Bitcoin worth has completed modestly nicely this week because it soared to $66,000, rising to its highest degree since July 31.

Bitcoin strikes into bull market

Bitcoin (BTC) restoration coincided with the surge of probably the most dangerous belongings like altcoins and equities. The Dow Jones and the S&P 500 index have jumped to a report excessive, whereas the Nasdaq 100 is just a few factors under its all-time excessive.

In a put up on X.com, crypto analyst Miles Deutscher estimated that Bitcoin could proceed rising within the close to time period, reaching a excessive of $81,000.

He argued that the S&P 500 index, which tracks the most important American corporations, was up by 9% above its highest degree this yr. As such, he instructed his 541,000 followers that the coin would hit $81,000 if it caught up with equities because it has completed prior to now.

Different analysts are bullish on Bitcoin. In a latest be aware, analysts at BlackRock, the most important asset supervisor on this planet, referred to Bitcoin as a “unique diversifier” in a report on Sept. 17.

The New York-based agency argued that the highest cryptocurrency was a novel asset that’s uncorrelated with equities, particularly in durations of elevated dangers.

BlackRock has continued allocating Bitcoin in its stability sheet, a transfer which will encourage different companies to begin shopping for.

In the meantime, MicroStrategy has continued to build up Bitcoin. The agency’s founder, Michael Saylor, predicts that Bitcoin will rise to over $13 million by 2045. The corporate at the moment holds over 252,000 cash.

MC Consultunacy founder and self-proclaimed Bitcoin fanatic Michael van de Poppe additionally famous that the coin would leap to between $90,000 and $100,000 by the top of the yr. He cited the hovering international liquidity, which can improve as central banks slash rates of interest.

Seasonality can also be favoring Bitcoin within the close to time period. CoinGlass knowledge exhibits that the common return within the fourth quarter is 88%, greater than the third quarter’s 6.3% and the second quarter’s 27%.

October and November are normally the very best months for the coin.

Polymarket merchants are betting that the coin will leap to a brand new all-time excessive in 2024 — 63% odds.

Bitcoin technicals

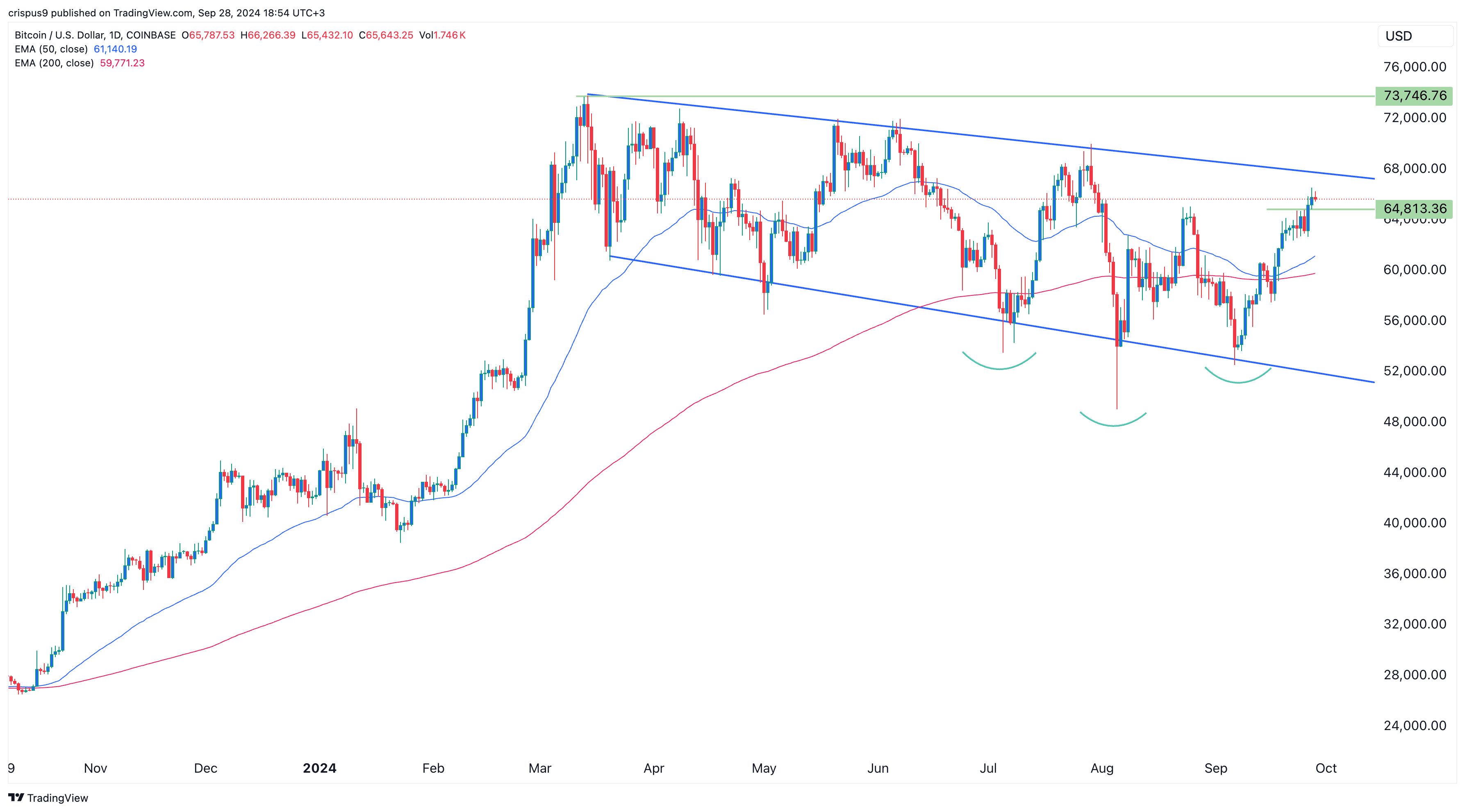

The each day chart exhibits that Bitcoin has stable technicals. It has fashioned an inverse head and shoulders sample, a preferred bullish signal. It has additionally been forming a falling broadening wedge.

Bitcoin has averted forming a dying cross sample, and has as an alternative, moved above the 50-day and 200-day shifting averages. The coin might want to transfer above the higher aspect of the wedge to proceed the bullish development and clear the year-to-date excessive of 73,777 to speed up the restoration.