Canada’s economy and living standards are gradually disintegrating.

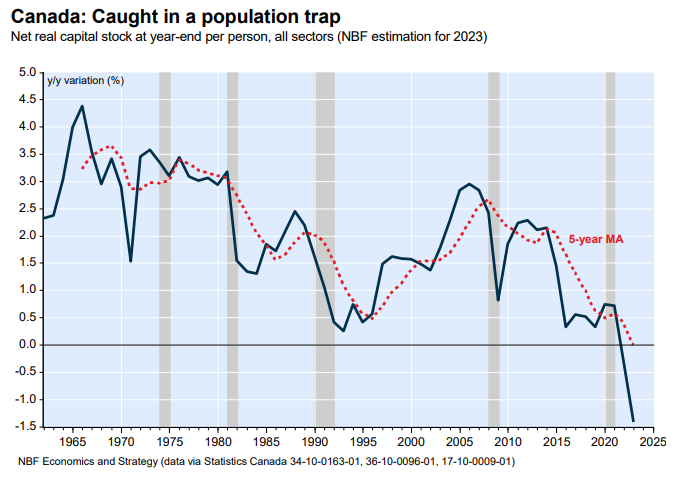

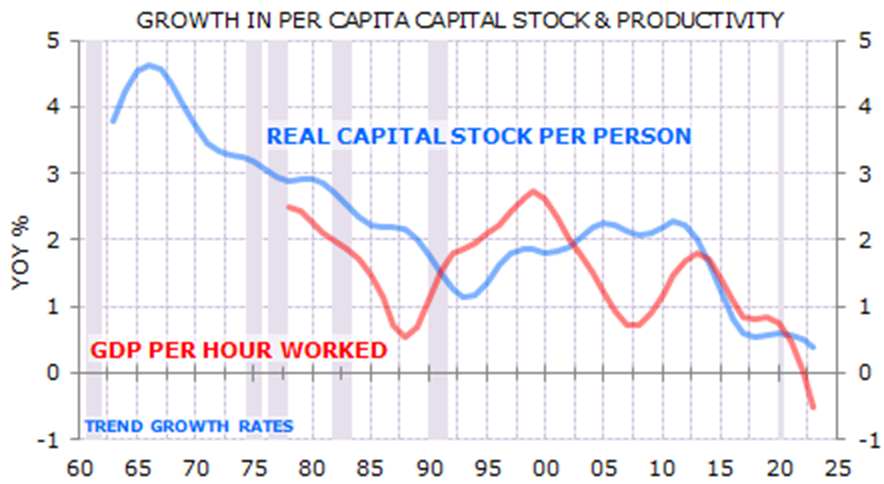

For years, Canada’s population has grown faster than business, infrastructure, and housing investment, resulting in what economists term “capital shallowing”. In turn, productivity growth has suffered.

Economists at the National Bank of Canada explained the productivity predicament as follows:

Advertisement

“Why is our productivity record so bad? Could it be that our demographic ambitions are too high relative to the stock of capital available in the country?”

“This means that our population is growing so fast that we do not have enough savings to stabilize our capital-labour ratio and achieve an increase in GDP per capita”.

“Simply put, Canada is in a population trap for the first time in modern history”…

“We currently lack the infrastructure and capital stock in this country to adequately absorb current population growth and improve our standard of living”.

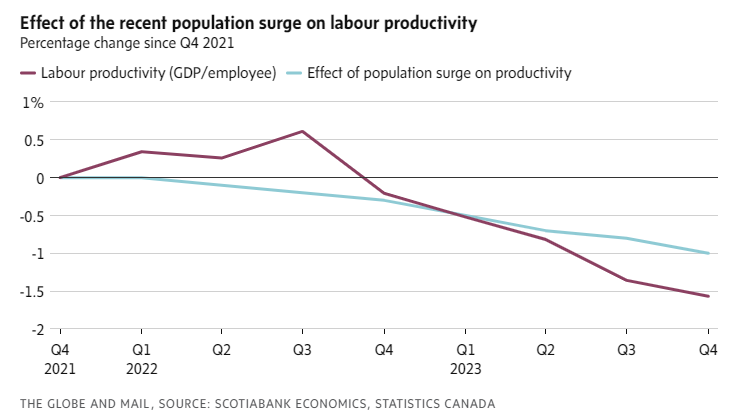

Scotiabank economists additionally confirmed that Canada’s productiveness is struggling as a result of the inhabitants is rising at a quicker tempo than enterprise funding, infrastructure, and housing:

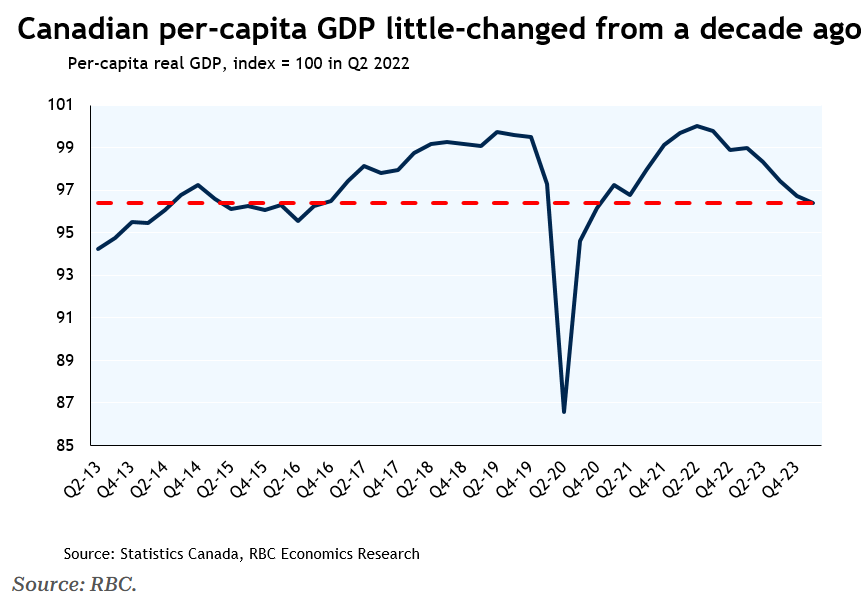

The result’s that Canada’s per capita GDP has stagnated for round a decade:

Advertisement

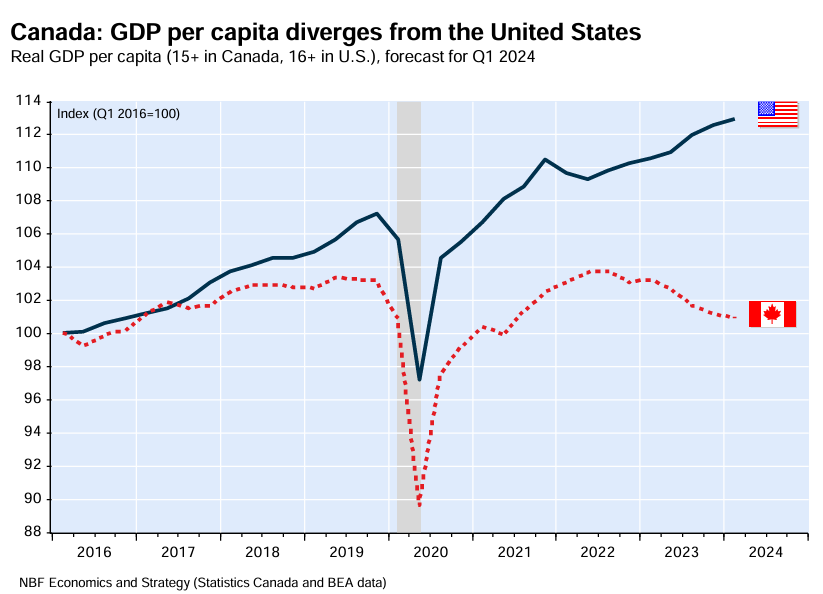

Evaluating Canada’s GDP per capita efficiency with that of the neighbouring United States is damning and exhibits an economic system that’s steadily wrecking dwelling requirements:

Advertisement

Certainly, a brand new research by Canada’s Fraser Institute warns that the nation’s lifestyle is on monitor for its worst decline in 40 years.

The research in contrast Canada’s three worst durations of decline during the last 40 years: the 1989 recession, the 2008 international monetary disaster, and the present post-pandemic period.

The authors found that, in contrast to in prior recessions, Canada just isn’t recovering this time. One thing has damaged:

Advertisement

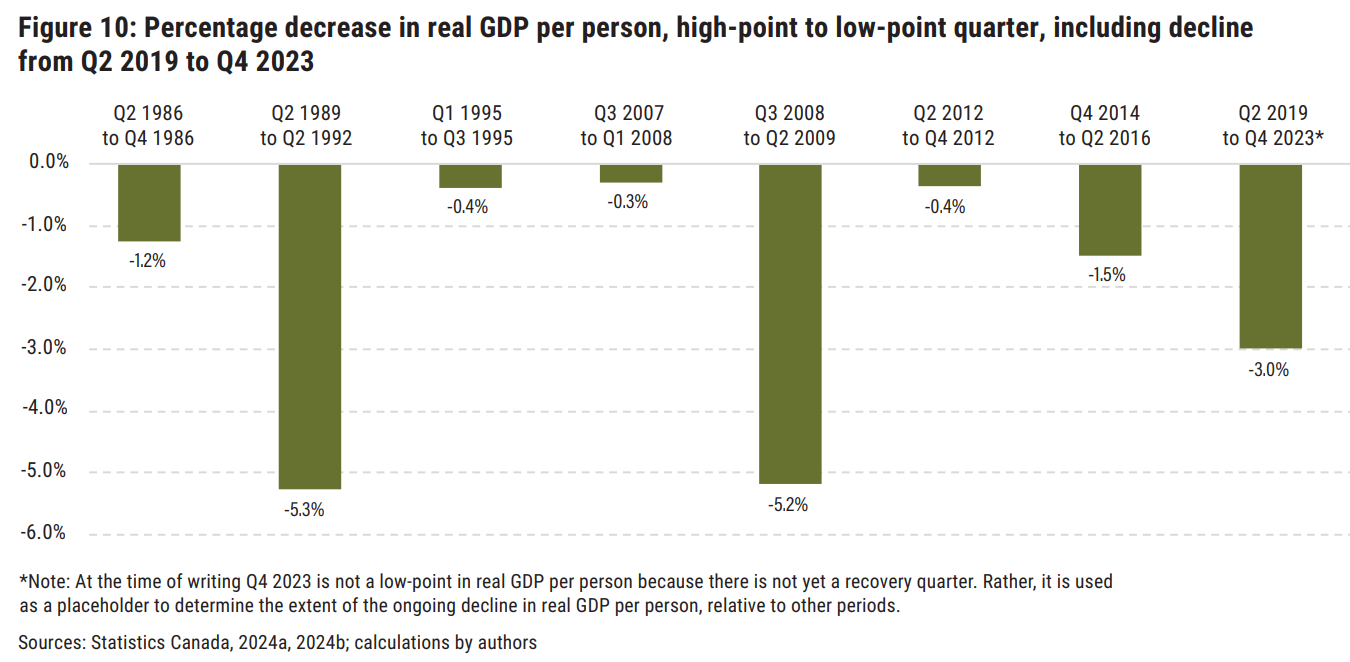

Determine 10 presents the share decline in actual GDP per particular person from the high-point to the low level, once more extending the interval from Q2 2019 to This fall 2023. Along with being among the many longest durations, it additionally has among the many largest decreases in actual GDP per particular person at 3.0%.

Whereas the decline from Q2 2019 to This fall 2023 remains to be lower than the declines from Q2 1989 to Q2 1992 and Q3 2008 to Q2 2009, it stays double that of all different durations. And once more, as of This fall 2023 the decline remains to be ongoing and will deepen additional…

We discover that the expertise since Q2 2019 is in contrast to any since 1985. As of This fall 2023, actual GDP per particular person is under the extent it was in Q2 2019, and regardless of a quick pause, the decline in actual GDP per particular person ought to nonetheless be thought of ongoing.

This represents one of many longest and deepest declines in actual GDP per particular person since 1985, exceeded in each respects solely by the decline and restoration that occurred from Q2 1989 to Q3 1994.

Nonetheless, the decline in incomes since Q2 2019 is ongoing, and should still exceed the downturn of the late-Eighties and early-Nineteen Nineties in size and depth of decline.

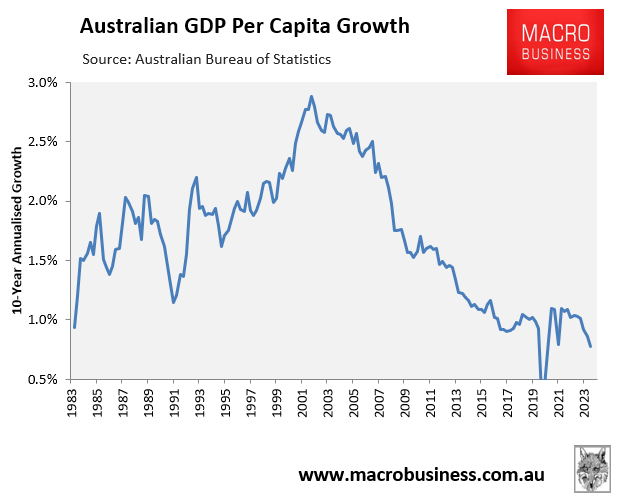

As I hold saying, Canada’s financial disintegration ought to function a warning to Australia.

Like Canada, many years of sturdy immigration-driven inhabitants development has outpaced enterprise, infrastructure, and housing funding, leading to “capital shallowing” and declining productiveness development:

Advertisement

In consequence, GDP per capita development has collapsed, with Australia about to report its sixth consecutive quarterly decline in per capita GDP.

Each nations must wean themselves from lazy immigration-driven development and create sustainable, productive economies that work within the pursuits of incumbent residents, not oligopolistic companies.

Advertisement

In any other case, each nations will stay caught in “population traps” with declining productiveness, ongoing housing shortages, and infinite per capita recessions.