Benchmark house worth for June stays almost flat

Article content material

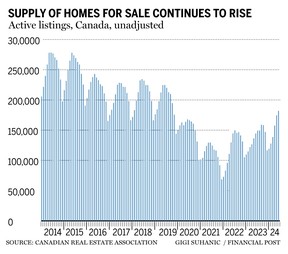

The Canadian Real Estate Affiliation (CREA) launched its June report as we speak, exhibiting one more rise in stock and a virtually flat month-over-month benchmark house worth of $717,700. The 0.1 per cent worth enhance was the primary rise in 11 months, although nonetheless 3.4 per cent beneath final yr’s ranges.

As of the tip of June, there have been roughly 180,000 properties listed on the market on the Canadian a number of listings service, reflecting a 26 per cent enhance from a yr earlier. Regardless of this rise, the present variety of listings stays beneath the historic common of round 200,000 for this time of yr. On a seasonally adjusted foundation, the end-of-June provide quantity elevated modestly by 0.5 per cent from the tip of Might, indicating a possible slowdown within the nationwide stock buildup.

Commercial 2

Article content material

The variety of new listings was up 1.5 per cent month-over-month in June, pushed largely by the Larger Toronto Space and British Columbia’s Decrease Mainland. Nonetheless, the nationwide enhance in new listings was lower than the gross sales achieve for the month, leading to a tightening of the nationwide sales-to-new listings ratio to 53.9 per cent in June from 52.8 per cent in Might. This ratio stays near the long-term common of 55 per cent, suggesting balanced market circumstances as a sales-to-new listings ratio between 45 per cent and 65 per cent is often per a balanced housing market.

James Mabey, chair of CREA, highlighted the numerous experiences for patrons throughout totally different areas in Canada.

“The second half of 2024 is widely expected to see the beginnings of a slow and gradual return of buyers into the housing market,” Mabey stated. “Those buyers will face a considerably different shopping experience depending on where they are in Canada, from multiple offers in places like Calgary, to the most inventory to choose from in over a decade in places like Toronto.”

Article content material

Commercial 3

Article content material

Gillian Oxley, founding father of Oxley Real Estate in Toronto stated that the increase in provide in Toronto has created a shift in purchaser behaviour.

“If you don’t have that pressure with multiple offers, maybe you’re going back to the house a second time. Maybe you’re going back a third time. Maybe you’re looking a little closer at how much storage space there is. There’s been a shift in the time consideration, which then makes buyers more thoughtful. There’s just a time consideration that buyers didn’t have in 2021. They did not have the luxury of time,” Oxley stated.

On a nationwide foundation, there have been 4.2 months of stock on the finish of June 2024, down from 4.3 months on the finish of Might. This marks the primary month-over-month decline in stock ranges for 2024. The long-term common is about 5 months of stock, suggesting that whereas there may be extra stock than final yr, it’s nonetheless comparatively tight by historic requirements.

General gross sales elevated by 3.7 per cent on a seasonally-adjusted foundation in June, however remained 9.4 per cent decrease than the earlier yr.

Toronto Dominion Financial institution economist Rishi Sondhi believes that the market has not but felt any impression from the Financial institution of Canada’s newest transfer.

Commercial 4

Article content material

“The Bank of Canada’s recent rate cut had virtually no impact on the Canadian housing market in June… the market’s still up against some serious affordability issues,” Sondhi stated in a observe to purchasers.

Nonetheless, Oxley believes that the speed lower has infused the market with a long-missing sense of optimism.

“We’ve all been holding our breath, waiting, so even though it was just a quarter per cent, at least it was ‘okay, it’s starting,’” she stated.

Sondhi anticipates additional rate of interest cuts later within the yr, though he holds a extra cautious outlook on affordability.

Beneficial from Editorial

-

Weaker inflation, even in U.S., what Financial institution of Canada hoping for

-

Toronto apartment listings soar, however households battle to search out properties

-

Excessive price of housing has younger Canadians on the transfer

“Indeed, we think that markets will be stronger in the back half of the year, as the economy holds up and more meaningful interest rate relief is delivered. However, stretched affordability conditions will likely limit the degree of improvement.” Sondhi stated.

• Electronic mail: shcampbell@postmedia.com

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you have to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material