Celestia (TIA) has struggled to interrupt out of a three-month-long persistent downtrend, with a number of unsuccessful makes an attempt to maintain positive aspects above key resistance ranges.

This means a market missing robust conviction, with traders hesitant to push the altcoin into a transparent upward trajectory.

Celestia Finds Assist From Buyers

The Chaikin Cash Stream (CMF) indicator has proven a modest enhance just lately however stays just under zero. This means that whereas capital inflows are current, general investor confidence is tentative.

Patrons appear to be attracted by TIA’s comparatively low worth, but the momentum isn’t robust sufficient to decisively break the downtrend.

The CMF’s failure to climb above zero indicators lingering warning and means that merchants are solely cautiously getting into positions. This tentative curiosity could end in heightened volatility until broader market help emerges.

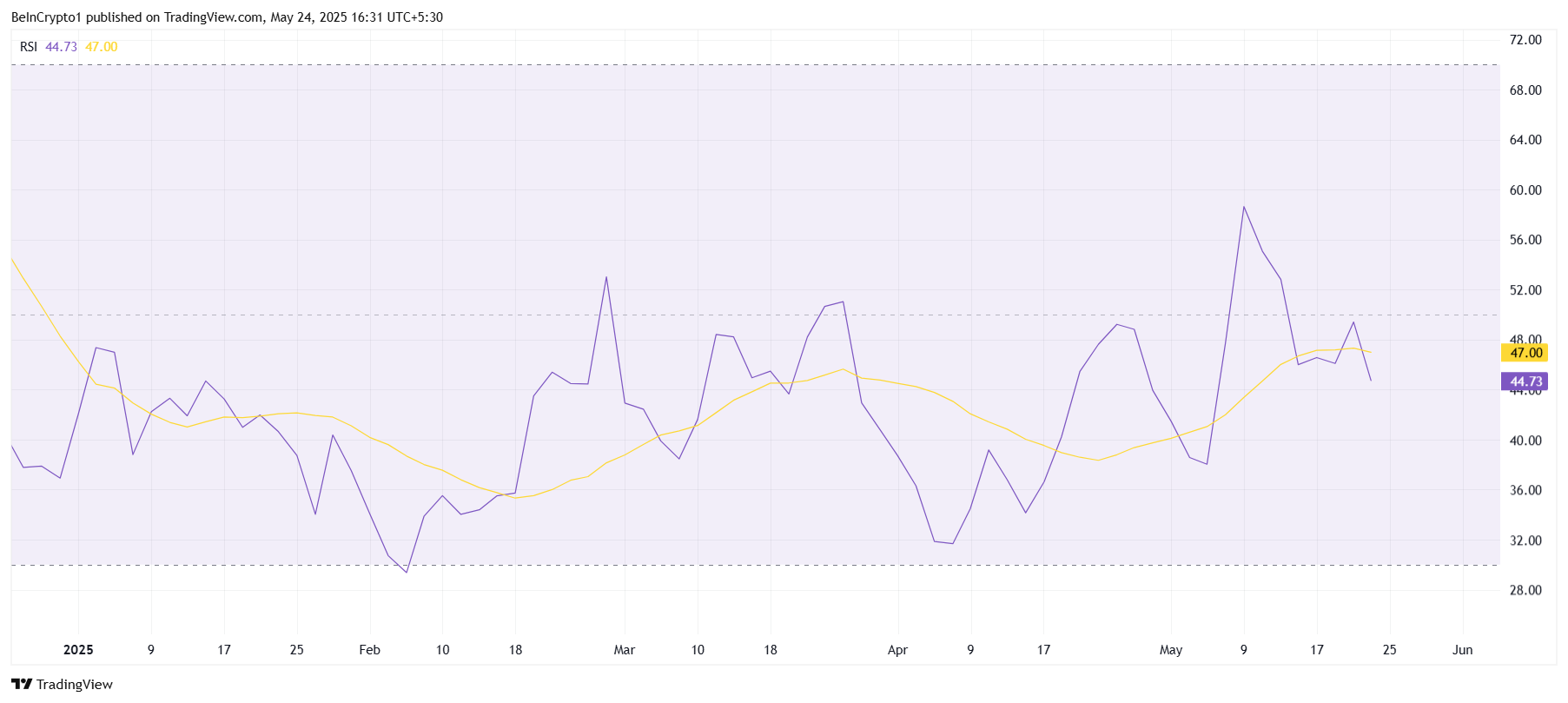

The Relative Energy Index (RSI) spiked briefly into bullish territory however has since retreated beneath the impartial 50 degree. This sample factors to fragile bullish momentum, seemingly hampered by promoting stress or exterior market uncertainties.

The drop beneath 50 reinforces the notion that TIA’s worth restoration is precarious. With out renewed shopping for energy, it faces problem overcoming resistance and will proceed to languish in subdued buying and selling ranges.

TIA Worth Goals To Leap

At the moment buying and selling round $2.54, TIA is testing a important help degree at $2.53. This degree is pivotal for stabilizing worth motion and stopping additional losses, particularly after failing to surpass the $3.00 resistance throughout its extended downtrend.

A major upward breakout seems unlikely for now. Nevertheless, if help at $2.53 holds, TIA would possibly consolidate, probably constructing momentum to retest the $3.00 resistance after breaching $2.73.

Conversely, a decisive break beneath $2.53 might intensify bearish stress, pushing the value down towards $2.27. Such a transfer would invalidate short-term bullish prospects and enhance draw back dangers.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.