A number of challenges are undermining Filecoin’s place as a number one venture amongst Decentralized Bodily Infrastructure Networks (DePIN). Regardless of notable value swings, with FIL reaching a yearly excessive of $11.46 in June, its worth has since dropped by almost fourfold.

On-chain evaluation means that FIL stays a dangerous alternative for traders. Declining community exercise, weak demand, and ecosystem hurdles point out that the venture’s development potential remains to be restricted, making it much less interesting regardless of current value fluctuations.

Challenges Emerge for Filecoin as Most Useful DePin Venture

Filecoin’s value, which trades at $3.57, might indicate that the token is undervalued. Nevertheless, in line with the Sharpe ratio information obtained from Messari, the token will not be value investing in for the brief time period.

This ratio measures risk-adjusted returns for a cryptocurrency. In non-technical phrases, a constructive ratio implies that traders have an excellent probability of getting a better return on the cash they spend on an asset.

Nevertheless, a adverse ratio factors to an especially low risk-to-reward probability. At press time, Filecoin’s Sharpe ratio is -2.95, suggesting that purchasing the cryptocurrency on the present value might not supply an excellent return on funding.

Learn extra: What Is DePIN (Decentralized Bodily Infrastructure Networks)?

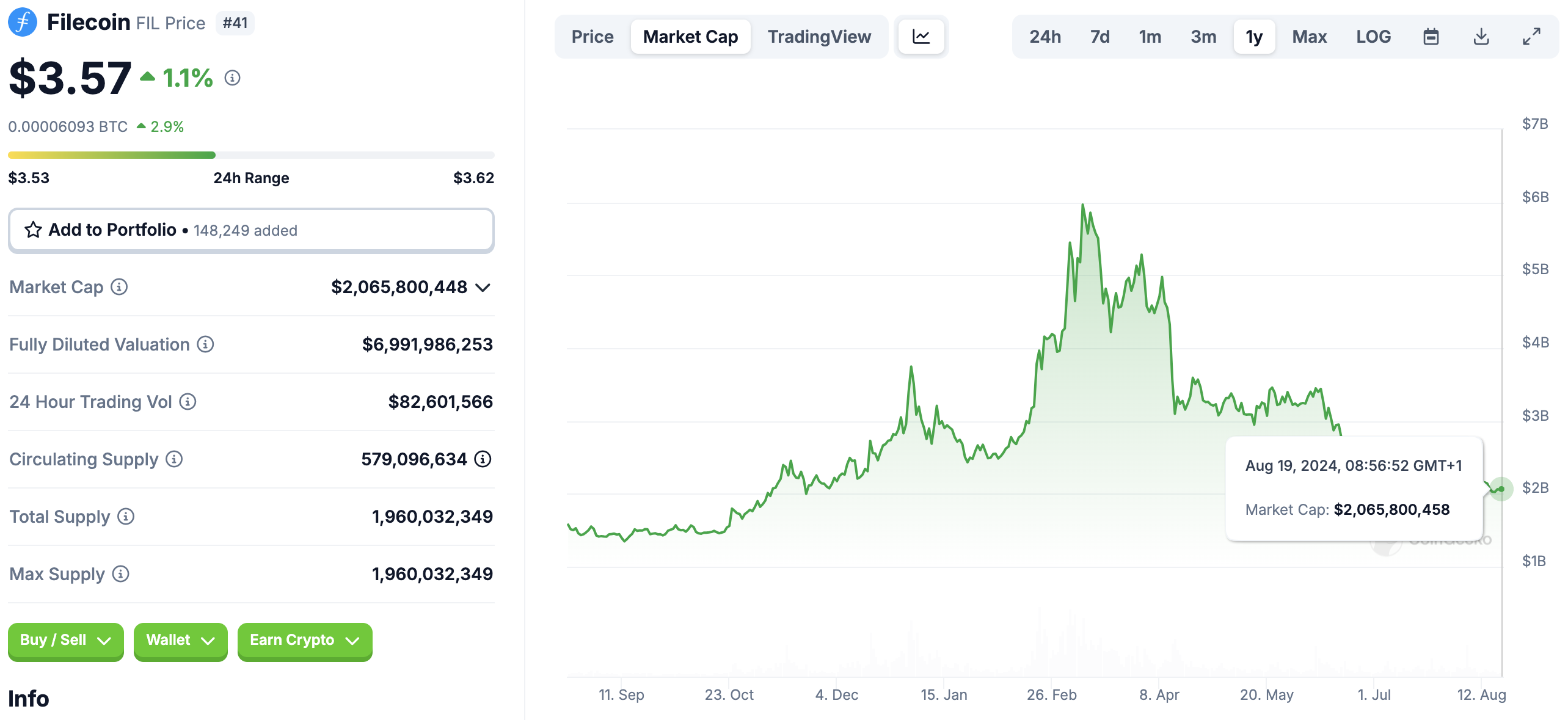

Regardless of the gloomy outlook, Filecoin stays probably the most priceless DePIN venture when it comes to market capitalization. Primarily based on CoinGecko information, FIL’s market cap is $2.06 billion.

Nevertheless, it’s essential to focus on that this worth displays a threefold drop from March. Market cap is decided by multiplying circulating provide by value, so the decline in FIL’s market cap immediately correlates with the numerous correction the token has skilled in current months.

If this continues, Filecoin dangers shedding the highest place to different DePIN initiatives like Render (RNDR) and The Graph (GRT).

FIL Worth Prediction: Falling Momentum Factors to $3.25

In line with the day by day FIL/USD chart, the token has been buying and selling inside a descending channel since April, indicating a bearish pattern. On this sample, two downward trendlines kind throughout correction and consolidation phases, with the higher trendline performing as resistance and the decrease one as help.

This aligns with the low risk-to-reward outlook for FIL, particularly because it has but to interrupt above the channel. Moreover, the RSI is beneath the impartial 50.00 line, suggesting that bearish momentum stays dominant, with bulls missing management.

Learn extra: Filecoin (FIL) value prediction 2024/2025/2030

Primarily based on the evaluation above, FIL’s value dangers additional decline beneath its present stage. If momentum stays flat, the token may drop to help round $3.25. Nevertheless, if a surge in shopping for strain emerges, FIL would possibly rally towards resistance at $4.27.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.