Fantom skilled a 17% improve in worth, positioning it because the main performer within the cryptocurrency market.

Fantom (FTM), a blockchain platform optimized for decentralized finance purposes, soared 17% in worth on the morning of Aug. 22, exchanging palms at $0.461 per value information from crypto.information. The crypto asset’s every day buying and selling quantity jumped greater than double from the previous day, hovering round $284 million, whereas its market cap stood at $1.29 billion, rating it 62nd among the many high largest cryptocurrencies.

The token’s value has jumped by 67% since its drop to $0.276 on Aug. 5, when the crypto and inventory markets crashed, resulting in over $1 billion in liquidations. Regardless of the newest value surge, FTM remains to be down 86.6% from its all-time excessive of $3.46 recorded in October 2021.

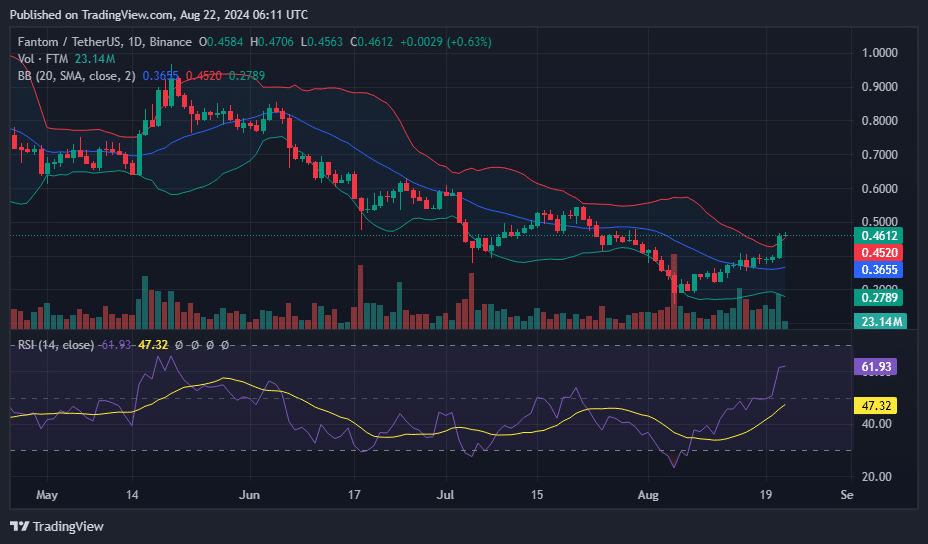

Fantom‘s present value at $0.4621 positions it above the higher Bollinger Band at $0.4520, signaling a possible breakout from typical volatility ranges. This place above each the center band at $0.3655 and the higher band suggests an uncommon upward momentum out there, indicative of a powerful bullish sentiment.

On condition that FTM value exceeds the higher Bollinger Band, there may very well be considerations concerning the asset changing into overbought, however the Relative Energy Index at 61.93, whereas elevated, nonetheless doesn’t firmly categorize the asset as overbought, which might sometimes be indicated by an RSI over 70. This implies that whereas the shopping for momentum is powerful, there should still be room for upward motion earlier than the asset enters doubtlessly overbought territory.

The situation displays a market that has probably reacted to constructive stimuli, propelling the worth above standard resistance ranges however not but to some extent of reversal primarily based on overbuying. This could entice additional curiosity from merchants trying to capitalize on the momentum, doubtlessly pushing the worth even larger within the quick time period.

Nonetheless, merchants also needs to be cautious of any fast adjustments that might result in a fast retracement if the worth adjusts again into the traditional vary of the Bollinger Bands.