Chainlink (LINK) has surged to the forefront of crypto improvement, not too long ago surpassing Ethereum (ETH) in GitHub exercise.

This momentum coincides with Chainlink’s profitable function in Hong Kong’s e-HKD+ Pilot Program, the place its interoperability protocol enabled a cross-border alternate between CBDCs and stablecoins.

Chainlink Overtakes Ethereum in Improvement Exercise Amid RWA Focus

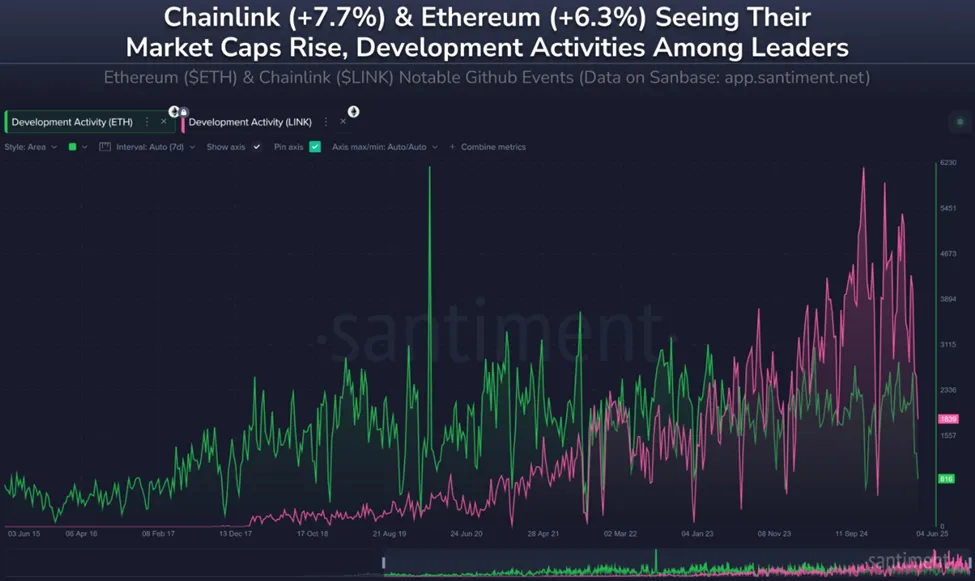

Chainlink (LINK) has outpaced Ethereum in improvement exercise over the previous 30 days, in keeping with on-chain analytics agency Santiment. The transfer solidifies its standing as a number one real-world asset (RWA) tokenization infrastructure supplier.

The analytics agency additionally revealed a surge in GitHub exercise, with Chainlink rating second total, even forward of Ethereum, which positioned eighth. This displays Chainlink’s rising momentum, notably within the context of institutional use instances.

“While most of crypto stays flat Tuesday, Chainlink (+7.7%) and Ethereum (+6.3%) have continued to break out. These two projects are known for their top ranked developing teams. Over the past 30 days, LINK has had the 2nd most notable github events and ETH is in 8th,” Santiment analysts famous.

Chainlink’s continued technical progress comes because it deepens its ties with main monetary establishments.

Co-founder Sergey Nazarov not too long ago responded to a report from Visa, reflecting Chainlink’s function in fixing three core challenges for institutional sensible contracts: safe knowledge feeds, cross-chain connectivity, and compliance requirements.

“Very excited about this report from Visa, showcasing how Chainlink is able to solve the three biggest problems of next generation smart contracts for institutional transactions, all in one platform,” Nazarov stated on X.

He cited a posh transaction involving ANZ and Constancy Worldwide, executed inside the HKMA’s regulatory framework. In accordance with the Chainlink government, it is a clear signal of the distinctive worth the community gives.

“As more and more top institutions join the Chainlink standard for institutional transactions to happen on-chain, the network and the standards become more valuable to the current participants and the ones considering joining the transactional standard,” Nazarov added.

LINK Rallies 5% on Actual-World Use Case with e-HKD Pilot

On June 9, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) facilitated the safe alternate of a Hong Kong central financial institution digital forex (CBDC) and an Australian greenback stablecoin.

The check concerned monetary heavyweights together with Visa, ANZ, China AMC, and Constancy Worldwide. The announcement fueled a powerful market response, with LINK rising from $13.90 to $14.60, an 8% improve within the aftermath.

The spike displays rising investor confidence in Chainlink’s infrastructure as a foundational layer for institutional blockchain adoption. As of this writing, the chainlink worth surge has elevated by over 5% within the final 24 hours to commerce for $15.28.

“There simply isn’t a project with the institutional adoption of Chainlink,” Crypto analyst Quinten François famous.

Chainlink’s technical and institutional momentum seems to be converging. That is regardless of its dominance of GitHub exercise, its management of the RWA class, and its execution of high-profile pilot applications with world monetary gamers.

Chainlink Worth Outlook

Regardless of bullish fundamentals, Chainlink worth is confronting resistance resulting from an overhanging provide zone between $16.04 and $17.43. It additionally faces resistance offered by the higher trendline of a falling wedge sample.

If the LINK worth breaks and holds above the trendline, it may provoke a 57% run long run, executing the goal goal of the falling wedge. This goal is set by measuring the longest top of the wedge and superimposing it on the potential breakout level.

Technical indicators align, as Chainlink worth flipped the 50-day SMA (Easy Transferring Common) into assist at $15.07. Moreover, the 100-day SMA additionally gives extra assist at $14.35.

Nonetheless, merchants trying to take lengthy positions on LINK ought to think about ready for a candlestick shut above $16.70, the midline or imply threshold of the provision zone. The Relative Power Index (RSI) additionally reveals rising momentum, including credence to the bullish thesis.

The RSI indicator’s place above 50 accentuates the bullish outlook, displaying LINK bulls have the higher hand. That is additionally seen within the greater highs on the LINK/USDT chart throughout the one-day timeframe over the previous 5 buying and selling periods.

Conversely, if the higher trendline of the wedge holds as a resistance, Chainlink worth may drop, flipping the 50-day SMA again right into a resistance degree.

Elevated promoting strain may additionally see the LINK worth lose assist as a result of 100-day SMA, at $14.35. The demand zone between $10.78 and $11.46 would provide LINK bulls a attainable entry, however a breakdown of this purchaser congestion zone may lengthen losses for LINK holders.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.