Buy value remains to be crucial issue for 58% potential homebuyers

Article content material

As economists sign one other rate of interest lower is on the horizon, a brand new survey suggests the true property market would possibly nonetheless have a muted response.

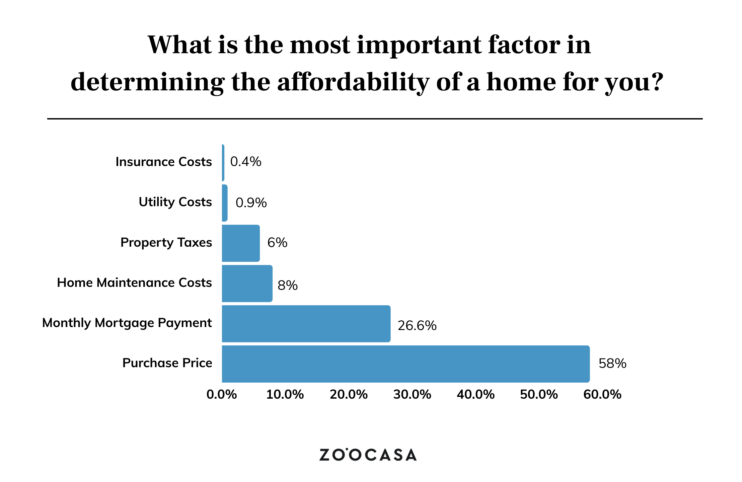

A report from on-line realtor Zoocasa discovered that buy value remains to be crucial issue for 58 per cent of potential homebuyers, suggesting that if the Financial institution of Canada cuts charges subsequent week it’s unlikely to carry these customers again to the market.

Commercial 2

Article content material

In response to the Canadian Real Estate Affiliation, the typical dwelling value fell 1.6 per cent year-over-year in June to $696,179, although Ontario and the Northwest Territories are the one two areas with year-over-year value drops. CREA doesn’t have information for Prince Edward Island and Nunavut.

The month-to-month mortgage cost ranked the second most vital issue within the survey with 26.6 per cent of respondents, adopted by dwelling upkeep prices with eight per cent.

After Tuesday’s client value index report that confirmed inflation eased to 2.7 per cent in June, most economists count on the Financial institution of Canada to chop rates of interest to 4.5 per cent on July 24.

However it seems the central financial institution might want to drop rates of interest considerably to have an effect on the housing market.

The survey discovered simply 15.1 per cent of respondents are ready for yet another lower earlier than getting into the market, whereas 31.6 per cent of respondents say they’re ready for important rate of interest cuts.

Twenty-two per cent of respondents stated they don’t seem to be planning to enter the housing market in any respect this 12 months.

Article content material

Commercial 3

Article content material

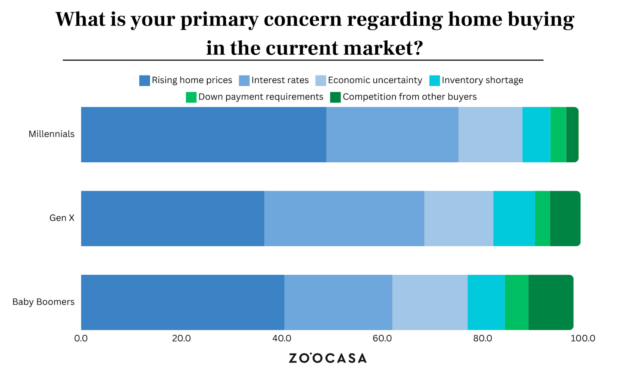

Rates of interest seem to have hit youthful Canadians the toughest. Virtually 22 per cent of child boomers stated charges wouldn’t affect their resolution to enter the housing market, in comparison with 12.2 per cent of gen X and eight per cent of millennials.

“Rising home prices have especially impacted millennials and older gen-Z, who are looking to buy their first homes but are finding themselves priced out of many markets,” Zoocasa chief govt Carrie Lysenko stated within the report.

“Although borrowing costs have eased slightly with the first Bank of Canada rate drop in four years this June, this hasn’t been sufficient to counterbalance the affordability challenges. As a result, many potential buyers are forced to reconsider their timing or location for purchasing a home.”

As charges come down and costs stay excessive, potential homebuyers are divided on when is perhaps the precise time to enter the housing market. Simply over 40 per cent of respondents stated they’re not sure if now’s the precise time, whereas 11.9 per cent strongly consider that now’s the time and 12.1 per cent strongly disagree.

Commercial 4

Article content material

“Real estate agents may need to provide more assurance and information to ease any hesitancy,” the report states. “It may now be more necessary than ever for agents to work closely with clients to ensure they feel knowledgeable and comfortable about local market conditions.”

Enroll right here to get Posthaste delivered straight to your inbox.

Whereas the Zoocasa report factors to excessive costs in Canada’s sluggish housing market, others level to a hangover from the COVID-19-induced home-buying get together.

Projections from the Canadian Real Estate Affiliation predict 472,395 properties can be offered in 2024, which is a six per cent climb from final 12 months, however beneath earlier forecasts and much beneath the 10-year common.

Nonetheless, information counsel earlier projections had been distorted by rate of interest cuts in 2020 and 2021 which led to an estimated 238,000 extra transactions.

Learn extra right here.

- As we speak’s information: Canada development funding for Could

- As we speak’s earnings: Netflix Inc., Blackstone Inc., Nokia Corp., Domino’s Pizza Inc., United Airways Holdings Inc., Organigram Holdings Inc.

Commercial 5

Article content material

Really useful from Editorial

-

Canada set to be quickest rising economic system in G7 in 2025

-

Snowbirds paying $15,000 a 12 months in funding charges fear

Tackling debt is a critical problem for a lot of Canadians, however there are a number of strategies to get it underneath management. Whereas the state of affairs will be traumatic, Stacy Yanchuk Oleksy, chief govt of Cash Mentors, informed The Canadian Press these seeking to scale back their debt ought to take a deep breath and select the precise technique for them.

Study extra about how to decide on the precise technique for you.

FP Solutions

Are you fearful about having sufficient for retirement? Do it’s essential to modify your portfolio? Are you questioning how you can make ends meet? Drop us a line at aholloway@postmedia.com together with your contact information and the final gist of your downside and we’ll attempt to discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll hold your identify out of it, after all). You probably have an easier query, the crack group at FP Solutions led by Julie Cazzin or one in all our columnists may give it a shot.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Publish column can assist navigate the complicated sector, from the newest traits to financing alternatives you received’t need to miss. Learn them right here

As we speak’s Posthaste was written by Ben Cousins, with extra reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E mail us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material