In accordance with Coinbase, the crypto market might face volatility or downward stress within the subsequent 4-6 weeks.

The Coinbase Month-to-month Outlook for April 2025 supplies a transparent roadmap for the crypto market, balancing warning with optimism in comparison with different forecasts.

Brief-Time period Market Volatility Anticipated

Coinbase predicts that crypto costs might stabilize in mid-to-late Q2 (Could to June 2025), laying a robust basis for progress in Q3 (July to September). This era is anticipated to supply vital alternatives for buyers.

Equally, a QCP Capital report predicts a possible bullish Q2 for crypto, drawing from TradFi market developments. Nonetheless, from April to mid-Could, Coinbase anticipates destructive market volatility.

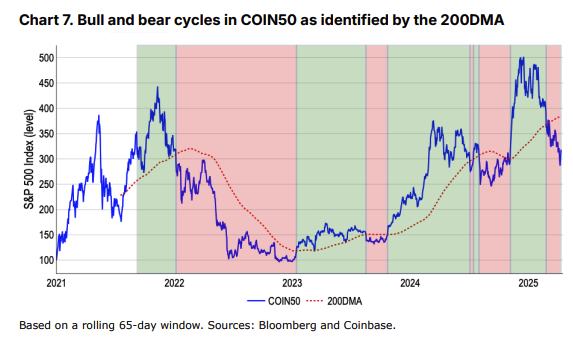

It was noticed that each Bitcoin (BTC) and the COIN50 index have lately fallen beneath their 200-day transferring common (200DMA), signaling the potential begin of a bearish market cycle. The Coinbase 50 Index or COIN50 tracks the efficiency of the 50 largest and most liquid digital belongings by market cap.

The volatility stems from world financial uncertainties, notably new tariff insurance policies. Tight fiscal insurance policies and macroeconomic components additionally stress danger belongings, together with cryptocurrencies. Coinbase advises buyers to stay cautious and undertake defensive danger methods.

This short-term outlook aligns with Morningstar Q1 2025 Evaluation forecasting continued Q2 volatility attributable to commerce insurance policies and rate of interest expectations. Escalating US-China commerce tensions, a CNY change fee at an 18-year low, and the Concern & Greed Index indicating “Extreme Fear” in early 2025 additional contribute to market uncertainty.

Q3 Restoration and Progress

Regardless of the gloomy short-term outlook, Coinbase is optimistic about mid-term prospects, predicting worth stabilization in mid-to-late Q2 attributable to sturdy supportive components. Historic developments present that after sharp Q1 corrections, markets typically stabilize in Q2. For example, after Bitcoin dropped from $10,000 to $3,850 in March 2020, it stabilized round $6,000-$7,000 by Could-June earlier than surging later that 12 months.

ARK Make investments’s Huge Concepts 2025 report predicts 2025 as a 12 months of “unprecedented growth” for cryptocurrencies, pushed by institutional adoption and technological developments. Looser financial insurance policies and declining bond yields in early Q2, as famous in Morningstar’s Q1 2025 Evaluation, may additional help danger belongings.

Rising institutional adoption is one other key driver. Coinbase’s 2025 Crypto Market Outlook highlights elevated institutional participation, notably by spot Bitcoin ETFs. ARK Make investments notes that blockchain improvements and clearer US laws will bolster market stability and progress.

Coinbase expects Q3 2025 to be a interval of sturdy progress, constructing on Q2’s foundations. A important issue is Bitcoin’s post-halving cycle, which traditionally triggers vital worth will increase. Q3 2025 aligns with this cycle, promising substantial positive aspects.

Extra catalysts, resembling approvals for extra crypto ETFs within the US and improved laws, as predicted in Coinbase’s 2025 Crypto Market Outlook, may additional propel the market.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.