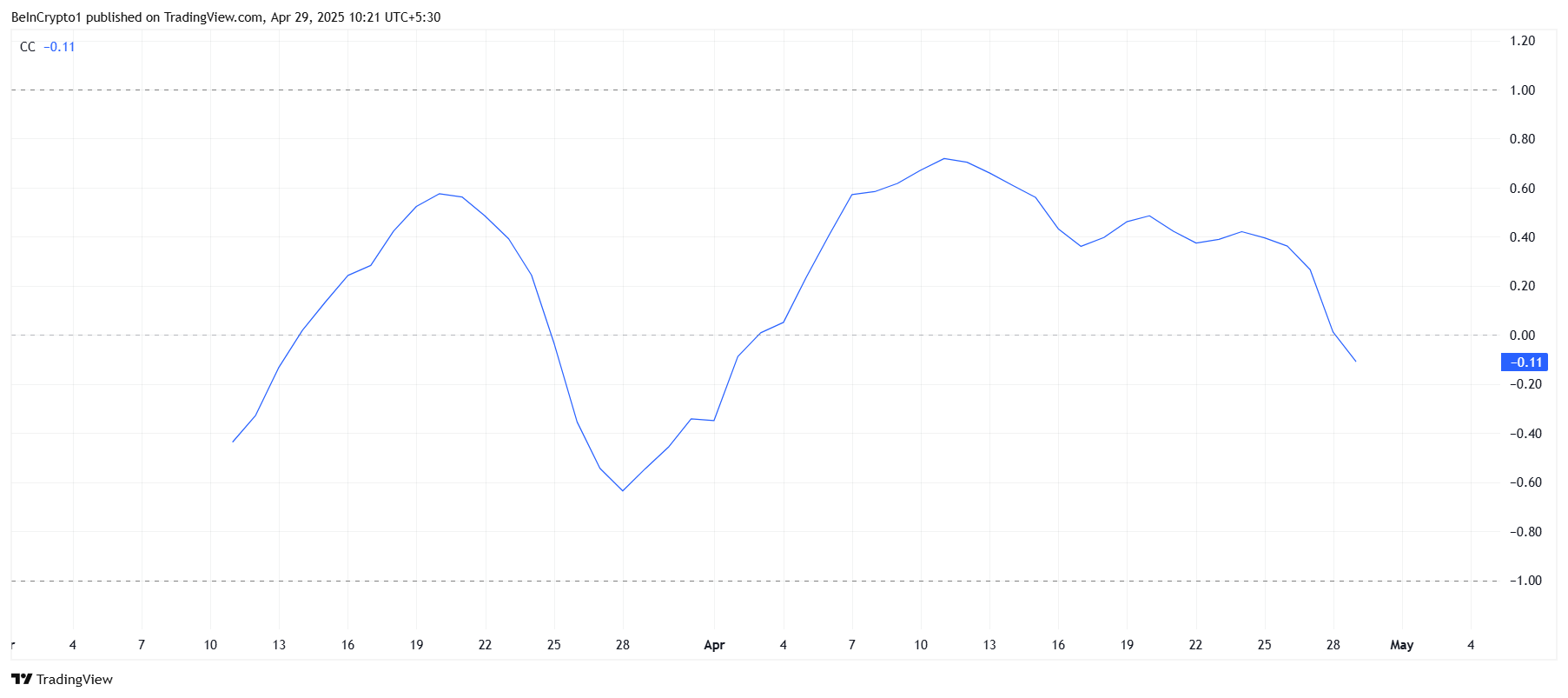

Pi Community’s correlation with Bitcoin can also be some extent of concern. At present, Pi shares a correlation of -0.11 with Bitcoin, indicating an inverse relationship. Which means every time Bitcoin experiences upward momentum, Pi tends to face declines.

With Bitcoin nearing $100,000, Pi Community might wrestle to capitalize on Bitcoin’s potential features, doubtlessly going through additional corrections.

Given Bitcoin’s power, Pi might proceed to say no, as its value usually strikes in the other way of Bitcoin’s rise. This inverse correlation means that even when Bitcoin reaches new highs, PI may not profit from the broader market rally. As a substitute, it might face extra downward stress.

PI Worth Wants A Robust Reversal

Pi Community’s value has dropped 15% during the last month, presently sitting at $0.6077. The decline in value, particularly after the excessive expectations surrounding the token, has induced frustration amongst buyers. Because the promoting stress mounts, it seems that extra buyers are pulling their cash out of Pi, leading to ongoing losses for the token.

If this development continues and Bitcoin’s value continues to rise, the altcoin might expertise an extra drop. The destructive correlation with Bitcoin might end in Pi falling by means of the $0.6077 assist degree and heading towards the $0.5192 assist. If the development persists, the altcoin might strategy its all-time low of $0.4000, additional deepening its losses.

Thus, staying on alert is the best choice for any investor.

Whereas the novelty of Pi Community’s minting on the cell machine took off strongly, it didn’t stick round for lengthy, impacting the worth in consequence.

“Pi Network’s mobile mining and referral model helped it build a massive user base, but also invited skepticism around sustainability. While the project clarifies that it doesn’t follow a multi-level structure, concerns persist over perceived lack of transparency and real-world use cases. To move past the debate, the focus will need to shift toward building credible utility and expanding access. If that happens, sentiment could recover—but trust takes time,” Kan instructed BeInCrypto.

Nonetheless, if market circumstances enhance and investor sentiment shifts, Pi Community might have an opportunity at restoration. A breach of the $0.8727 resistance, adopted by flipping it into assist, might sign a reversal. This could set Pi on a path towards $1.0000, invalidating the present bearish outlook and setting the stage for potential development.

Disclaimer

In keeping with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.