Avalanche (AVAX) value is displaying indicators of a possible breakout as long-term holders surge and short-term merchants lower. With the value at the moment hovering round $29.26, AVAX is approaching two key resistance zones that would decide its subsequent transfer.

A profitable break above the $34.12 degree may set off a large 79% rally. Nevertheless, failure to interrupt these resistances may end in important draw back danger, with potential drops forward.

AVAX Lengthy-Time period Holders Surge: A Bullish Sign?

Prior to now month, the variety of long-term holders of Avalanche (AVAX) has grown by 4.26%, which could not appear to be a lot at first look, however that interprets to about 200,000 further addresses.

These long-term holders, outlined as these proudly owning AVAX for greater than a 12 months, point out a rising dedication to the asset, which might have a big impression on its value stability and potential future progress.

Learn extra: How To Purchase Avalanche (AVAX) and All the pieces You Want To Know

On the similar time, the variety of merchants — those that maintain AVAX for lower than a month — has dropped by 6.86%, or round 13,000 addresses. This shift suggests a strengthening perception in coin’s worth and long-term potential. As extra folks maintain onto their AVAX for prolonged durations, promoting stress decreases, which may create a extra favorable atmosphere for value appreciation.

Fewer merchants imply much less volatility, and with extra long-term holders displaying confidence within the venture, this might be a robust bullish sign for AVAX within the coming months.

Ichimoku Cloud Appears Bullish for AVAX

The Ichimoku Cloud chart for AVAX/USD exhibits a number of indications that time towards a bullish outlook for Avalanche. One of many key bullish indicators in Ichimoku evaluation is when the value is buying and selling above the cloud, and this clearly occurs within the chart.

When the value breaks out above the cloud, it typically suggests a shift in direction of upward momentum, which might point out additional value appreciation. Moreover, the cloud itself is at the moment inexperienced, reinforcing the constructive pattern. Whereas the cloud is comparatively thick, suggesting there could also be some resistance forward, the general outlook stays favorable.

One other essential facet is the place of the lagging span (Chikou Span), which is at the moment above the value, confirming that present momentum is backing the upward pattern. Moreover, the conversion line (Tenkan-sen) is above the baseline (Kijun-sen), indicating stronger short-term momentum in comparison with longer-term tendencies, which provides to the bullish case.

Total, the chart means that AVAX is more likely to proceed its constructive motion.

AVAX Value Prediction: A 79% Pump?

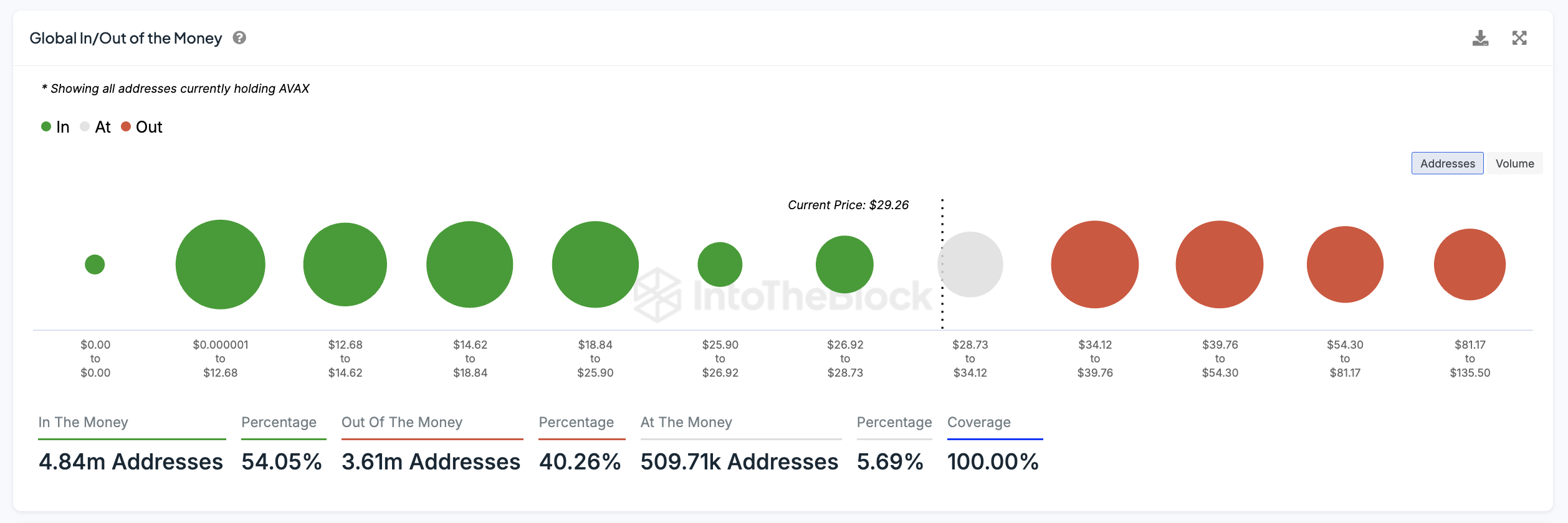

Wanting on the World In/Out of the Cash chart for AVAX, we will observe two key resistance zones that lie forward for its value.

The “Global In/Out of the Money” is a metric that measures the profitability of addresses holding AVAX. Basically, it exhibits the proportion of addresses which are both “In the Money” (revenue), “At the Money” (break-even), or “Out of the Money” (loss) primarily based on the present AVAX value of $29.26.

The primary important resistance is across the $34.12 degree, the place a substantial variety of addresses are holding AVAX, ready to interrupt even or promote at this value vary.

Learn extra: The best way to Add Avalanche to MetaMask: A Step-by-Step Information

If AVAX can efficiently break by way of this resistance, the following zone to observe is between $39.76 and $54.30. This is able to characterize a possible pump of as much as 79%, signaling a significant alternative for upward value motion.

On the flip aspect, if the present pattern fails to interrupt by way of the resistances, AVAX may face important draw back danger. A value reversal may see it drop to the $25 vary, the place the following cluster of holders is concentrated.

In a extra bearish situation, the value may even fall as little as $18, resulting in a possible 38% drop from present ranges. This exhibits the significance of monitoring key ranges intently, as breaking or failing to interrupt them will decide AVAX’s short-term path.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.