Binance Coin (BNB) has skilled a gradual lower in market volatility over the previous few days, as its value begins to consolidate inside an outlined vary.

This consolidation is clear on the one-day chart, the place BNB’s 20-day exponential transferring common (EMA) and 50-day easy transferring common (SMA) have began to flatten out, indicating a interval of lowered value motion.

Binance Coin Is Not At Danger Of Value Swings

The 20-day EMA is a short-term transferring common that shortly responds to cost modifications, representing the typical closing value of an asset over the previous 20 days. In distinction, the 50-day SMA is a longer-term transferring common that displays an asset’s common closing value during the last 50 days.

Since August 26, BNB’s 20-day EMA and 50-day SMA have each flattened. When an asset’s transferring averages flatten, it alerts market indecision, the place neither consumers nor sellers have sufficient energy. This sometimes signifies that the market is trending sideways.

This era is characterised by a low chance of serious value swings, as confirmed by BNB’s volatility indicators. As an example, the coin’s Common True Vary (ATR), which measures the diploma of an asset’s value volatility, has been trending downward over the previous few days. As of the newest knowledge, BNB’s ATR stands at 24.6.

Learn Extra: How To Commerce Crypto on Binance Futures: Every little thing You Want To Know

A declining ATR means that an asset’s value is experiencing much less fluctuation, indicating that the market is getting into a consolidation part the place costs have a tendency to maneuver inside a narrower vary.

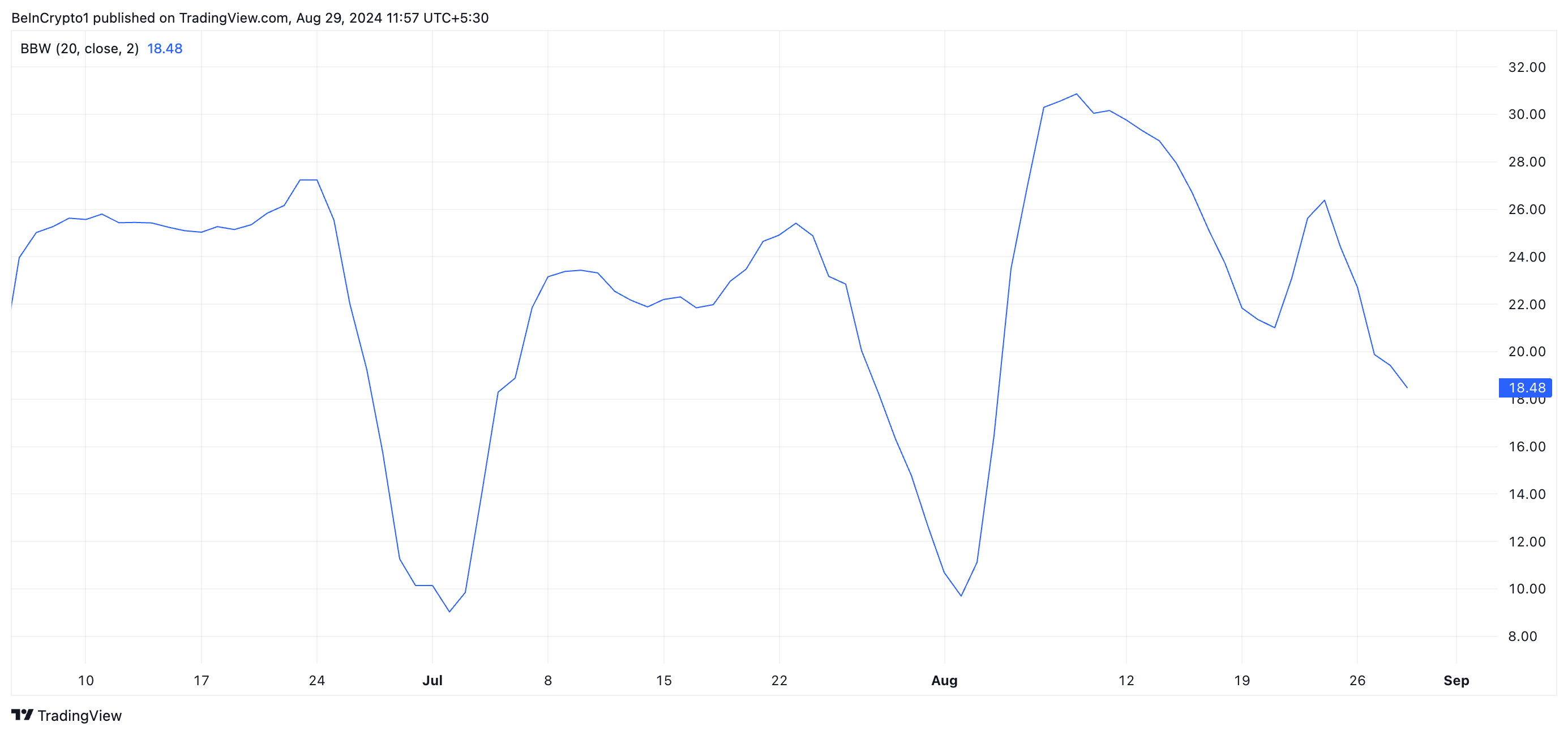

Moreover, BNB’s downward-trending Bollinger Bandwidth helps this view. This indicator helps merchants assess market volatility and establish potential breakout alternatives. As of the newest knowledge, the Bollinger Bandwidth for BNB stands at 18.48.

A declining bandwidth resembling this means that BNB’s Bollinger bands are far aside, confirming low market volatility.

BNB Value Prediction: Bulls and Bears Face Off in Battle

When an asset trades sideways, it signifies a stability between shopping for and promoting pressures, which retains the worth from transferring strongly in both path.

If BNB experiences a bullish resurgence and demand for the altcoin will increase, it might escape of its slender vary and begin an uptrend. If this situation unfolds, BNB’s value could climb to $560.90, which is above its 20-day EMA and 50-day SMA.

Learn extra: Binance Coin (BNB) Value Prediction 2024/2025/2030

Nevertheless, if the bearish sentiment in opposition to BNB intensifies and promoting stress will increase, the worth might drop to $522.90.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.