Cardano (ADA) worth has dropped over 25% within the final seven days, bringing its market cap all the way down to $26 billion. Buying and selling quantity has additionally fallen 35% up to now 24 hours, now sitting at $766 million, signaling decreased market exercise.

In the meantime, whale addresses have stabilized after a quick surge, suggesting a interval of stability as massive holders await clearer market alerts.

Cardano ADX Exhibits the Present Downtrend Is Nonetheless Robust

Inside 5 days, Cardano’s Common Directional Index (ADX) climbed from 11.2 to 41.6, indicating a powerful pattern that coincided with a 20% worth correction.

ADX measures pattern energy, not path, with readings above 25 indicating a powerful pattern and under suggesting weak point. Given ADA’s excessive ADX, the current downtrend has been highly effective, reinforcing bearish momentum.

Regardless of nonetheless being in a downtrend, ADA’s ADX has remained steady round 41 and 42 for 2 days and barely declined between yesterday and immediately.

This means the pattern could also be shedding depth, although it hasn’t reversed and continues to be very sturdy. If ADX continues to drop whereas ADA worth steadies, sellers might be weakening, presumably resulting in consolidation.

Nevertheless, with no clear reversal, draw back dangers stay.

Cardano Whales Has Been Secure For Three Weeks

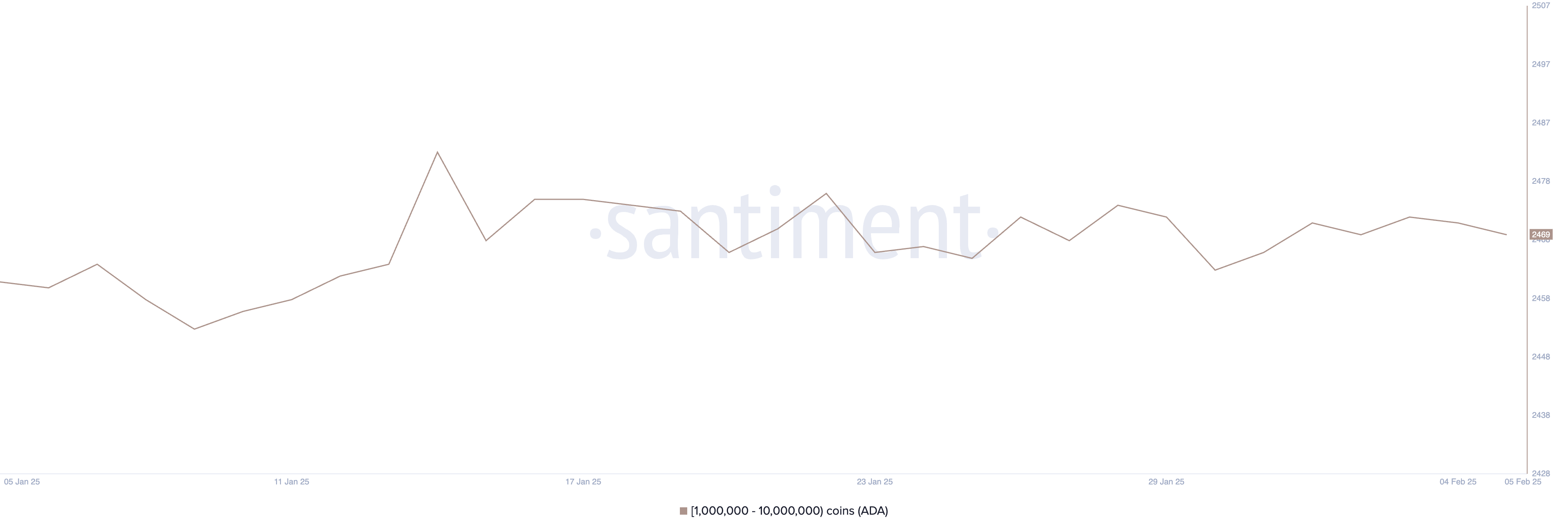

The variety of Cardano whale addresses, holding between 1,000,000 and 10,000,000 ADA, jumped from 2,453 to 2,483 between January 9 and January 14. Nevertheless, after that spike, the quantity declined barely and has remained steady over the previous few weeks.

Monitoring these whales is necessary as a result of their accumulation or distribution can sign shifts out there. A rising variety of whale addresses typically suggests confidence and potential worth assist, whereas a decline might point out promoting strain.

At the moment, ADA whale addresses are at 2,469, hovering round this stage with minor fluctuations for the previous three weeks. This means a interval of stability. Massive holders are neither aggressively accumulating nor promoting, presumably focusing their investments on different cash for doable positive factors in February.

If stability continues, it may imply ADA worth is in a consolidation part, with whales ready for clearer market path earlier than making main strikes.

ADA Value Prediction: A 55% Upside or Draw back?

Cardano worth is presently buying and selling between assist at $0.65 and resistance at $0.82, with its EMA traces exhibiting a bearish setup—short-term EMAs are positioned under long-term ones.

This means that downward momentum stays dominant, reinforcing the concept that ADA continues to be in a downtrend.

If an uptrend emerges, ADA may take a look at the $0.82 resistance, and a breakout above it may open the door for a transfer towards $1.03 and even $1.16, a possible 55% upside.

Nevertheless, if the downtrend continues and ADA worth loses the $0.65 assist, it may drop additional to $0.51 and even $0.32, marking a 55% decline and reaching its lowest ranges since December 10, 2024.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.