Welcome to the US Crypto Information Morning Briefing—your important rundown of an important developments in crypto for the day forward.

Seize a espresso for perception into the present Bitcoin (BTC) worth outlook. The pioneer crypto is steadily approaching its all-time excessive (ATH) recorded on Might 22, 2025. Will Bitcoin report a brand new ATH anytime quickly? Learn on for extra insights.

Crypto Information of the Day: US Traders Push Bitcoin In the direction of New ATH

Bitcoin worth is making an attempt to retake its ATH of $111,980. BeInCrypto reported that BTC’s newest run attracts tailwinds from progress within the US-China commerce talks and perceived truce between President Donald Trump and Elon Musk.

“BTC led a euphoric surge overnight, rallying from $107K to above $110K, as US-China trade talks resumed in London. The move was initially driven by optimism following headlines suggesting progress, though market enthusiasm quickly waned,” QCP analysts wrote.

Towards this backdrop, investor sentiment has flipped from worry to greed, with merchants deciphering each developments as a stabilizing pressure amid broader volatility.

Nonetheless, amid rising greed and optimism, on-chain analyst and CryptoQuant Korea Neighborhood Supervisor Crypto Dan highlights the position of US traders in driving the surge in Bitcoin worth.

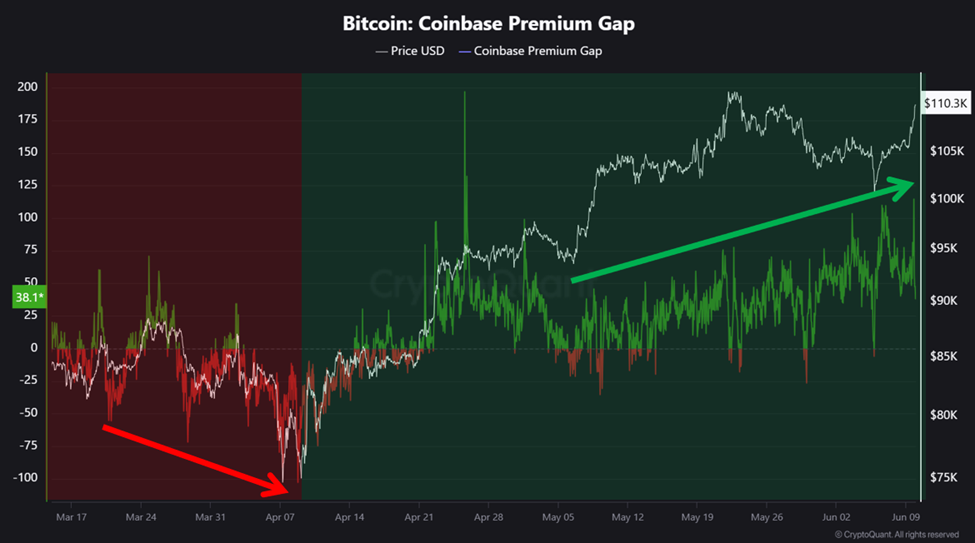

Particularly, Crypto Dan notes that the Coinbase premium is rising and whale shopping for exercise is being noticed incrementally.

“In particular, the Coinbase Premium is gradually rising, indicating that buying pressure from US investors is supporting the trend. Additionally, whale buying activity is being observed incrementally. This positive movement, without signs of overheating, is a typical pattern seen in a rising cycle following a correction, suggesting optimistic movements in the cryptocurrency market in the second half of 2025,” the analyst wrote.

Bitcoin’s Coinbase Premium Index measures the distinction between coin costs on Coinbase and Binance. When its worth grows above zero, it suggests important shopping for exercise by US-based traders on Coinbase.

Conversely, when it declines and dips into the unfavourable territory, it indicators much less buying and selling exercise on the US-based alternate.

Notably, a constructive Coinbase Premium Index is a bullish sign for BTC’s worth. This implies the coin trades at a better worth on Coinbase as demand from US-based traders strengthens.

Elevated shopping for stress from American institutional and retail merchants like this usually drives BTC’s worth increased, pushing the market upward.

Bitcoin Quietly Builds Power Close to ATH, Extra Upside Potential in Sight

Constructive developments within the US-China commerce talks and the Musk-Trump thaw seem to have reignited shopping for stress amongst American traders, who swiftly resumed accumulating Bitcoin.

“Bitcoin quietly builds strength near ATH. More Upside Potential in Sight. The Bitcoin price is continuing its steady trend. Currently, the Bitcoin price is on the verge of an all-time high, and it would not be strange if it recorded a new high at any time,” one other analyst, pseudonymous CryptoQuant analyst Avocado_onchain, wrote in a publish on X.

The analyst notes that in comparison with when Bitcoin broke the earlier new excessive, this time the upward development is unfolding in a comparatively quiet market environment.

Past the continual improve in Coinbase premium, the Kimchi Premium (Korea Premium Index) continues to be low. This implies there could also be extra room to the upside because the market isn’t “overheating.”

The Crypto Dan and Avocado evaluation aligns with what BeInCrypto reported in a latest US Crypto Information publication. Citing Markus Thielen within the newest 10X Analysis, BeInCrypto highlighted {that a} Bitcoin worth breakout could also be imminent.

Nonetheless, as BeInCrypto articulated, the upside potential is contingent on BTC overcoming the availability zone between $109,242 and $111,774.

Merchants seeking to take lengthy positions on the pioneer crypto ought to think about ready for a candlestick shut above the imply threshold of $110,478, the midline of the availability block.

If this provide zone holds as a resistance order block, Bitcoin may drop. Nonetheless, solely a candlestick shut under $102239 would invalidate the bullish thesis in a downward directional bias.

Breaking this help degree would signify a decrease low for BTC, suggesting a development reversal.

Chart of the Day

This chart exhibits that Bitcoin’s Coinbase Premium Index presently sits at 0.034.

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to observe right this moment:

- Bitcoin surges practically 4% to $109,275, pushed by US-China commerce talks and easing tensions between Trump and Musk.

- Plasma’s ICO raised $500 million from 1,111 members, however a couple of whales dominated the allocation, elevating considerations about equity.

- SEC critiques DeFi guidelines to encourage innovation and investor safety. Steering clarifies mining and staking actions below securities legislation, however authorized circumstances affect regulatory readability for decentralized finance.

- Bitcoin ETFs noticed $386 million in inflows following BTC’s surge above $105,000, closing at $110,263.

- FARTCOIN worth leads right this moment’s crypto rally, surging practically 20% amid Coinbase itemizing hype.

- Public corporations like Rectangular and Synaptogenix are investing tens of millions in Bittensor (TAO), citing its mounted provide and AI utility.

- Polkadot’s native token, DOT, sees rising demand because the June 11 ETF resolution approaches, fueling optimism amongst merchants.

- Bitcoin approaches $110,000 resistance, however rising CPI and market sentiment within the “Greed” zone may set off a worth correction.

- Bitcoin Core’s v30 will improve the OP_RETURN restrict from 80 bytes to 4MB, sparking debates over Bitcoin’s scalability and decentralization.

- An analyst highlights 4 causes Ethereum could also be on the verge of a breakout. Amongst them is BlackRock’s over $600 million ETH purchase with none gross sales, which indicators long-term bullish intent and parallels its affect on BTC’s historic rally.

Crypto Equities Pre-Market Overview

| Firm | On the Shut of June 9 | Pre-Market Overview |

| Technique (MSTR) | $392.12 | $395.39 (+0.83%) |

| Coinbase International (COIN) | $256.63 | $259.47 (+1.11%) |

| Galaxy Digital Holdings (GLXY.TO) | $20.93 | $21.25 (+1.53%) |

| MARA Holdings (MARA) | $16.27 | $16.26 (-0.069%) |

| Riot Platforms (RIOT) | $10.12 | $10.23 (+1.09%) |

| Core Scientific (CORZ) | $12.71 | $13.15 (+3.46%) |

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.