XRP’s sturdy correlation with Bitcoin (BTC) may be limiting its efficiency, because the token has remained comparatively muted over the previous two months, regardless of a number of occasions that might usually set off constructive value actions.

As an example, in July, experiences revealed that Donald Trump raised over $4 million in marketing campaign donations via digital tokens, together with XRP, but this information didn’t influence XRP’s value. Moreover, the altcoin confirmed no response when 33 million tokens have been transferred to a Binance pockets on August 22. Most just lately, after Ripple introduced plans to introduce good contracts to the XRP Ledger (XRPL), XRP’s value dropped by 3%.

Ripple’s Ties with Bitcoin Spells Bother

Ripple’s announcement of plans to introduce good contracts to the XRP Ledger (XRPL) ought to ideally have sparked a constructive value response for XRP. Nevertheless, the altcoin’s sturdy correlation with Bitcoin (BTC), with a correlation coefficient of 0.72, has resulted in a muted response. This determine displays a fairly sturdy constructive relationship between the 2 property.

Up to now 24 hours, Bitcoin’s value has dropped by 4%, and XRP adopted with a 3% decline. Regardless of this drop, XRP’s buying and selling quantity surged by 39%, making a damaging divergence. Such divergence usually signifies growing promoting strain, suggesting XRP might face additional decline.

Learn extra: XRP ETF Defined: What It Is and How It Works

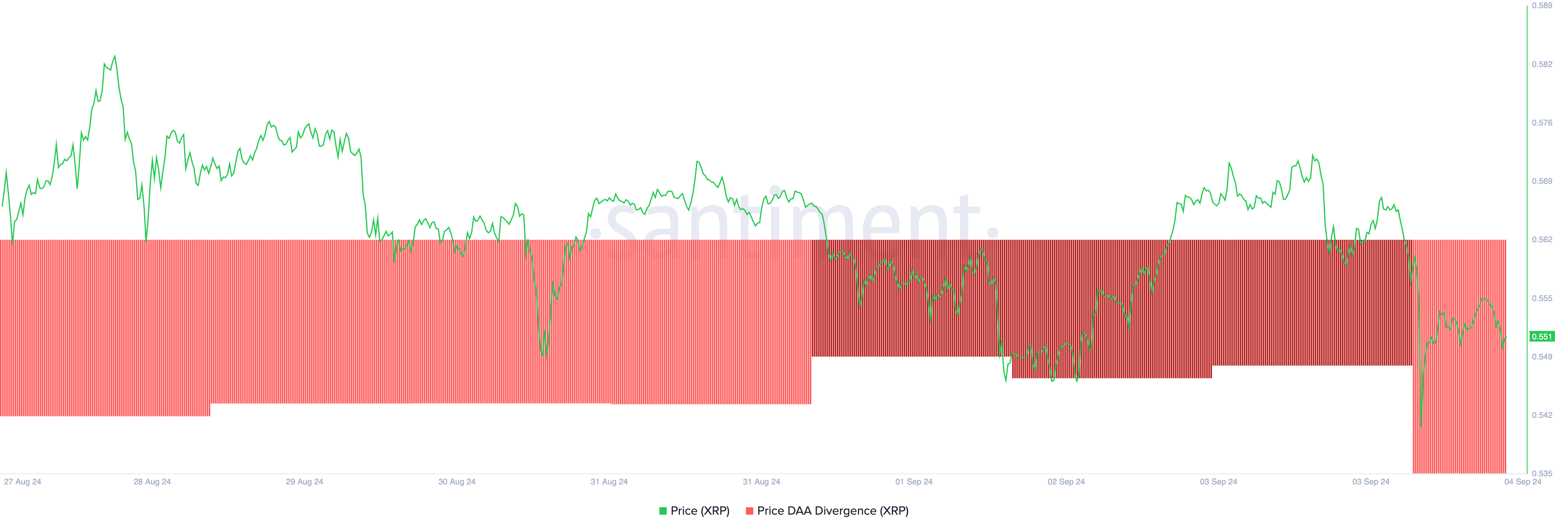

XRP’s damaging price-to-daily energetic tackle divergence additional confirms the rise in promoting exercise. This metric tracks the asset’s value actions and compares them with modifications within the variety of day by day energetic addresses.

As of this writing, XRP’s price-to-daily energetic tackle divergence stands at -63.81, signaling decreased participation in shopping for, promoting, or holding XRP, which might contribute to continued value strain.

XRP Worth Prediction: Brace For Extra Devaluation

At press time, XRP is buying and selling at $0.55, and its 12-hour chart suggests additional decline. The token’s MACD line (blue) sits beneath its sign line (orange) and the zero line, indicating a robust bearish development. This setup indicators a continued downtrend until a reversal happens, prompting merchants to both keep away from the market or contemplate quick positions.

Moreover, XRP’s bull-bear energy, measured by the Elder-Ray Index, reveals that sellers dominate the market. As of now, the index stands at -0.035, having remained damaging since August 26, indicating bear energy is in management.

Learn extra: Ripple (XRP) Worth Prediction 2024/2025/2030

If bears proceed to overpower bulls, XRP’s value might drop to $0.52. Ought to this degree fail to carry, an additional decline to $0.46 might observe. Nevertheless, if market sentiment shifts to bullish, XRP might rise to $0.56.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.