SEI and KAIA tokens prolonged their rally Friday as Bitcoin held agency under $105,000, signaling dealer resilience forward of a probably unstable derivatives expiration day.

With markets weathering geopolitical and macroeconomic shocks in latest weeks, the approaching “quadruple witching” may check altcoin stability—but when Bitcoin (BTC) stays above key assist at $104,000, SEI and KAIA could have room to run.

SEI and KAIA worth evaluation

SEI traded at $0.1948 early on Friday, with modest positive aspects. The token added 6% to its worth prior to now seven days, as seen on TradingView.

SEI’s closest assist and resistance ranges are S1 at $0.1582, the June 17 low and R1 at $0.2494, the higher boundary of an FVG on the each day worth chart.

Technical indicators RSI and MACD assist a bullish thesis. RSI reads 50 and is sloping upwards. MACD reveals underlying optimistic momentum in SEI worth pattern on the each day timeframe.

SEI may see a each day candlestick shut above R1 and check resistance at $0.2750, the Might 11 peak for the token.

Conversely, larger volatility may usher a correction in SEI, sending the token to gather liquidity at $0.1303 assist, as seen within the SEI/USDT worth chart.

KAIA hovers above the $0.19 stage on Friday. The token posted over 2% positive aspects and prolonged its worth on Friday. KAIA has noticed almost 9% enhance in its worth prior to now seven days. The KAIA/USDT each day worth chart reveals robust potential for additional enhance within the token’s worth.

RSI indicators the token is at present overvalued, nonetheless till it dips underneath the 70 stage, it doesn’t sometimes generate a promote sign. MACD flashes more and more taller inexperienced histogram bars, that means there may be an underlying optimistic pattern in KAIA worth.

The closest resistance is R1 at $0.2054, the higher boundary of the FVG on the each day worth chart. Subsequent hurdle on the trail to re-test 2025 peak at $0.2665 is R2 at $0.2525.

Conversely, KAIA may sweep liquidity on the February 3 low of $0.08. One other key assist is the decrease boundary of the FVG at $0.1077.

Market volatility in response to quadruple witching

Crypto market capitalization is down 2.3% within the final 24 hours. The quadruple witching occasion has merchants on edge, anticipating larger volatility and worth swings in Bitcoin and altcoin costs. Volatility could have subsided for now, with most altcoins ending the week in inexperienced, geopolitical tensions over the weekend may impression liquidity and dealer sentiment.

Merchants have beforehand remained impartial, and crypto costs have proven resilience within the face of tariff uncertainty, wars, and missiles. Nevertheless, it stays to be seen how the market will react to short-lived volatility this weekend.

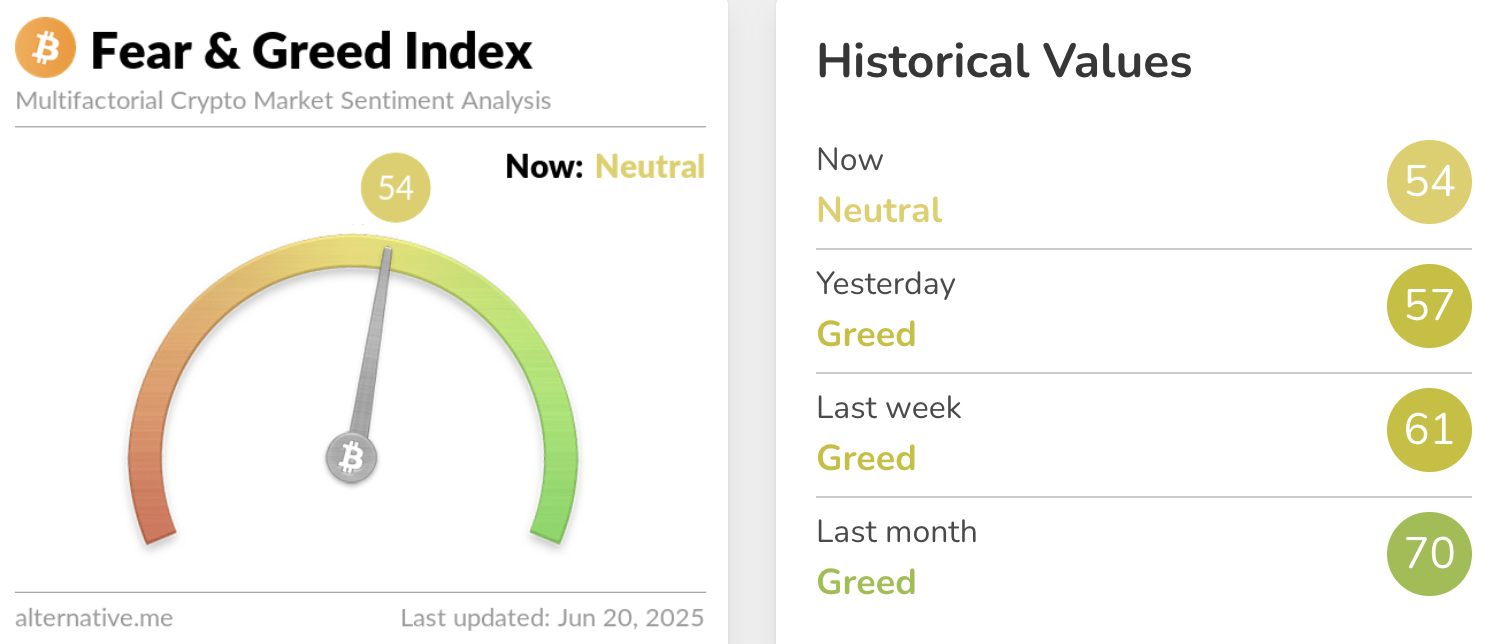

Merchants remained impartial on Friday, sentiment reads 54 on a scale of 0 to 100, suggesting a impartial outlook in the direction of the market.

Trump-era optimism

The optimism that Trump ushered in along with his election victory and Bitcoin’s new all-time excessive may maintain altcoins afloat throughout occasions of uncertainty. Whilst merchants flip risk-averse, Bitcoin worth defended the $100,000 milestone and failed to comb underneath the extent even within the face of escalating battle between Israel and Iran.

Briefly, macroeconomic headwinds have did not shake the resolve of crypto merchants, maybe as a result of passage of the GENIUS Act within the Senate, the decision of the SEC v. Ripple lawsuit, and the SEC’s leniency towards the crypto sector.

Altcoin market capitalization is testing key assist at $1.09 trillion. If costs stay comparatively secure and merchants defend the assist, altcoins like SEI and KAIA may survive the short-lived market volatility with out erasing prior positive aspects.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.