Bitcoin’s decisive break above the psychologically vital $95,000 mark has injected recent optimism into the market, not less than amongst miners.

This key milestone has triggered a shift in miner sentiment, with on-chain information exhibiting a noticeable uptick in BTC miner reserves over the previous few days.

Miners Guess on BTC Upside as Reserve Jumps from Yearly Low

Based on CryptoQuant, Bitcoin’s miner reserve, which had been in a sustained downtrend, started to rise on April 29, shortly after BTC closed above the $95,000 threshold.

For context, the reserve had dropped to a year-to-date low of 1.80 million BTC only a day earlier earlier than reversing course and exhibiting indicators of accumulation.

Bitcoin’s miner reserve tracks the variety of cash held in miners’ wallets. It represents the coin reserves miners have but to promote. When it falls, miners are transferring cash out of their wallets, normally to promote, confirming rising bearish sentiment in opposition to BTC.

Conversely, when this metric rises, as it’s now, it suggests miners are holding onto extra of their mined cash, typically reflecting rising confidence within the BTC’s future worth appreciation.

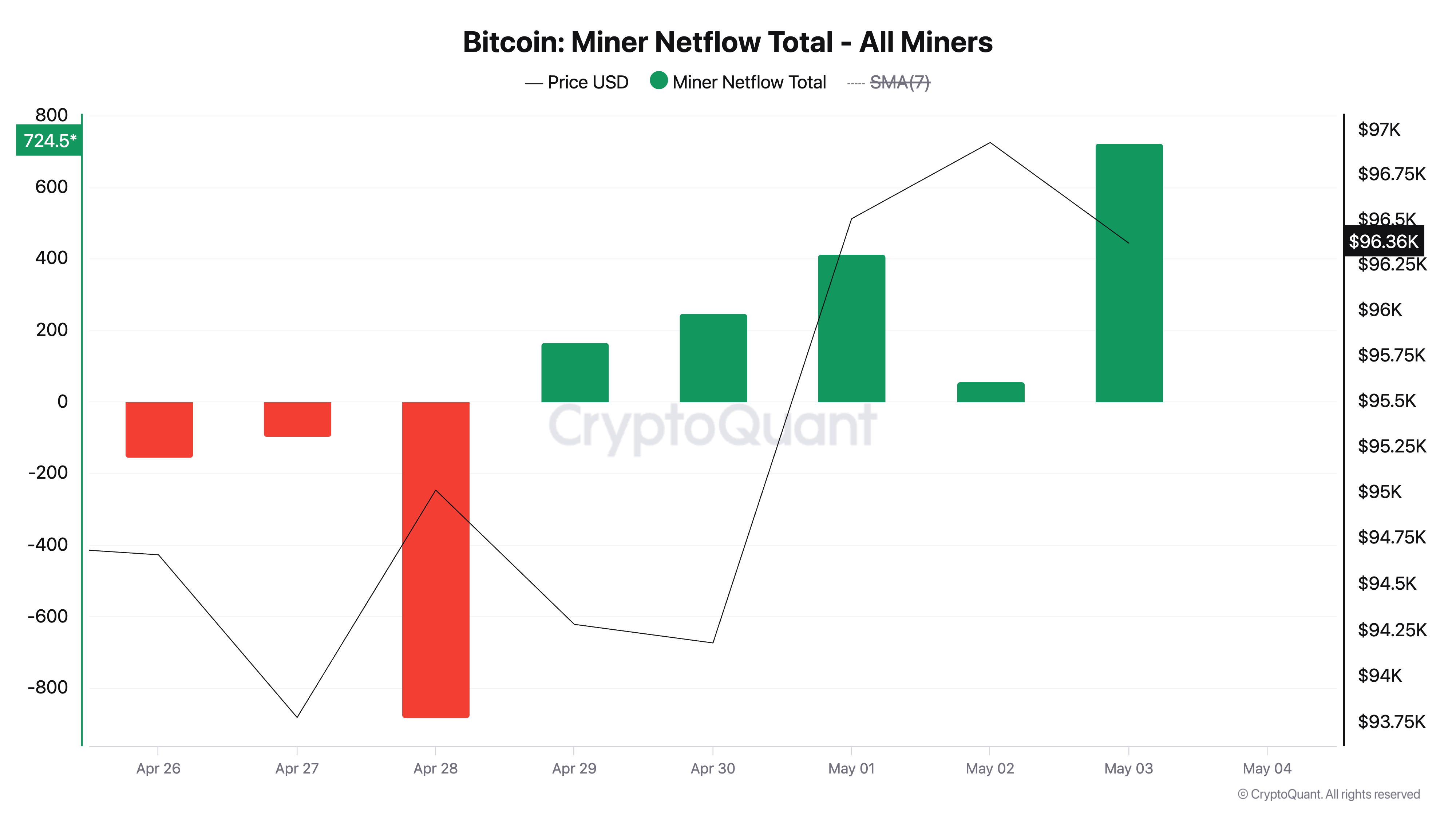

Furthermore, the bullish shift in miner sentiment is additional supported by the constructive miner netflow recorded since April 29. This alerts that extra cash are being put into miner wallets fairly than offloading to exchanges.

Such conduct displays confidence in additional upside, as miners, typically seen as long-term holders, are selecting to build up fairly than liquidate.

There Is a Catch

Nevertheless, the sentiment just isn’t universally bullish. Whereas BTC miners are stepping again from promoting, derivatives information tells a unique story.

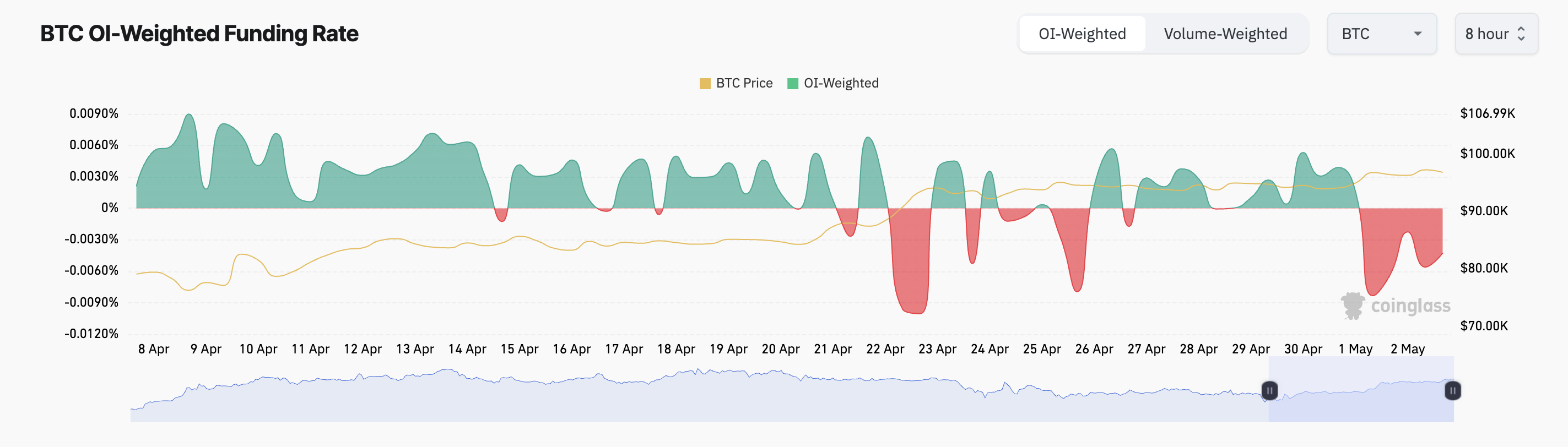

Within the futures market, BTC’s funding price has remained destructive for the reason that starting of Might, an indication that a good portion of merchants are betting on a near-term worth correction. At press time, the coin’s funding price is -0.0056%.

The funding price is a periodic cost exchanged between lengthy and quick merchants in perpetual futures contracts to maintain the contract worth aligned with the spot worth.

When it’s constructive, it means merchants holding lengthy positions are paying these with quick positions, indicating that bullish sentiment dominates the market.

However, a destructive funding price like this alerts extra quick bets than lengthy ones, suggesting bearish stress on BTC’s worth.

Breakout or Breakdown as Merchants and Miners Diverge

Whereas miner conduct could level to renewed confidence, the regular bearish sentiment in derivatives means that merchants stay cautious of a possible pullback.

If coin accumulation strengthens, BTC may prolong its good points, break above the resistance at $98,515, and try and regain the $102,080 worth mark.

Nevertheless, if the bearish bets in opposition to the main coin win and witness a shortfall in demand, its worth may fall beneath $95,000 to succeed in $92,910.

Disclaimer

In step with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.