One other day, one other transfer within the markets. From contemporary ETF inflows signaling institutional urge for food to derivatives knowledge revealing the place merchants are inserting their bets, in the present day’s evaluation presents key insights into what’s driving value motion.

Let’s break down the most recent tendencies shaping the ETF and derivatives area.

Bitcoin Spot ETFs Rebound With $221 Million Inflows

The decreased cryptocurrency market exercise famous in March brought about BTC spot ETFs to document a month-to-month outflow of $767 million. Nevertheless, with broader market restoration underway, April has began nicely.

On April 2, spot BTC ETFs noticed a constructive surge in inflows, with $221 million pouring into spot Bitcoin merchandise. Ark Make investments and 21Shares’s ETF ARKB led this inflow, with a day by day internet influx of $130.15 million, bringing its internet property below administration to $4.14 billion.

Nevertheless, not all funds shared this constructive trajectory, as BlackRock’s ETF IBIT skilled internet outflows totaling $115.87 million.

As of this writing, Bitcoin Spot ETFs have a complete internet asset worth of $97.35 billion, representing 5.73% of the coin’s market capitalization of $1.65 trillion.

BTC Derivatives Exercise Cools, Put Choices Outpace Calls

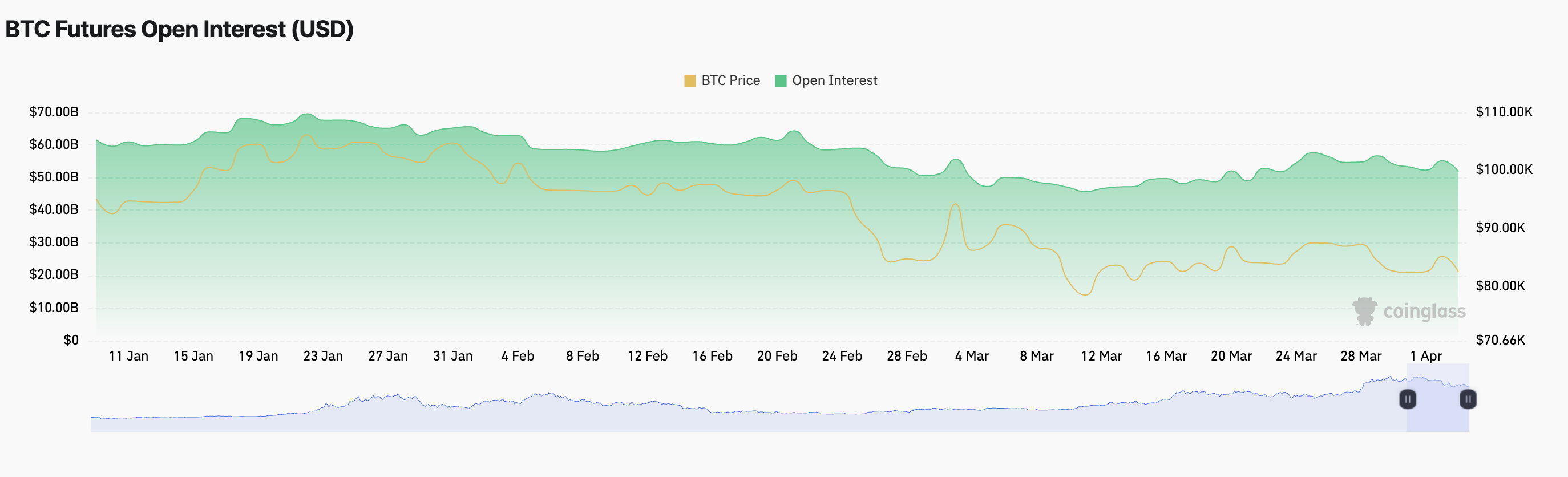

In the meantime, exercise within the BTC derivatives market has declined, with the coin’s futures open curiosity plummeting 7% over the previous 24 hours. At press time, per Coinglass knowledge, this stands at $51.82 billion.

An asset’s open curiosity measures the entire variety of excellent by-product contracts (comparable to futures or choices) that haven’t been settled.

Notably, BTC’s worth has dropped by 1% through the interval in evaluate, confirming the decline in buying and selling exercise. When BTC’s open curiosity falls alongside its worth like this, it signifies that merchants are closing positions moderately than opening new ones, including to the downward stress on the coin’s value.

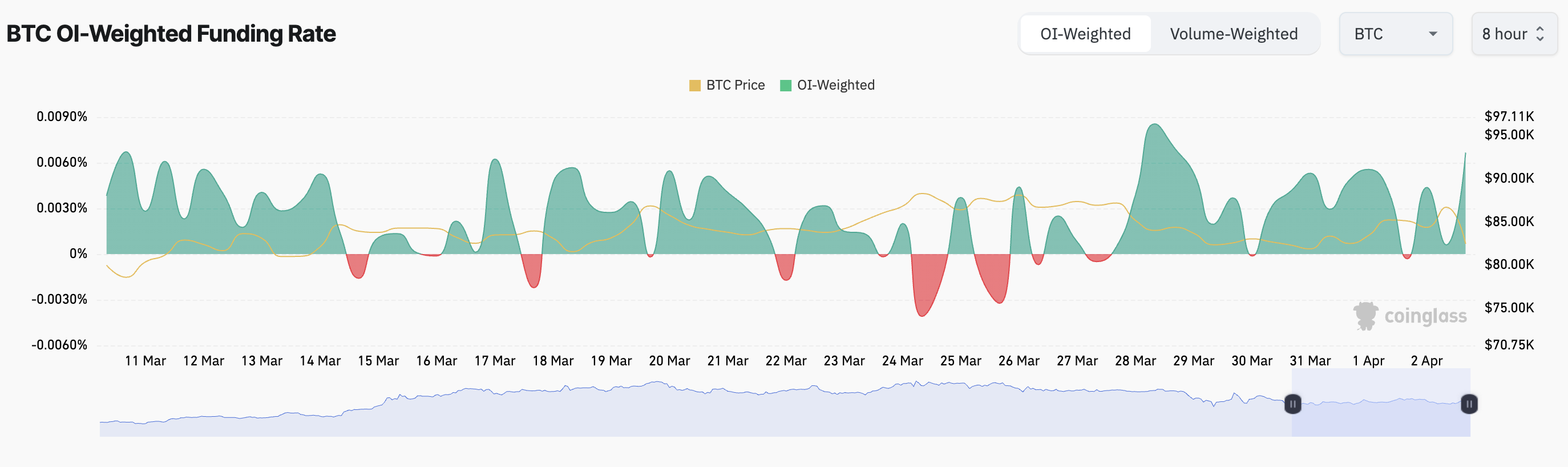

Nevertheless, the coin’s constructive funding charge presents some respite. At 0.0067% at press time, BTC’s funding charge displays robust demand for lengthy positions over brief ones, highlighting holder resilience regardless of BTC’s value volatility.

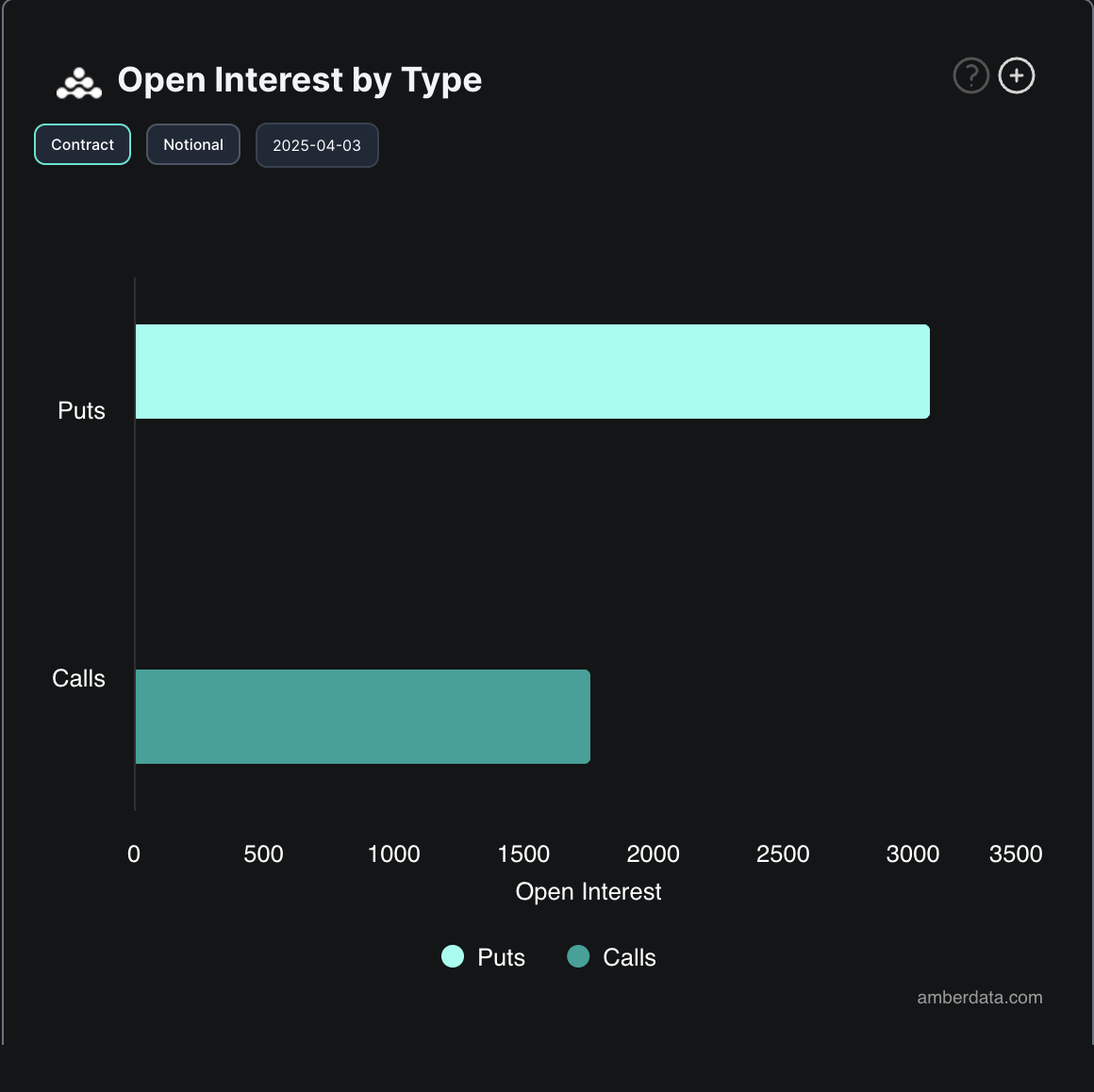

This bearish bias can be mirrored within the choices market in the present day, with put choices exceeding name choices. This means that merchants are more and more betting on Bitcoin’s value falling or remaining stagnant, additional reinforcing unfavorable sentiment.

The next variety of put choices like this indicators that market individuals are getting ready for a possible draw back, which might contribute to BTC’s additional value weak spot if this sentiment persists.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.