Cardano (ADA) is below strain, down 4% within the final 24 hours and practically 10% over the previous week, with day by day buying and selling quantity falling 15% to $869 million. The decline in worth and exercise comes as a number of key metrics level to weakening momentum and rising uncertainty.

From a bearish BBTrend shift to risky whale exercise and the specter of a looming demise cross on its EMA strains, ADA faces a important interval. Whether or not it may well maintain help and regain power or proceed slipping will possible rely on near-term market sentiment and broader crypto circumstances.

ADA Alerts Weak point With BBTrend Falling Beneath Zero

Cardano’s BBTrend has turned unfavourable, at present sitting at -2.43 after spending practically 5 days in constructive territory.

Between Could 11 and Could 16, the indicator remained above zero, even hitting a current excessive of 17.34 on Could 12.

This shift means that the current upward momentum has pale, and the asset could also be coming into a brand new part of weak spot or consolidation.

The BBTrend (Bollinger Band Development) measures how strongly worth strikes away from its common relative to volatility, providing insights into the power and path of tendencies.

Values above zero sometimes point out bullish momentum, whereas values under zero recommend bearish strain is growing. With ADA now exhibiting a BBTrend of -2.43, it indicators a possible shift towards draw back bias.

If this unfavourable pattern persists, it might result in additional worth weak spot or a interval of stagnation till new shopping for curiosity returns.

Cardano Whale Exercise Cools After Quick-Lived Spike

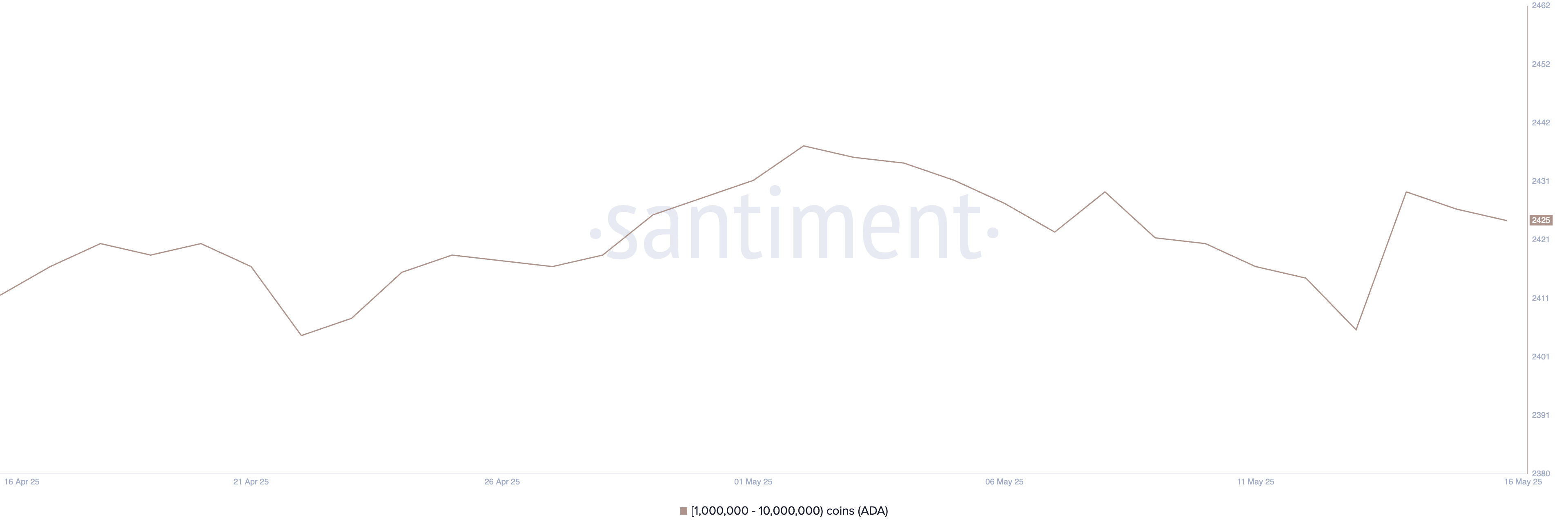

The variety of Cardano whale addresses—wallets holding between 1 million and 10 million ADA—has skilled noticeable volatility over the previous few days. On Could 13, this quantity dropped to 2,406, marking one of many lowest factors prior to now month.

A pointy rebound adopted on Could 14, with whale wallets leaping to 2,430, suggesting temporary renewed curiosity amongst giant holders.

Nonetheless, this uptick didn’t maintain, because the rely declined once more over the subsequent two days, now settling at 2,425. The fluctuations spotlight an absence of conviction amongst main gamers, with neither sustained accumulation nor constant distribution taking maintain.

Monitoring whale exercise is vital as a result of these giant traders can drive main worth strikes because of the measurement of their holdings.

A rising whale rely usually factors to accumulation, signaling long-term confidence and probably supporting upward worth motion. In distinction, a decline or stagnation in whale numbers usually suggests hesitation or promoting strain, which might weigh on worth momentum.

With the present rely nonetheless under peak ranges and exhibiting instability, Cardano could wrestle to construct sturdy bullish momentum within the brief time period until accumulation resumes extra decisively.

Cardano at Threat of Demise Cross as Bears Eye Key Assist Ranges

Cardano’s EMA construction is exhibiting early indicators of weak spot, with short-term shifting averages starting to dip towards the longer-term ones—a setup that would quickly set off a demise cross.

This bearish crossover usually indicators the beginning of a deeper downtrend. If it confirms, Cardano worth could check the help stage at $0.729.

A break under that would open the door to additional losses towards $0.68, and in a extra aggressive sell-off, costs might fall as little as $0.642.

Nonetheless, if the present momentum shifts and bulls regain management, ADA has an opportunity to reverse course.

The primary key goal is breaking above the $0.781 resistance. If that stage is cleared, Cardano might rally towards $0.841 and, in a stronger bullish transfer, attain $0.86.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.