The stage seems set for Bitcoin to surpass its earlier all-time excessive, fueled by a surge in international liquidity, a number of macroeconomic analysts argue.

In latest weeks, the worldwide macro monetary outlook has been exhibiting indicators of a shift. Over the weekend, Goldman Sachs economists introduced that they’d lowered their estimations of the likelihood of a U.S. recession in 2025 from 25% to twenty%.

This modification got here after the most recent U.S. retail gross sales and jobless claims information have been launched, which recommended that the U.S. economic system may be in higher form than many had feared.

The Goldman Sachs analysts added that if the upcoming August jobs report — set for launch on Sept. 6 — continues this development, the probability of a recession might drop again to their beforehand held marker of 15%.

The opportunity of such a growth has sparked confidence that the U.S. Federal Reserve may quickly lower rates of interest in September, presumably by 25 foundation factors.

The potential price cuts have already begun to impression the markets, with U.S. inventory indices, together with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Common, recording their largest weekly share positive aspects of the 12 months for the week ending on Aug. 16.

Alongside this comparatively constructive information for the U.S. economic system, international liquidity has begun to rise. Traditionally, rising liquidity and easing recession fears have typically been catalysts for bullish developments within the crypto area.

So, let’s take a better have a look at what’s taking place globally and the way these macroeconomic shifts might impression Bitcoin (BTC) and the whole crypto market within the coming weeks and months forward.

Liquidity surge throughout international markets

To know the place BTC may be headed, we have to delve into the mechanisms behind the present liquidity surge and the way it might impression the broader markets.

The U.S. liquidity flood

Within the U.S., the Treasury seems poised to inject an enormous quantity of liquidity into the monetary system. BitMEX cofounder and well-known crypto business determine Arthur Hayes said in a latest Medium submit that this liquidity increase might push Bitcoin previous its earlier all-time excessive of $73,700. However why now?

One doable clarification is the upcoming presidential elections. Sustaining a robust economic system is essential, and this liquidity injection might be a means to make sure favorable situations because the election approaches.

However how precisely is that this liquidity going to be injected? The U.S. Treasury and the Fed have a number of highly effective instruments at their disposal, as Hayes lays out in his evaluation.

First, there’s the in a single day reverse repurchase settlement mechanism, or RRP, the stability of which presently stands at $333 billion as of Aug. 19, down considerably from a peak of over $2.5 trillion in December 2022.

Hayes explains that the RRP must be checked out as a significant pool of “sterilized money” on the Fed’s stability sheet that the Treasury is evidently seeking to get “into the real economy” — aka add liquidity. The RRP represents the quantity of Treasury securities that the Fed has bought with an settlement to repurchase them sooner or later. On this course of, the shopping for establishments — specifically cash market funds — earn curiosity on their money in a single day.

As Hayes factors out, the drop in in a single day RRP over the previous 12 months signifies that cash market funds are shifting their money into short-term T-bills as a substitute of the RRP, as T-bills earn barely extra curiosity. As Hayes notes, T-bills “can be leveraged in the wild and will generate credit and asset price growth.” In different phrases, cash is leaving the Fed’s stability sheet, including liquidity to the markets.

The Treasury additionally not too long ago introduced plans to challenge one other $271 billion price of T-bills earlier than the top of December, Hayes famous.

However that’s not all. The Treasury might additionally faucet into its common account, the TGA, which is basically the federal government’s checking account. This account holds a staggering $750 billion, which might be unleashed into the market below the guise of avoiding a authorities shutdown or different fiscal wants. The TGA can be utilized to fund the acquisition of non-T-bill debt. As Hayes explains: “If the Treasury increases the supply of T-bills and reduces the supply of other types of debt, it net adds liquidity.”

If each of those methods are employed, as Hayes argues, we might see wherever between $301 billion (the RRP funds) to $1 trillion pumped into the monetary system earlier than the top of the 12 months.

Now, why is that this necessary for Bitcoin? Traditionally, Bitcoin has proven a robust correlation with durations of accelerating liquidity.

When more cash is sloshing round within the economic system, buyers are likely to tackle extra danger. Given Bitcoin’s standing as a danger asset — in addition to its finite provide — Hayes argues that the elevated liquidity means a bull market might be anticipated by the top of the 12 months.

If the U.S. follows by means of with these liquidity injections, we might see a robust uptick in Bitcoin’s value as buyers flock to the crypto market looking for larger returns.

China’s liquidity strikes

Whereas the U.S. is ramping up its liquidity efforts, China can also be making strikes — although for various causes.

In line with a latest X thread from macroeconomic analyst TomasOnMarkets, the Chinese language economic system has been exhibiting indicators of pressure, with latest information reportedly revealing the primary contraction in financial institution loans in 19 years. It is a large deal as a result of it signifies that the financial engine of China, which has been one of many world’s primary development drivers, is sputtering.

To counteract this strain, the Folks’s Financial institution of China has been quietly rising its liquidity injections. Over the previous month alone, the PBoC has injected $97 billion into the economic system, primarily by means of the exact same reverse repo operations.

Whereas these injections are nonetheless comparatively small in comparison with what we’ve seen up to now, they’re essential in a time when the Chinese language economic system is at a crossroads.

However there’s extra at play right here. In line with the analyst, the Chinese language Communist Social gathering’s senior management has pledged to roll out extra coverage measures to help the economic system.

These measures might embrace extra aggressive liquidity injections, which might additional increase the cash provide and probably stabilize the Chinese language economic system.

Over the previous few weeks, the yuan has strengthened towards the U.S. greenback, which might present the PBoC with extra space to maneuver and implement extra stimulus with out triggering inflationary pressures.

The large image on international liquidity

What’s notably fascinating about these liquidity strikes is that they don’t appear to be taking place in isolation.

Jamie Coutts, chief crypto analyst at Actual Imaginative and prescient, famous that previously month, central banks, together with the Financial institution of Japan, have injected substantial quantities into the worldwide cash base, with the BoJ alone including $400 billion.

When mixed with the $97 billion from the PBoC and a broader international cash provide growth of $1.2 trillion, it seems that there’s a coordinated effort to infuse the worldwide economic system with liquidity.

One issue that helps this concept of coordination is the latest decline within the U.S. greenback. The greenback’s weak spot means that the Federal Reserve may be in tacit settlement with these liquidity measures, permitting for a extra synchronized strategy to boosting the worldwide economic system.

Jamie added that if we draw comparisons to earlier cycles, the potential for Bitcoin to rally could be very excessive. In 2017, throughout the same interval of liquidity growth, Bitcoin rallied 19x. In 2020, it surged 6x.

Whereas it’s unlikely that historical past will repeat itself precisely, the analyst argues that there’s a robust case to be made for a 2-3x improve in Bitcoin’s worth throughout this cycle — supplied the worldwide cash provide continues to develop, and the U.S. greenback index (DXY) drops beneath 101.

The place might the BTC value go?

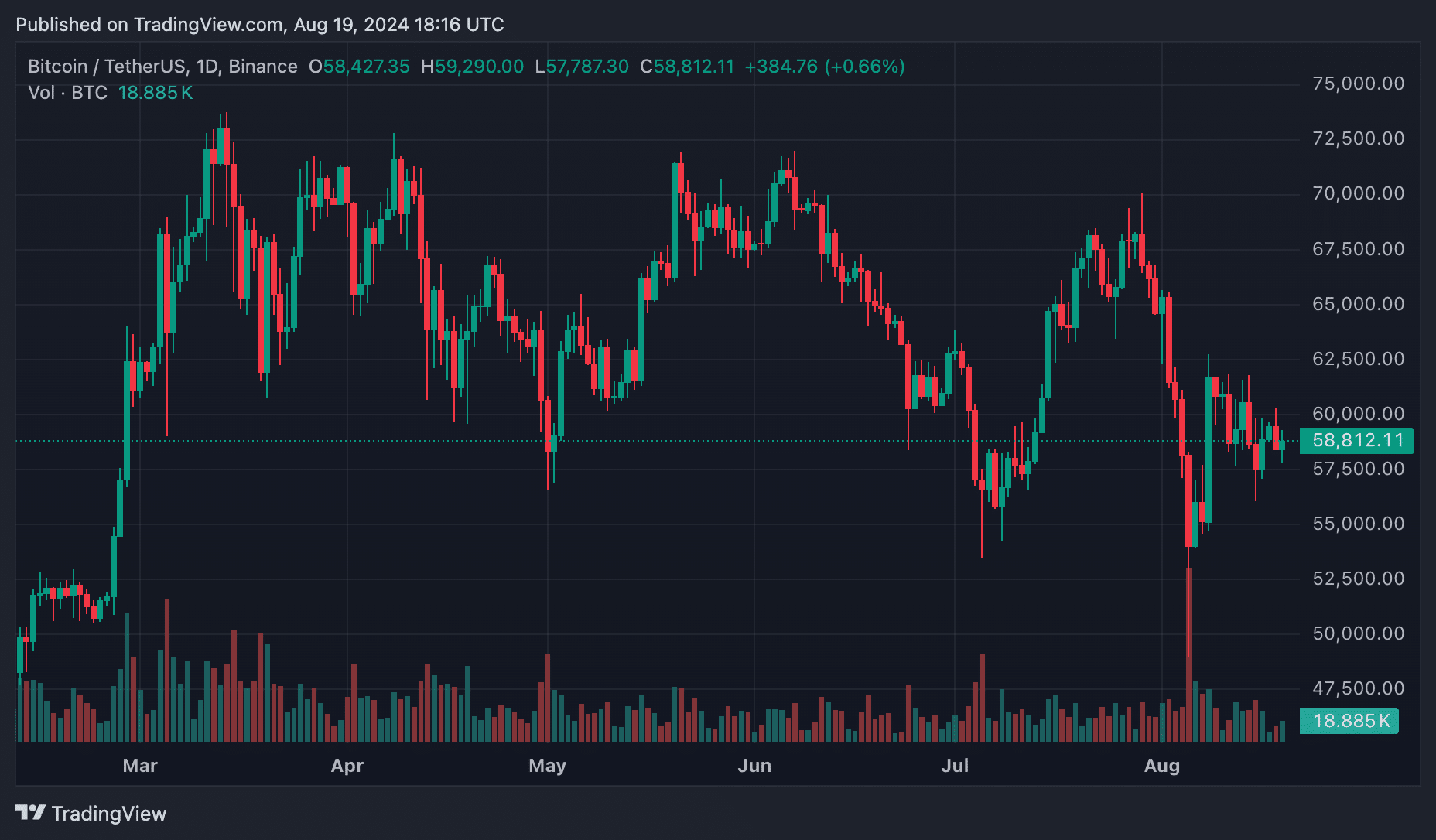

On Aug. 5, Bitcoin and different crypto belongings suffered a pointy decline attributable to a market crash triggered by rising recession fears and the sudden unwinding of the yen carry commerce. The impression was extreme, with Bitcoin plummeting to as little as $49,000 and struggling to get better.

As of Aug. 19, Bitcoin is buying and selling across the $59,000 mark, going through robust resistance between $60,000 and $62,000. The important thing query now’s: the place does Bitcoin go from right here?

In line with Hayes, for Bitcoin to actually enter its subsequent bull section, it wants to interrupt above $70,000, with Ethereum (ETH) surpassing $4,000. Hayes stays optimistic, stating, “the next stop for Bitcoin is $100,000.”

He believes that as Bitcoin rises, different main crypto belongings will comply with go well with. Hayes particularly talked about Solana (SOL), predicting it might soar 75% to achieve $250, simply shy of its all-time excessive.

Supporting this view is Francesco Madonna, CEO of BitVaulty, who additionally sees the present market atmosphere as a precursor to a unprecedented bullish section.

Madonna highlighted a sample he has noticed over the previous decade: in periods of uncertainty or quick liquidity injections, gold usually strikes first attributable to its safe-haven standing.

Lately, gold reached its all-time excessive, which Madonna interprets as a number one indicator that the bull marketplace for danger belongings, together with Bitcoin, is simply starting.

Madonna factors out that after gold peaks, the Nasdaq and Bitcoin usually comply with, particularly as liquidity stabilizes and buyers begin searching for larger returns in development belongings.

Provided that gold has already hit its all-time excessive, Madonna believes Bitcoin’s latest consolidation round $60,000 might be the calm earlier than the storm, with $74,000 being simply the “appetizer” and $250,000 probably inside attain.

As Coutts said in a latest X submit, the growth of the cash provide is a situation of a credit-based fractional reserve system just like the one we have now.

With out this growth, the system dangers collapse. The analyst argues that this “natural state” of perpetual development within the cash provide might be the catalyst that propels Bitcoin, alongside different development and danger belongings, into its subsequent main bull market.

With the U.S., China, and different main economies all injecting liquidity into the system, we’re more likely to see elevated demand for Bitcoin as buyers search belongings that may outperform conventional investments.

If these liquidity measures proceed as anticipated, Bitcoin might be on the verge of one other key rally, with the potential to interrupt by means of its earlier all-time excessive and set new data.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.