Solana’s (SOL) value has climbed 5% over the previous week, shifting nearer to the higher line of its symmetrical triangle. A profitable breakout above this line may sign the beginning of a bullish pattern.

The technical setup on the one-day chart suggests this situation is feasible.

Solana Makes an attempt to Provoke a Bullish Development

SOL started buying and selling throughout the symmetrical triangle sample on July 29. This sample varieties when an asset’s value strikes between two converging traces, indicating a interval of market consolidation the place consumers and sellers compete for management.

A breakout above the triangle’s higher line indicators that consumers have taken the lead. As shopping for strain will increase, the asset’s value usually continues to rise, extending the uptrend.

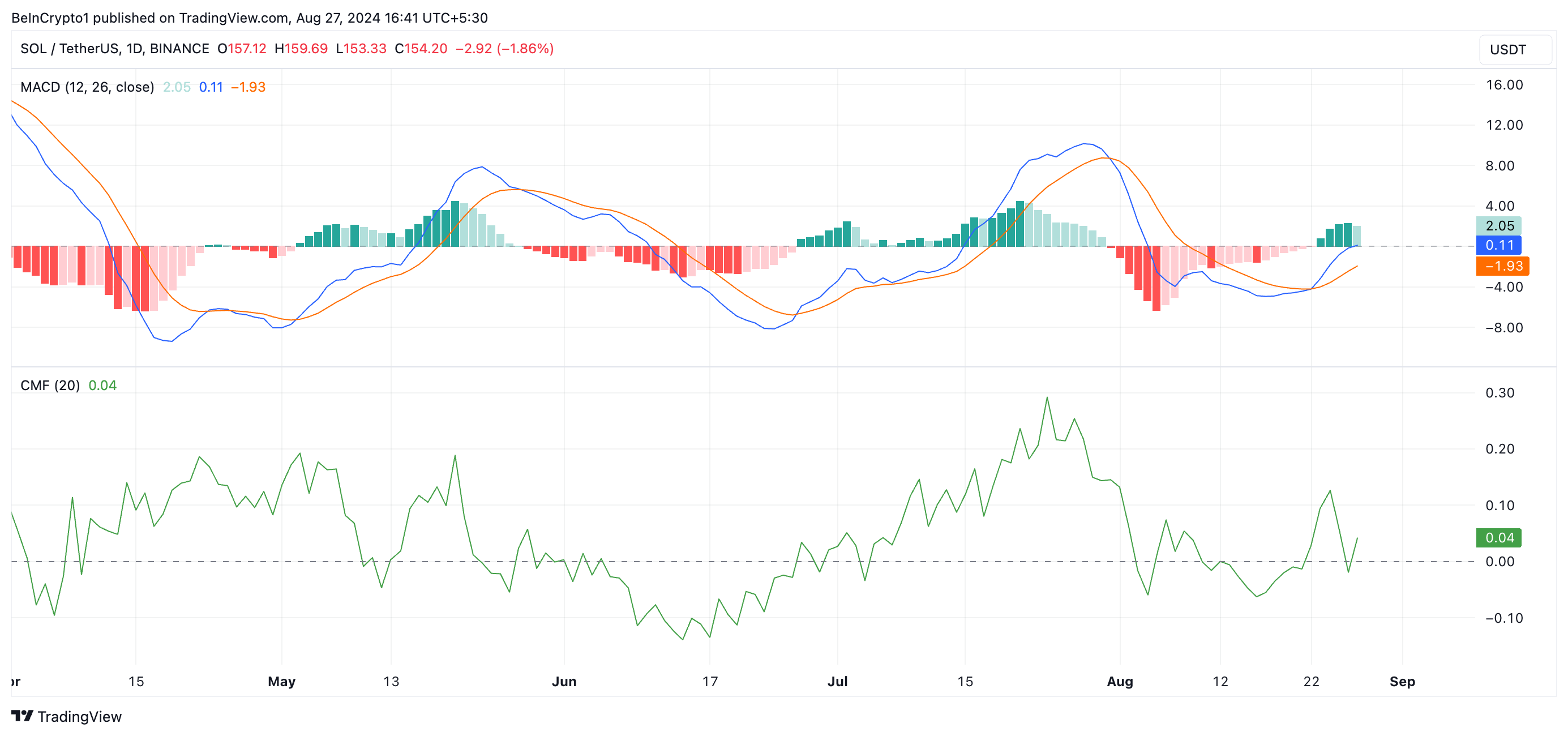

Readings from SOL’s technical indicators counsel a possible upward breakout within the close to time period. As an illustration, the Transferring Common Convergence Divergence (MACD) indicator exhibits the MACD line (blue) positioned above the sign line (orange) and approaching the zero line.

The MACD tracks an asset’s value pattern, route, and momentum shifts. When the MACD line is above the sign line, it signifies that purchasing strain is outpacing promoting, signaling strengthening bullish momentum. A rally above the zero line confirms the bullish pattern, prompting merchants to exit brief positions and go lengthy.

Learn extra: 11 High Solana Meme Cash to Watch in August 2024

Moreover, SOL’s optimistic Chaikin Cash Circulation (CMF) studying reinforces this outlook. At press time, the CMF is above the zero line at 0.04.

The CMF measures the movement of capital into and out of an asset. A worth above zero signifies sturdy market demand and optimistic liquidity inflows, each of that are essential for sustaining a value rally.

SOL Value Prediction: 12% Value Surge Anticipated

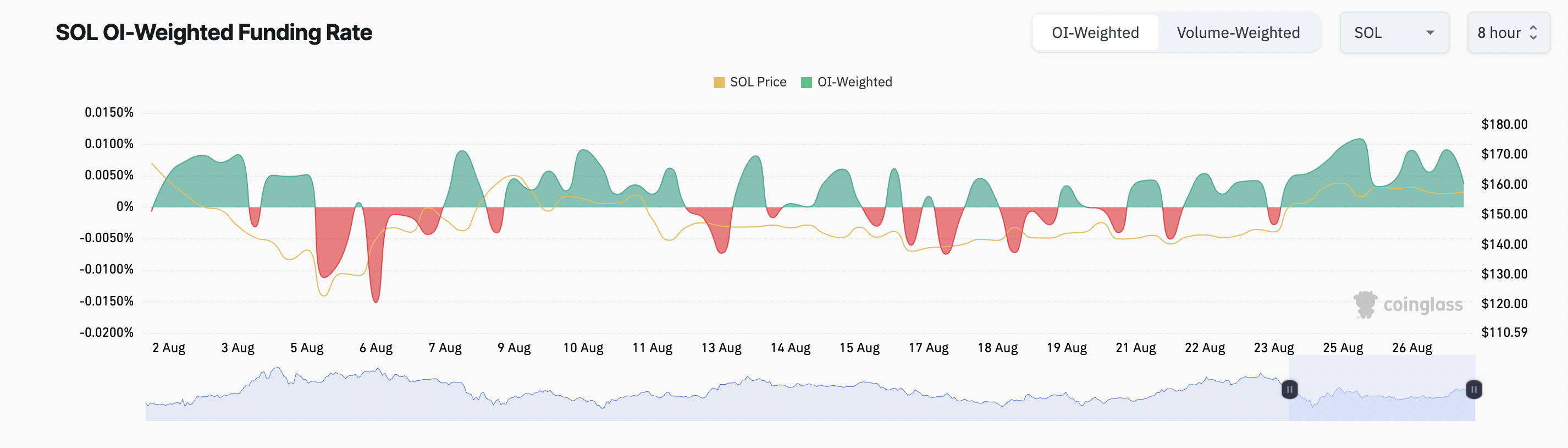

SOL’s funding charge throughout cryptocurrency exchanges stays optimistic, indicating stronger demand for lengthy positions in its futures market. In perpetual futures contracts, funding charges are funds exchanged between merchants based mostly on the distinction between the perpetual contract value and the spot value.

When the funding charge is optimistic, merchants with lengthy positions pay a charge to these holding brief positions. This dynamic means that extra merchants are optimistic about SOL’s value motion, anticipating additional features and prepared to take care of lengthy positions.

If SOL efficiently breaks above the higher line of the symmetrical triangle, its value may rally to $171.91, marking a 12% enhance from its present worth. This breakout would sign the continuation of a bullish pattern, pushed by elevated shopping for strain and optimistic market sentiment.

Learn extra: 11 High Solana Meme Cash to Watch in August 2024

Nonetheless, if the market pattern turns bearish, SOL’s value may fall to the decrease line of the symmetrical triangle at $148.27.

Disclaimer

In keeping with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.