Canada’s housing market finds itself, as of June, poised for a comeback after a difficult 12 months. The set off? A strategic rate of interest lower by the Financial institution of Canada, resulting in a 3.7 per cent rise in nationwide residence gross sales in comparison with Might. After months of declining exercise, the market is exhibiting indicators of life, however the highway forward is stuffed with uncertainties and hardship for each business professionals and consumers and sellers alike.

However will this rate of interest lower be sufficient? Is it the beginning of a slicing cycle? Will it worsen earlier than it will get higher? We glance into the story behind the numbers, analyzing how financial coverage, client sentiment and regional variations are shaping the restoration of Canada’s actual property panorama.

Dialed again expectations round rate of interest cuts — cuts that will attract consumers

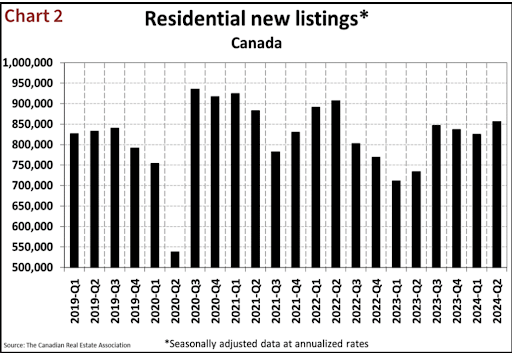

Because the final forecast in April, expectations surrounding rate of interest cuts this 12 months have been dialed again because the market has seen an inflow of properties with many sellers itemizing their properties within the spring. Nonetheless, purchaser exercise and client sentiment have remained low.

It’s anticipated that step by step decreasing rates of interest will finally draw consumers again into the market. Nonetheless, the sluggish spring market and growing provide ranges have led to a downward revision in gross sales and common residence worth projections.

26% extra listings than final June however beneath historic common

In 2024, roughly 472,395 residential properties are anticipated to be offered, marking a 6.1 per cent enhance from 2023, whereas the entire common residence worth is projected to rise by 2.5 per cent to $694,393.

Waiting for 2025, residence gross sales are forecasted to extend by 6.2 per cent to 501,902 items, supported by continued declines in rates of interest and returning demand. The nationwide common residence worth is anticipated to climb by 5 per cent to $729,319.

However what actually occurred is by the top of June, there have been about 180,000 properties listed on the market, which is a 26 per cent enchancment from the earlier 12 months however stays beneath the historic common of roughly 200,000 gross sales by this month.

Potential slowdown in stock buildup, approaching balanced market circumstances

The variety of new listings elevated modestly by 1.5 per cent month-over-month, whereas the MLS House Value Index (HPI) edged up by 0.1 per cent from Might 2024. Regardless of these slight beneficial properties, the HPI was down 3.4 per cent year-over-year, and the nationwide common sale worth decreased by 1.6 per cent in comparison with June 2023.

The top-of-June provide of properties was up by 26 per cent from the earlier 12 months however remained beneath the historic common, suggesting a doable slowdown in stock buildup. The nationwide sales-to-new listings ratio improved to 53.9 per cent in June from 52.8 per cent in Might, approaching the long-term common of 55 per cent and indicative of balanced market circumstances.

Housing costs fluctuating

Regionally, housing costs proceed to fluctuate. Calgary, Edmonton, Saskatoon, Montreal and Quebec Metropolis’s costs have been on an upward trajectory since early final 12 months, whereas Ontario and Nova Scotia have additionally seen current worth will increase beginning late final 12 months.

Nonetheless, the non-seasonally adjusted Nationwide Composite MLS HPI stays 3.4 per cent beneath June 2023 ranges, reflecting the sharp worth will increase that occurred within the spring and early summer time of 2023. The nationwide common residence worth in June was $696,179, down 1.6 per cent from the identical month the earlier 12 months.

Our takeaways: the story of Canada’s housing market in June 2024 is one in every of cautious optimism and evolving dynamics. The early indicators of revival triggered by the Financial institution of Canada’s rate of interest technique have laid the groundwork for continued cuts and anticipated (hopeful) development within the coming years.

With a projected 6.1 per cent enhance in property gross sales this 12 months and continued development into 2025, there’s a way of nervous anticipation as consumers’ and sellers’ expectations have extra floor to cowl. Nonetheless, the story is much from over.

The market’s future will depend on overcoming challenges like rebuilding purchaser confidence and managing the complicated relationship of provide and demand. Wanting forward, the continued story of Canada’s housing market guarantees a mixture of resilience, adaptation and hopeful development.