Binance Coin (BNB) has been buying and selling inside an ascending triangle sample since August 6, following a pointy drop to a five-month low of $463.97 in the course of the market decline on August 5.

Presently priced at $522.63, BNB has skilled a 16% value improve since that dip.

Binance Coin Makes an attempt to Break Resistance

An ascending triangle sample types when an asset’s value strikes inside a spread outlined by a flat horizontal resistance line above and a rising assist line beneath. This sample alerts bullish momentum, suggesting that patrons are gaining energy and pushing the worth increased, whereas sellers preserve regular resistance.

Since BNB began buying and selling inside this sample, it has encountered resistance at $524, a stage it now goals to interrupt. If BNB breaks above this resistance, it could point out that purchasing strain has surpassed promoting exercise, probably resulting in a continued uptrend.

Supporting this outlook are readings from BNB’s technical indicators. The Parabolic Cease and Reverse (SAR) indicator, as an example, reveals a robust bullish bias, because the dots at the moment lie beneath BNB’s value.

The Parabolic SAR indicator tracks an asset’s value path and identifies attainable reversal factors. When its dots seem beneath the asset’s value, it signifies an uptrend, suggesting that the asset’s value has been rising and that the expansion may proceed.

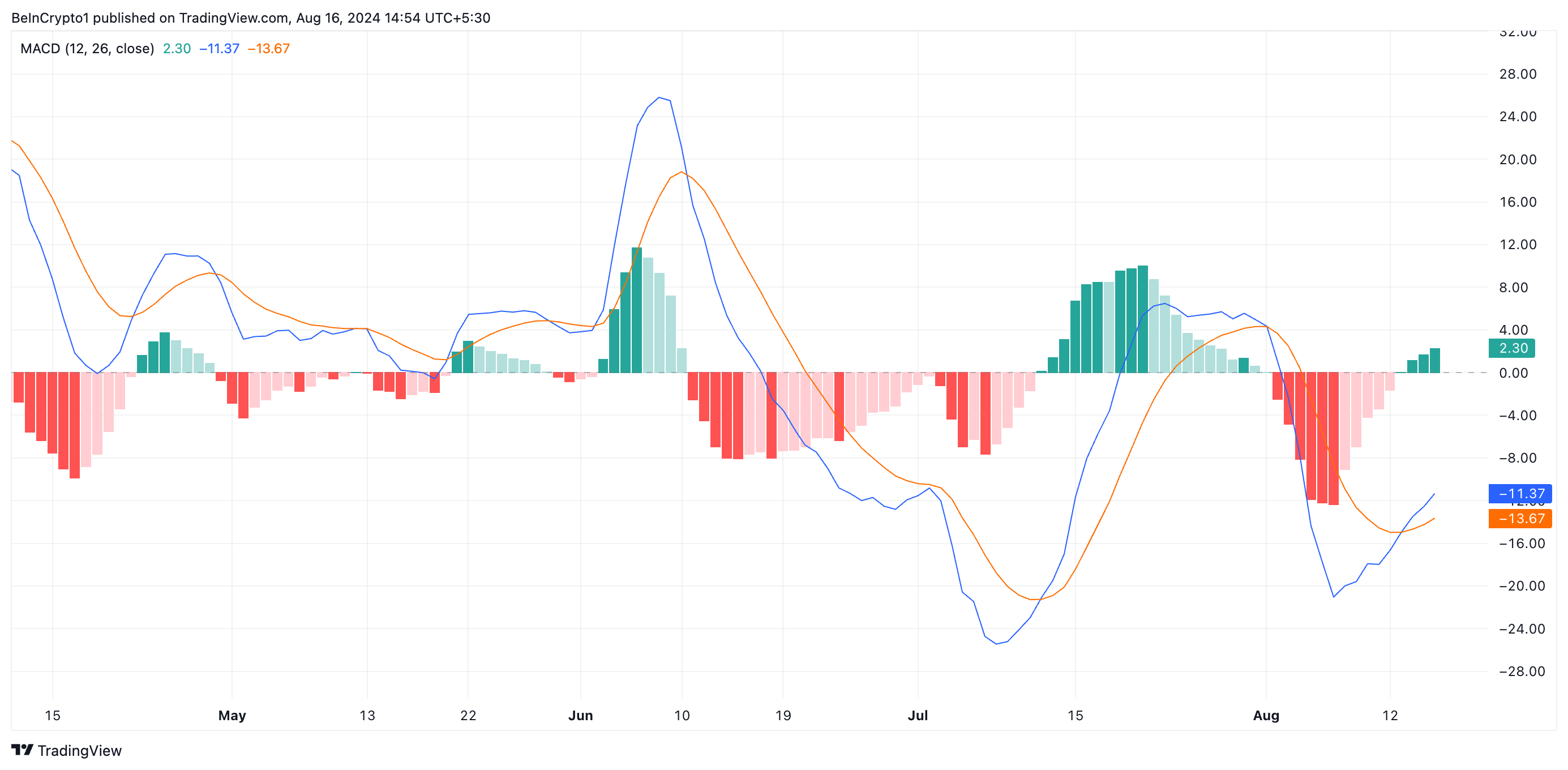

Moreover, BNB’s Shifting Common Convergence Divergence (MACD) indicator displays stronger shopping for strain than promoting exercise. Presently, the MACD line (blue) is positioned above the sign line (orange), additional confirming bullish momentum.

Learn extra: Binance Coin (BNB) Worth Prediction 2024/2025/2030

Which means BNB’s shorter-term transferring common is rising sooner than its longer-term transferring common. Merchants view this as a bullish sign to go lengthy and exit quick positions.

BNB Worth Prediction: a Rally to $561 or a Drop to $476

If shopping for strain stays robust sufficient to push BNB above the horizontal resistance at $524, its value may climb to $561.09, a key goal inside the ascending triangle sample. This may sign that patrons have decisively overcome promoting strain, permitting the uptrend to proceed.

Learn extra: How To Purchase BNB and All the pieces You Want To Know

Nevertheless, a decline in demand at this resistance stage may trigger BNB’s value to slide beneath $500, probably triggering additional promoting. If bearish momentum intensifies, BNB may face a deeper pullback to $476.32, a crucial assist stage the place patrons may try to regain management.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.