Fashionable altcoin Solana has shed almost 10% of its worth over the previous week, and the bearish stress doesn’t seem like letting up. The token dropped to $129 right this moment, as geopolitical tensions between the US and Iran escalate.

Because the second quarter of 2025 attracts to a detailed, mounting selloffs have positioned Solana’s value liable to breaking under the essential $130 help degree. This evaluation explains how.

SOL Slips as Key Indicators Stay Bearish

Over the previous seven days, SOL’s value has steadily declined. This has been accompanied by a dip within the coin’s Chaikin Cash Stream (CMF), which has fallen deeper into damaging territory. As of this writing, SOL’s CMF is at -0.13.

The CMF measures the move of cash into and out of an asset over a particular interval, sometimes 20 or 21 days. It combines value and quantity information to evaluate shopping for and promoting stress. When an asset’s CMF is constructive, shopping for quantity is dominant and capital is flowing into the asset, indicating potential bullish sentiment.

Conversely, when the CMF turns damaging, promoting quantity outweighs shopping for quantity, which means cash flows out. This indicators weakening demand for SOL, particularly if the damaging studying deepens whereas value declines.

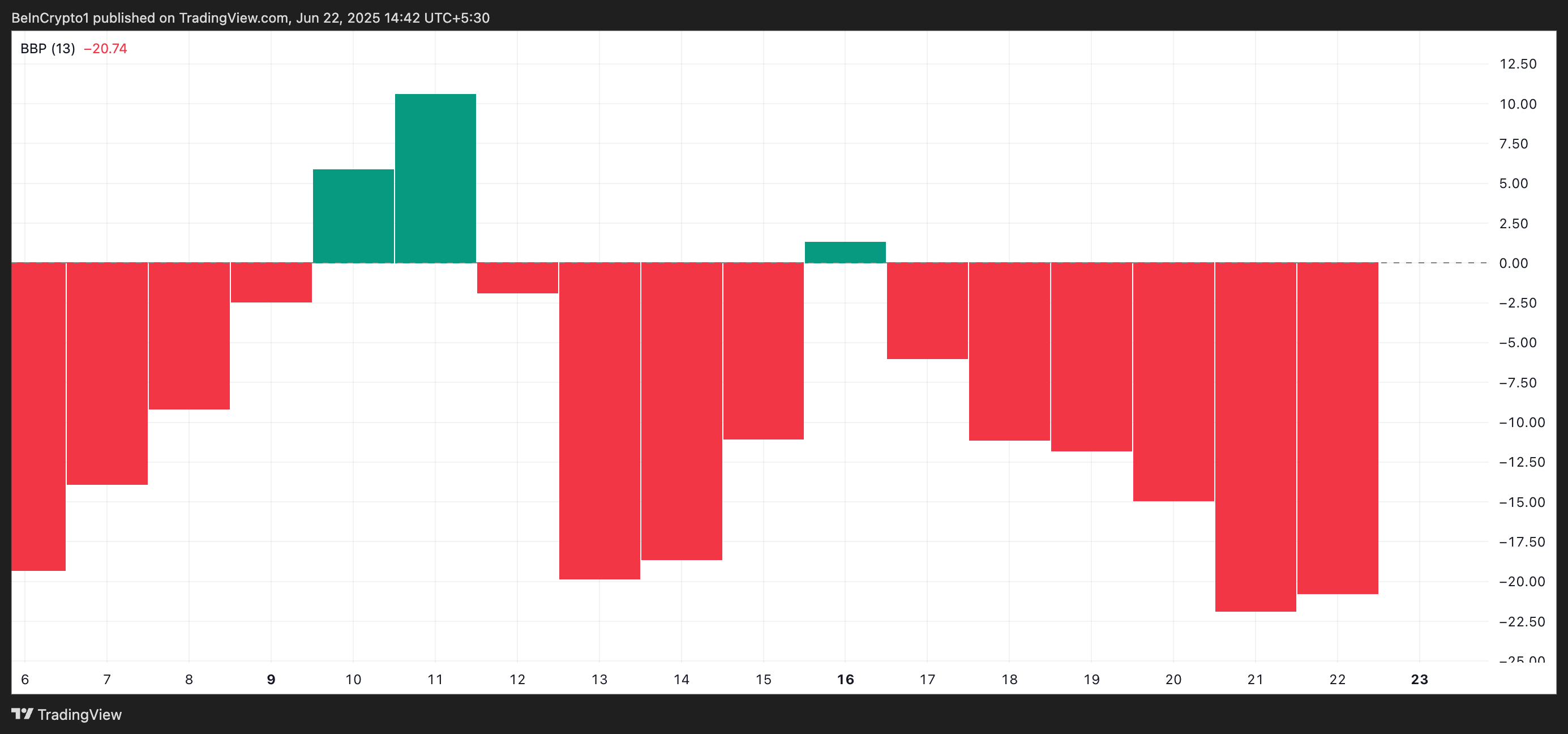

Furthermore, the coin’s Elder-Ray Index, which gauges the stability between consumers and sellers, is at -20.74, signifying that sellers are firmly in management.

This indicator measures the energy of bulls and bears out there by analyzing the distinction between an asset’s value and a transferring common. When it’s damaging, bears dominate, as costs persistently fall under the common, suggesting promoting stress outweighs shopping for curiosity.

Will SOL Get better Above $130 or Is a Drop to $123 Looming?

This bear dominance displays the rising conviction that SOL’s value might decline additional, notably if $134 fails to carry as a help flooring.

In the meantime, a breakdown under this degree might open the door for deeper losses, doubtlessly dragging SOL towards $123.49.

Nevertheless, if bulls handle to regain management, they might push Solana’s value upward to $142.59.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.