Bitcoin (BTC) closed the week at its lowest degree since Could, ending at $100,970. BTC fell beneath $99,000 at one level resulting from fears sparked by escalating geopolitical tensions.

Nevertheless, high consultants out there stay optimistic, whilst total sentiment has shifted from impartial to fearful.

What Are Consultants Saying About Bitcoin Dropping Under $100,000?

As BeInCrypto reported, Bitcoin slipped beneath the $100,000 mark after Iran threatened to close down the Strait of Hormuz. This marked a severe escalation in tensions following US assaults on Iran.

As an alternative of panicking, main business consultants stayed optimistic. They based mostly their confidence on technical evaluation and macroeconomic components.

Raoul Pal, Founder and CEO of RealVision, shared his perspective alongside a chart evaluating the worldwide M2 cash provide to Bitcoin’s worth. He argued that Bitcoin falling beneath $100,000 isn’t a surprise, contemplating its sturdy correlation with the expansion of the worldwide M2 provide.

The chart exhibits that Bitcoin sometimes follows M2 progress with a 12-week lag. Pal emphasised that buyers shouldn’t count on each short-term motion to match completely. What issues extra is the general context.

“Nothing seems unusual here but please do not expect all wiggles to match or all timing points to be exact, it’s the overall contextualization that matters the most… and yes, alts bleed more than BTC in corrections,” Raoul Pal stated.

Arthur Hayes, former CEO of BitMEX, shared an analogous view. He predicted that central banks—particularly the US Federal Reserve—would quickly restart aggressive cash printing. In a earlier evaluation, Hayes argued that unfastened financial coverage might drive Bitcoin’s worth to skyrocket, doubtlessly even reaching $1 million.

“Do you hear that? … it’s the sound of the money printers revving up to do their patriotic duty. This weakness shall pass and BTC will leave no doubt as to its safe haven status,” Arthur Hayes stated.

His view strengthens the assumption that Bitcoin, usually dubbed “digital gold,” will profit from money-printing insurance policies throughout financial and political uncertainty.

On the technical aspect, standard analyst TechDev additionally provided a optimistic outlook. Whereas he acknowledged that BTC would possibly drop additional, he stays assured in a serious rebound.

“$95,000 would make sense structurally. Then $170,000 is closer than you think,” TechDev stated.

Moreover, main business figures like Binance founder CZ and Ran Neuner, founding father of Crypto Banter, additionally expressed sturdy confidence in Bitcoin’s restoration.

Information Reveals Retail Sentiment Diverges from Market Actions

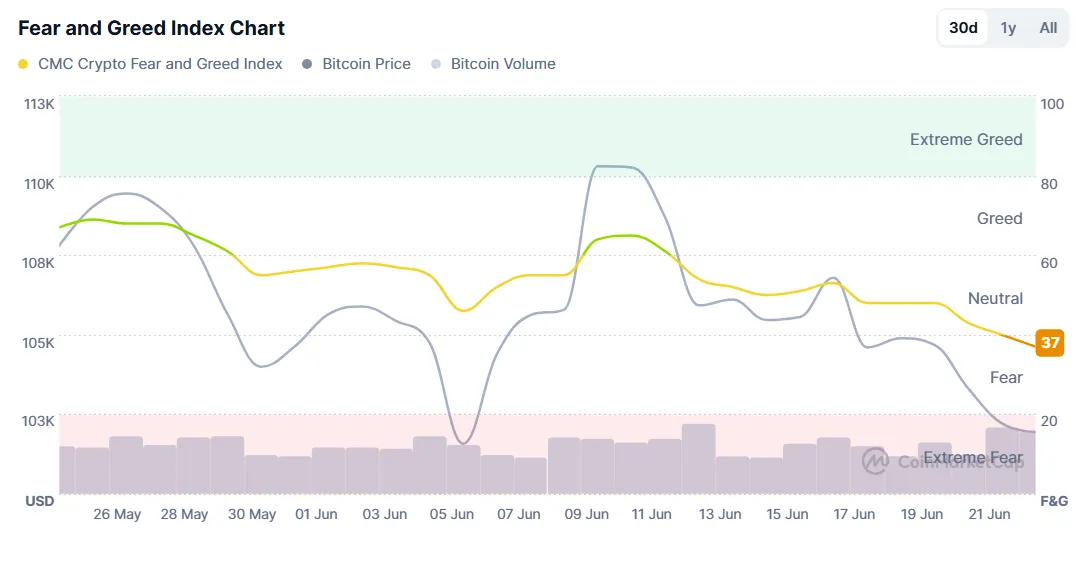

Whereas consultants remained optimistic amid rising political tensions, retail sentiment painted a special image. In response to CoinMarketCap, the Worry and Greed Index dropped from 65 to 37 in June. This shift displays a transition from greed to worry amongst retail buyers.

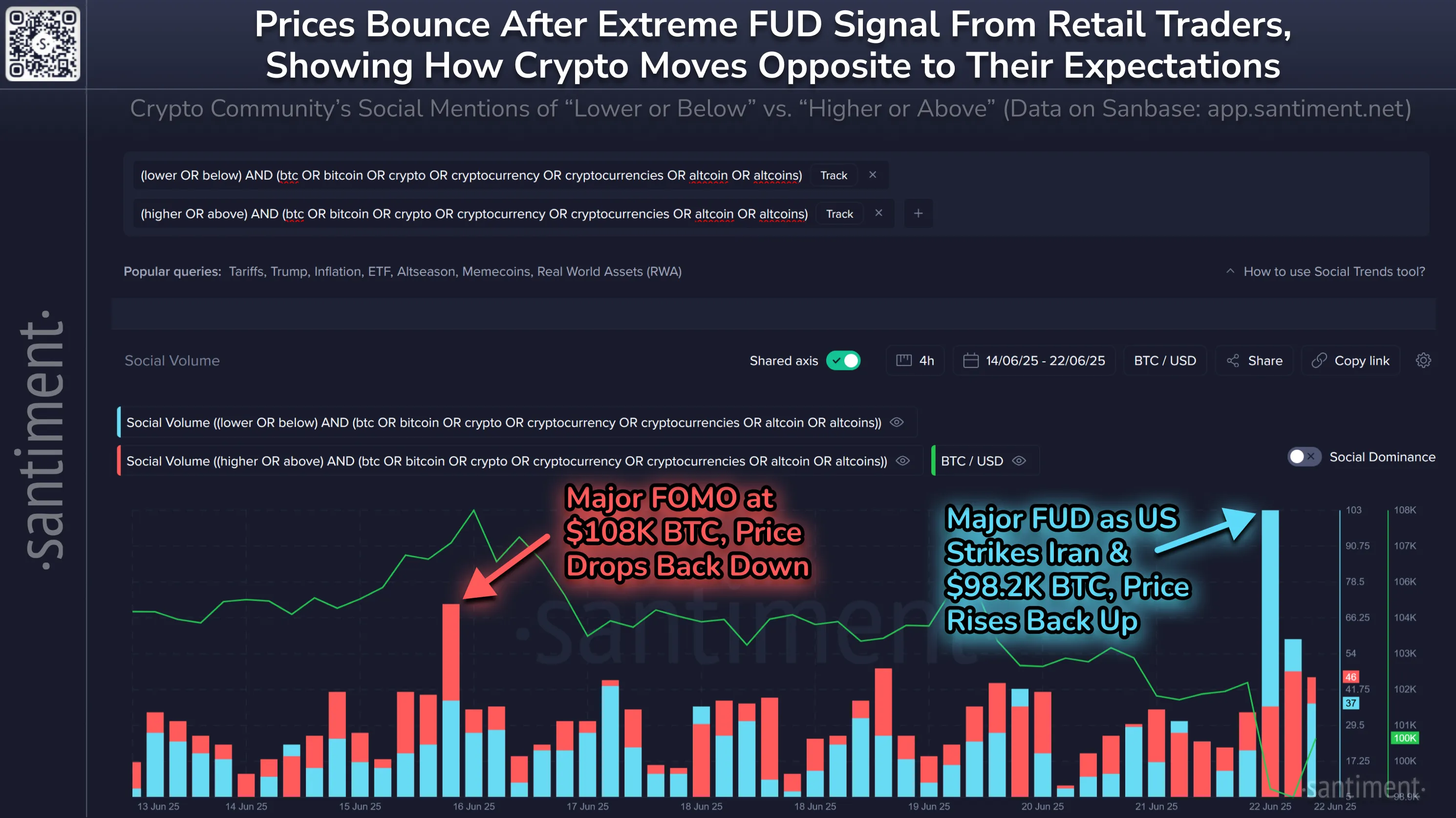

Nevertheless, Santiment’s evaluation means that Bitcoin usually strikes in opposition to the sentiment of retail buyers. Social quantity information signifies that overly optimistic discussions have lately coincided with worth drops. In the meantime, during times of extraordinarily unfavourable discussions—such because the latest US-Iran battle—Bitcoin’s worth has tended to recuperate.

“With all of the real world concern and uncertainty in crypto now, the price swings for this upcoming week should be simple:

Retail calls for ‘lower’ or ‘below’ = price goes UP

Retail calls for ‘higher’ or ‘above’ = price goes DOWN,” analyst Brianq from Santiment stated.

On the time of writing, Bitcoin has recovered and is buying and selling above $101,000, including additional weight to the forecasts shared by these consultants.

Nonetheless, the following strikes by world leaders concerned within the battle stay unpredictable. These developments might shift the market in ways in which many buyers won’t count on.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.