TAO, the altcoin that powers Bittensor’s decentralized machine studying community, has witnessed a 36% value rally previously 24 hours as the overall cryptocurrency market rebounds following Monday’s decline.

This has led to an uptick within the token’s derivatives market exercise. Nevertheless, this isn’t with out a catch.

Bittensor Futures Merchants Wager In opposition to a Worth Rally

In keeping with Coinglass, TAO’s derivatives market has recorded a 14% upswing in day by day buying and selling quantity previously 24 hours.

When an asset sees a rise in derivatives buying and selling quantity, it suggests a rising curiosity within the underlying asset. Since derivatives permit merchants to invest on value actions with out proudly owning the underlying asset, a spike in buying and selling quantity might counsel that extra merchants are partaking in speculative actions, which can drive up value volatility.

TAO’s rising open curiosity confirms this inflow of recent merchants over the previous 24 hours. In keeping with Coinglass, the coin’s open curiosity has elevated by 32% throughout that interval, totaling $38.31 million.

Learn Extra: Prime 9 Most secure Crypto Exchanges in 2024

An asset’s open curiosity refers back to the complete variety of excellent by-product contracts, comparable to choices or futures, that haven’t been settled. When it spikes like this, extra merchants are opening new positions out there.

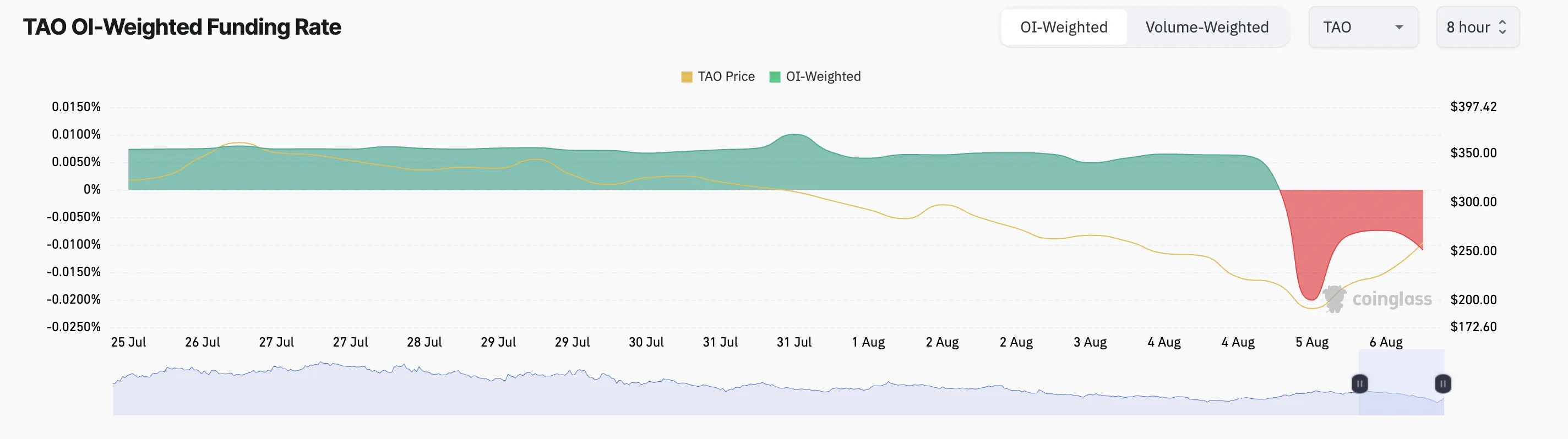

Nevertheless, TAO’s detrimental funding fee indicators that these new merchants have principally opened brief positions. As of this writing, the token’s funding fee throughout cryptocurrency exchanges is -0.01%.

Funding charges are utilized in perpetual futures contracts to make sure an asset’s contract value stays near its spot value. When they’re detrimental, it means extra merchants are shopping for the asset, anticipating a decline, than these shopping for in anticipation of a rally.

TAO Worth Prediction: A Bullish Divergence Provides Hope

Readings from TAO’s one-day chart reveal that its double-digit value rally over the previous 24 hours won’t be sustainable. It is because the bearish bias towards the altcoin continues to be important.

At press time, its Elder-Ray Index returns a detrimental worth of -64.2. For context, this indicator has returned values beneath zero since July 30, and the current value rally has not modified that.

An asset’s Elder-Ray Index measures the connection between the power of patrons and sellers out there. When its worth is detrimental, it signifies that bear energy outweighs bullish presence.

If the bears stay in management and proceed to place downward strain on TAO, its value might fall beneath $200 to commerce at $163.70.

Nevertheless, the bullish divergence between TAO’s value and its Chaikin Cash Circulate (CMF) hints at the opportunity of a rally. Whereas TAO’s value has maintained a downtrend since July 28, its CMF has risen, making a bullish divergence.

This divergence typically indicators a possible bullish reversal. Whereas the worth is declining, shopping for strain is growing, which might result in a value uptrend.

Learn Extra: How To Spend money on Synthetic Intelligence (AI) Cryptocurrencies?

If this shopping for strain positive aspects momentum, it might push the token’s worth to a two-month excessive of $419.80.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.