On this particular version of Bennett Jones’ quarterly M&A replace, we take a look at deal exercise and the funding local weather in Canada with a concentrate on the Québec market. The second quarter of 2024 and the yr to this point has been considered one of notable transactions, continued funding in Québec’s power transition innovation efforts, an rate of interest reduce (adopted by one other in July), tax and regulatory adjustments to contemplate and each shiny spots and challenges for personal fairness and enterprise capital.

M&A Exercise Q2 2024

All numbers are based on Bloomberg knowledge in U.S. {dollars} except in any other case said (introduced, accomplished or pending offers—excluding these which were terminated or withdrawn—the place a Canadian firm is the acquirer, goal or vendor) as of June 30, 2024.

The mixture quantity of Canadian M&A transactions continued its up-and-down sample within the second quarter of 2024. Q2 2024 was the third finest quarter because the starting of 2023 by quantity. The variety of offers stood at 666 and deal rely has now risen for 3 consecutive quarters.

Canadian M&A Deal Exercise

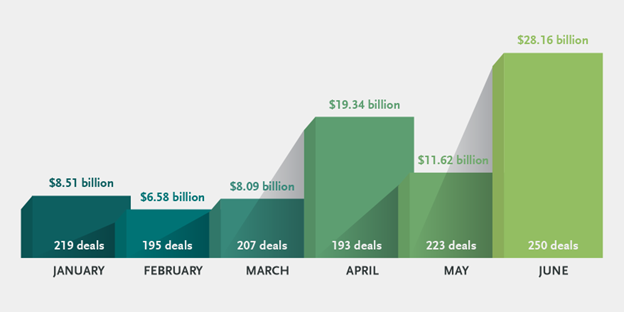

Exercise elevated throughout the board in Q2, from small to mid to massive sized transactions. June was probably the most energetic month in each M&A quantity and the variety of offers.

Month-to-month M&A Deal Exercise 2024

Québec-based corporations have participated in two monetary companies offers collectively valued at nearly $10 billion. One is a fintech go-private price $6.3 billion, introduced in April. On June 11, Monréal-based Nationwide Financial institution of Canada introduced its acquisition of Canadian Western Financial institution for $3.66 billion.

On June 24, CDPQ and personal fairness agency TPG introduced they’ll purchase Aareon – a European supplier of SaaS options for the property business – from Aareal Financial institution and Creation Intenational for $4.18 billion. Earlier within the month, CDPQ bought its stake in Budapest Airport in a $3.37 billion transaction.

Within the mining sector, the fourth largest transaction is for the acquisition of uranium deposits in Quebec. The fifth largest transaction includes the merger of two Québec gold corporations.

Whereas this newest knowledge reveals that the Canadian M&A panorama in Q2 2024 stays considerably spotty with month-to-month ups and downs each on the greenback worth and deal rely metrics, Q2 2024 marks a wholesome enhance on each fronts when in comparison with Q1 2024. Notable transactions in finance, power, know-how, healthcare, and mining spotlight sturdy sector participation. Trying forward, the M&A market is anticipated to stay pretty dynamic throughout the nation, notably in Québec.

Funding in Québec’s EV Trade

Québec is positioning itself to develop into considered one of North America’s leaders in power transition improvements. The province focuses on creating an electrical automobiles (EV) battery hub by funding in an ecosystem designed to help important minerals mining and transformation, electrochemical processes, transport electrification and decarbonization initiatives. Québec’s main tax incentive regime and the strategic help from Québec institutional buyers and their federal counterparts in massive capex initiatives fosters funding alternatives and positions the province as a lovely vacation spot, notably for mining corporations and different suppliers within the EV battery provide chain.

Québec attracted a file of C$13 billion in international direct funding for the fiscal yr ending March 31, based on Investissement Québec. That is greater than double final yr’s then-record excessive of C$6 billion. The latest spike in international funding is led by Sweden’s Northvolt, who introduced it should construct a C$7 billion battery megaplant east of Montréal. Billions of {dollars} in further investments in Quebec’s EV manufacturing chain have additionally been introduced by U.S. and South Korean corporations.

Regulatory Developments

Curiosity Charges

The Financial institution of Canada lowered its coverage fee by 25 foundation factors to 4.75 % on June 5, 2024. This was the primary fee reduce in 4 years. The Financial institution then decreased the coverage fee to 4.5 % on July 24.

The authors of Bennett Jones’ 2024 Mid-12 months Financial Outlook, led by former Financial institution of Canada Governor David Dodge, anticipate the Financial institution of Canada to make one or two further quarter-point cuts by the tip of the yr. The U.S. Federal Reserve is more likely to reduce as soon as, by 1 / 4 level, by year-end.

Below the Outlook’s situation, the coverage charges within the two economies might be decreased at completely different paces, however to the identical flooring of three.0 % to be reached early in 2026. Inflation is anticipated to succeed in the two % goal in Canada by the tip of 2025 and in the USA by early in 2026.

Capital Features Inclusion Fee

The 2024 federal price range raised the inclusion fee on capital positive factors realized yearly above $250,000 by people, and on all capital positive factors realized by firms and trusts, from one-half to two-thirds efficient June 25, 2024. The federal government means that the measure will increase tax equity and that it’s going to have an effect on solely a small proportion of taxpayers. Many within the enterprise neighborhood have mentioned it will dampen funding. Time will inform if the measure will have an effect on M&A exercise in Canada.

Mining and Invoice 63

Québec stands out as considered one of Canada’s most favorable jurisdictions for mining actions, due to its pleasant regulatory framework and tax incentives. The province is especially centered on important minerals and has established a number one tax incentive regime to encourage funding on this sector.

Invoice 63, An Act to amend the Mining Act and different provisions, was introduced on Could 27, 2024, marking Quebec’s dedication to modernizing mining laws to replicate its long-term environmental and sustainable objectives. Sustaining the present regulatory regime, together with tax incentives for important minerals funding, and signaling Québec’s long-term dedication to being a serious participant within the mining business are essential.

PE and VC Exercise in Québec

Réseau Capital launched its Q1 2024 market overview of enterprise capital (VC) and personal fairness (PE) investments in Québec on Could 17. There are a selection of shiny spots and in addition some ongoing challenges to funding.

For each VC and PE, the worth of investments was up within the first quarter and the variety of offers was down. Québec represents 23 % of Q1 deal movement and 45 % of the VC investments in Canada. The common measurement of VC investments in Québec stands at $20.09 million, the best within the nation. Québec represents 55 % of personal fairness offers in Canada and 73 % of complete funding. The common transaction measurement of PE offers was $38 million, its highest degree since 2019.

Réseau Capital says that challenges to VC and PE funding have included inflation, the worldwide financial and geopolitical surroundings and issues about shopper confidence.

Trying Forward

Continued high-value offers in key sectors recommend a wholesome degree of exercise for the rest of 2024. Stakeholders ought to keep alert to alternatives and sector developments to capitalize on enhancing market and financial circumstances.

Whereas there could also be shifts in commodity preferences, Québec’s geological potential and favorable regulatory surroundings place it effectively to draw international funding, fostering continued progress within the mining sector. It is a optimistic outlook for the Québec mining business.