Bitcoin (BTC) broke above a brand new all-time excessive of $109,000 earlier than dealing with sharp resistance and pulling again. The short reversal underscored the psychological weight of the $110,000 stage, which now stands as a key hurdle for bulls.

Regardless of the rejection, whale accumulation has quietly elevated, signaling that giant holders could also be positioning for one more leg up. Mixed with bullish Ichimoku Cloud indicators, BTC seems to be constructing a technical basis—although follow-through above resistance stays important.

Whale Exercise Picks Up: What 2,019 Giant BTC Holders Might Imply for the Market

The variety of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—elevated from 2,007 to 2,021 between Could 13 and Could 19, earlier than barely dipping to 2,019 yesterday.

Whereas the online change is small, the upward motion suggests renewed accumulation amongst massive holders throughout the latest value vary. Fluctuations on this metric usually mirror shifts in institutional or high-net-worth investor sentiment, making it a crucial sign for broader market tendencies.

Even a modest rise in whale addresses can point out rising confidence, notably throughout unsure or consolidating value motion.

Monitoring Bitcoin whales is necessary as a result of these entities have sufficient capital to affect the market considerably.

Their habits usually precedes main value actions, both by offering liquidity assist throughout pullbacks or driving rallies via large-scale accumulation.

The present whale depend suggests underlying assist, with massive holders both positioning for a breakout or reinforcing long-term conviction. If this development of accumulation holds or resumes, it might sign a bullish basis forming beneath the floor, even when value stays range-bound within the quick time period.

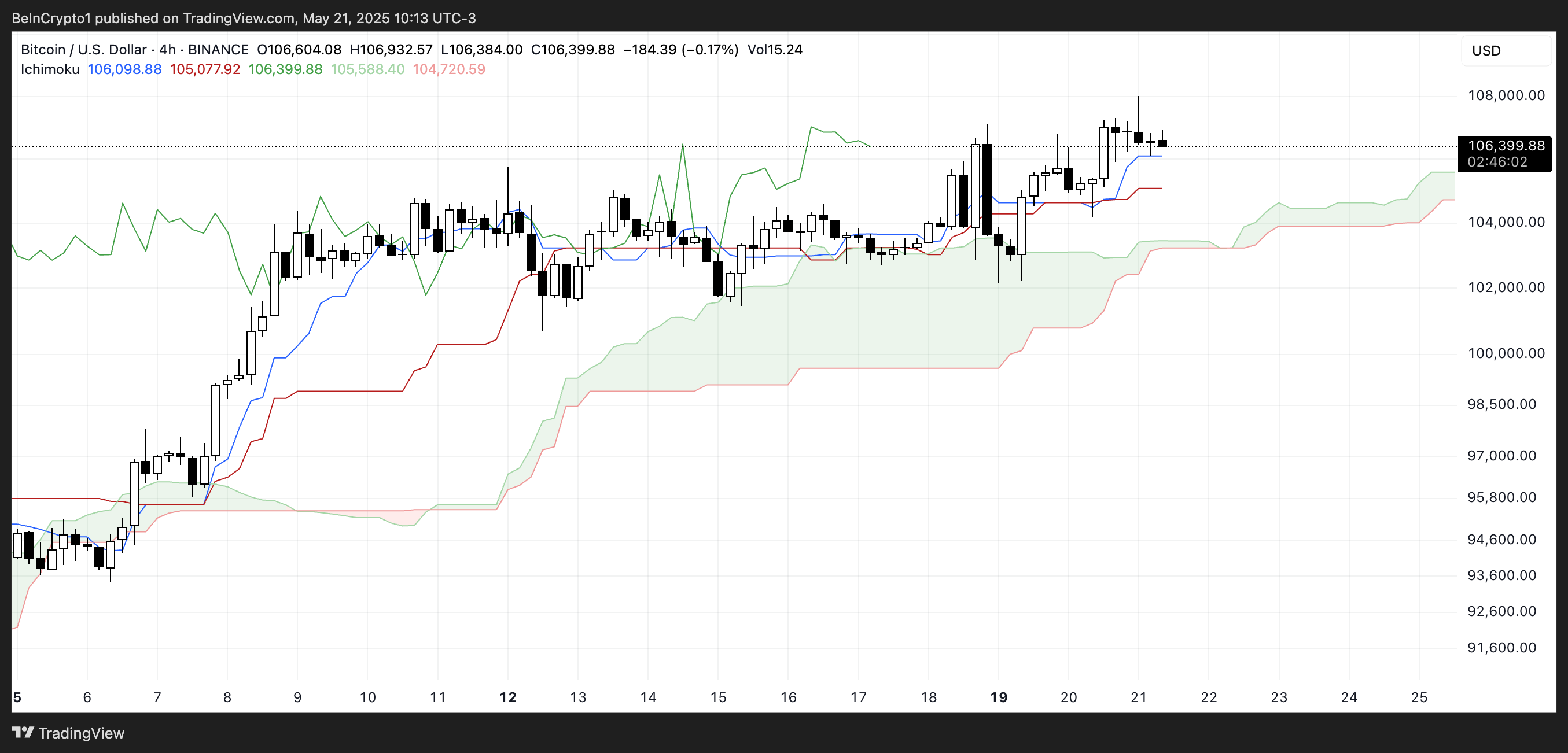

Bitcoin’s Ichimoku Cloud Flashes Bullish Continuation Sign

Bitcoin’s Ichimoku Cloud construction stays strongly bullish. The value is positioned properly above the cloud, which is thick and inexperienced—indicating stable assist and a continuation of the upward development.

The Main Span A (the higher fringe of the cloud) is climbing above Main Span B, confirming a optimistic momentum outlook.

This upward-sloping cloud means that the bulls are in management and the trail of least resistance remains to be to the upside.

The Tenkan-sen (blue line) is above the Kijun-sen (crimson line), sustaining a wholesome bullish unfold between the 2. This alignment is a basic affirmation of short-term bullish energy.

In the meantime, the Chikou Span (inexperienced lagging line) is properly above the worth candles, reinforcing the development from a historic perspective.

So long as value stays above the blue and crimson strains—and the cloud stays supportive—the bullish situation is prone to proceed constructing energy.

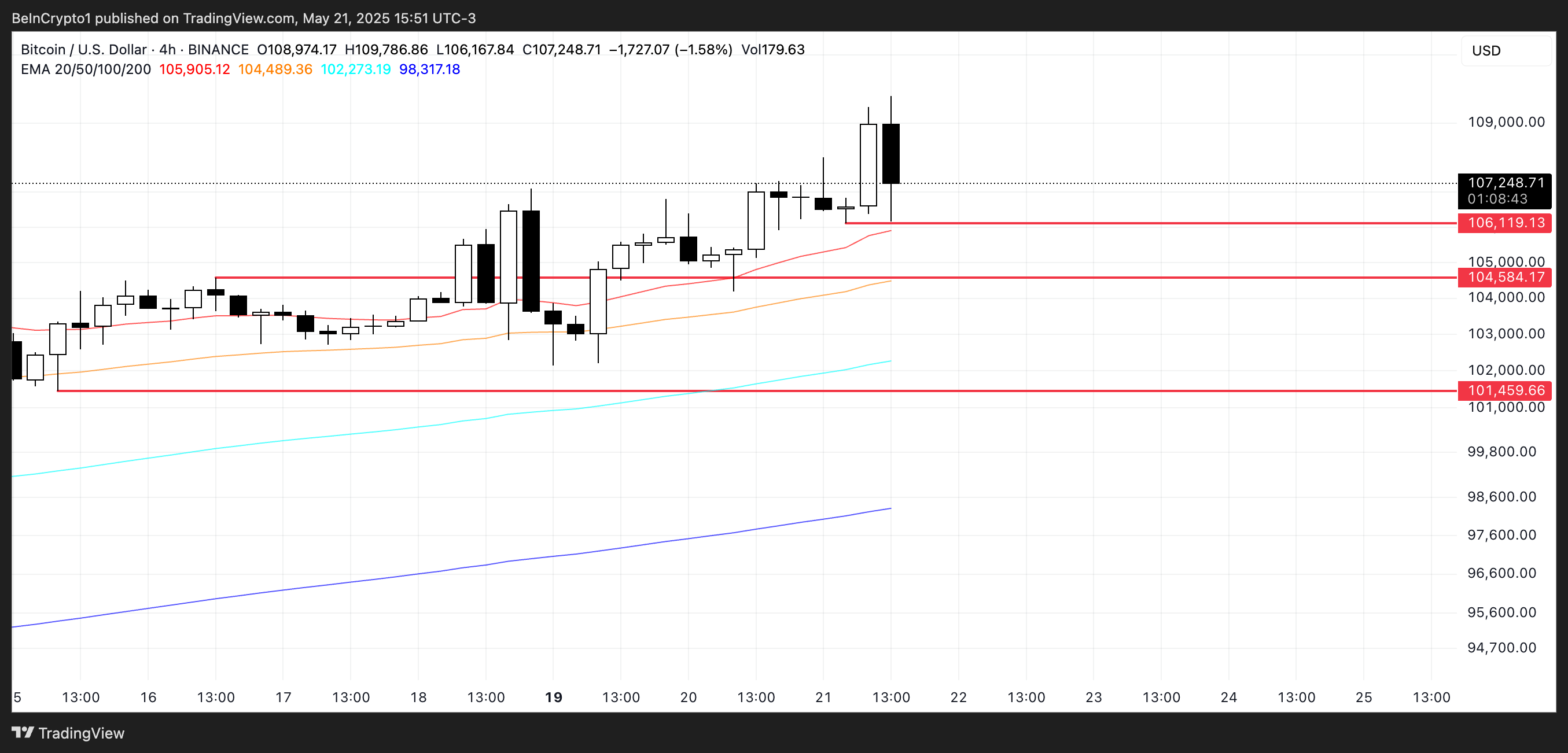

BTC Pulls Again After $109K Breakout — Will $106K Maintain?

Bitcoin briefly surged to a brand new all-time excessive above $109,000, however the breakout was shortly met with resistance.

The value retraced over 3% after touching the milestone, signaling that the $110,000 stage is appearing as a crucial psychological and technical barrier.

This pullback highlights how future bullish momentum might hinge on BTC’s value means to firmly shut above that threshold. Till that occurs, value motion might stay uneven or range-bound close to present ranges.

On the draw back, Bitcoin’s nearest assist lies across the $106,119 zone. If that stage fails to carry, it could set off a deeper correction towards the following assist close to $104,584.

A stronger bearish shift might open the door to a bigger retracement towards the $101,549 space.

Total, the latest rejection suggests bulls nonetheless want stronger follow-through to flip key resistances into assist and maintain the uptrend.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.