Cardano (ADA) has remained comparatively stagnant, with its value barely shifting from the degrees seen seven days in the past. Regardless of this lack of value motion, buying and selling quantity has surged practically 28% within the final 24 hours, climbing to $1 billion.

This improve in exercise comes whereas ADA continues to consolidate, with technical indicators signaling indecision out there. As momentum builds, merchants are watching carefully for indicators of a breakout from this tight vary.

Cardano ADX Reveals The Lack Of A Clear Path

Cardano’s pattern energy has remained comparatively unchanged, with its ADX at present at 16.49 – roughly the identical degree it has maintained since yesterday.

This flat motion within the ADX means that there hasn’t been a major shift in momentum, and the market lacks a transparent directional pattern.

ADA’s value is at present caught in a consolidation section, with neither patrons nor sellers capable of set up dominance, which is mirrored within the stagnant ADX studying.

The ADX (Common Directional Index) is a technical indicator used to measure the energy of a pattern with out indicating its path.

An ADX under 20 usually alerts a weak or non-existent pattern, whereas readings between 20 and 40 level to a creating or average pattern, and values above 40 point out a robust pattern.

With ADA’s ADX holding under the 20 mark, it means that the present market setting stays indecisive, seemingly resulting in continued sideways motion.

For now, this consolidation section might persist till a stronger directional transfer emerges, both by means of renewed shopping for momentum or a rise in promoting stress.

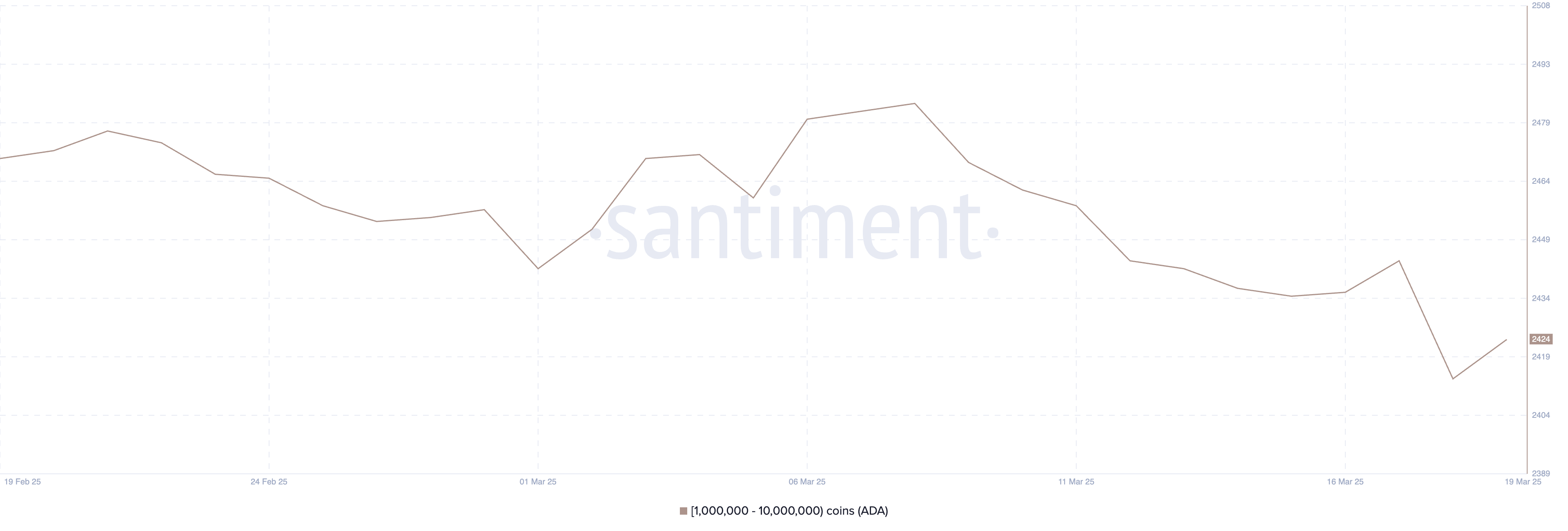

Cardano Whales Dip to July 2024 Lows

The variety of Cardano whales skilled a pointy decline between March 8 and March 18. These are wallets holding between 1 million and 10 million ADA.

In line with Santiment knowledge, the variety of ADA whales fell from 2,484 to only 2,414, marking the bottom degree since July 2024.

On March 19, there was a slight restoration, with the variety of whales rising to 2,424.

Whereas this minor rebound exhibits some renewed accumulation, the general rely stays properly under the degrees seen in earlier weeks, highlighting lowered participation from bigger holders throughout this era.

Monitoring ADA whales is essential as a result of these massive addresses typically play a major function in influencing value motion. Whales can create liquidity shifts and sometimes act as a sign for institutional or high-net-worth investor sentiment.

The present decrease whale rely means that confidence amongst these key gamers may nonetheless be cautious.

Even with the current uptick, whale numbers remaining under their earlier highs might level to subdued shopping for stress, doubtlessly limiting ADA’s capability to interrupt out of its present consolidation section within the close to time period.

Cardano Is Buying and selling Between a Important Vary

Cardano EMA traces sign a consolidation section. The short-term shifting averages stay under the long-term ones however are at present very shut collectively, indicating an absence of sturdy momentum in both path.

This setup suggests indecision out there, nevertheless it additionally leaves room for a possible breakout. If Cardano value manages to construct bullish momentum and set up an uptrend, it might first goal the $0.77 resistance.

A profitable breakout above this degree might pave the way in which for a rally towards $1.02, and if shopping for stress continues, ADA may even push as excessive as $1.17.

On the flip aspect, if a downtrend develops, ADA might fall again to check the important thing help degree at $0.64.

Shedding this help can be a bearish sign and will set off a deeper decline towards $0.58.

The present positioning of the EMA traces exhibits that whereas there’s no clear pattern dominance, each bullish and bearish eventualities stay potential relying on how the worth reacts to those crucial ranges.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.