The cryptocurrency market is reeling from the escalating public feud between US President Donald Trump and Tesla CEO Elon Musk. Whole liquidations have surged previously 24 hours, nearing $1 billion.

Moreover, the general market capitalization has dropped, with seven of the highest 10 cryptocurrencies posting losses immediately.

How Did The Trump-Musk Feud Influence the Crypto Market?

Tensions between Trump and Musk erupted over the latter’s criticism of the President’s tax and spending invoice.

“This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. Shame on those who voted for it: you know you did wrong. You know it,” Musk posted on X.

The feud escalated as Trump dismissed Musk’s criticisms, accusing him of affected by “Trump Derangement Syndrome.” Trump additionally threatened to revoke authorities subsidies and contracts for Musk’s companies.

The dispute, which is enjoying out publicly on X, has launched unpredictable variables into the market, together with private scandals and coverage disagreements.

Moreover, it has additionally rattled investor confidence, with the market going through vital downward stress. BeInCrypto information confirmed that over the previous 24 hours, the overall crypto market capitalization fell 5.1%.

Seven of the highest ten cash have depreciated over the previous day. Musk’s favourite, Dogecoin (DOGE), noticed the sharpest fall of seven.9%, adopted by Ethereum’s (ETH) 6.6% decline.

Bitcoin (BTC) dipped 2.4% and fell beneath the $105,000 mark. The President’s meme coin was additionally negatively impacted. Based on the most recent information, Official Trump (TRUMP) was down 10.8%.

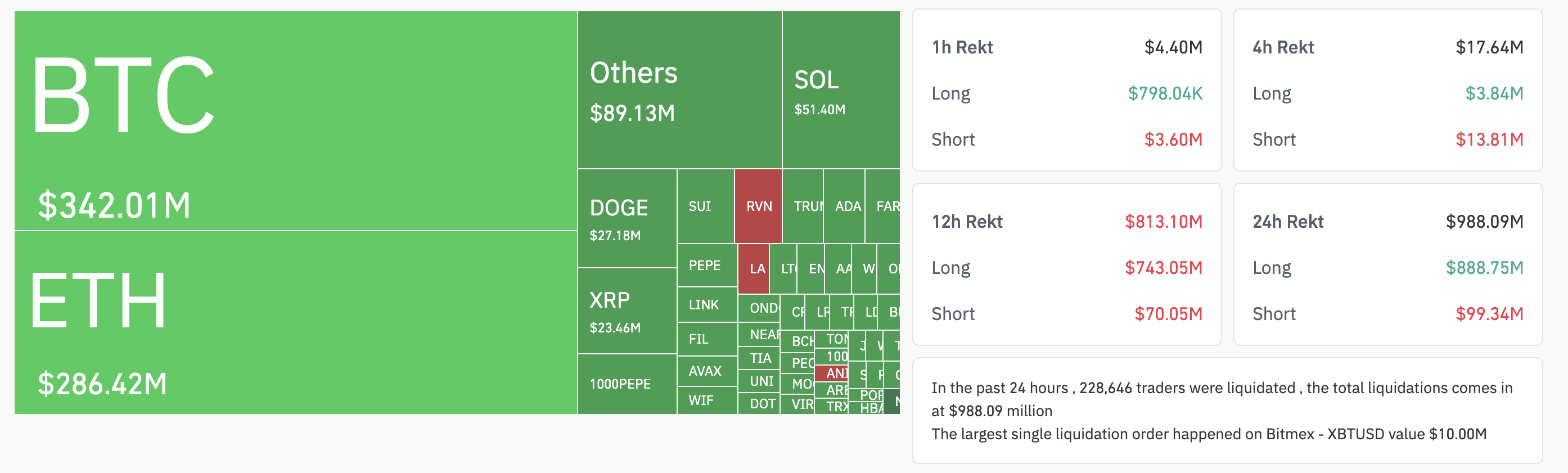

This worth drop triggered a wave of liquidations, as many leveraged positions had been pressured to shut, amplifying volatility. Based on Coinglass information, over the previous 24 hours, whole liquidations reached $988.09 million.

228,646 merchants had been liquidated throughout this era, highlighting the dimensions of the market’s response. Bitcoin bore the brunt of the sell-off, with liquidations amounting to $308.1 million for lengthy positions and $33.8 million for shorts. Ethereum adopted intently, recording $260.1 million in lengthy liquidations and $26.3 million in shorts.

Lengthy positions accounted for $888.7 million of the overall liquidations, whereas quick positions contributed $99.3 million, reflecting the depth of the risk-off sentiment.

That’s not all. The Bitcoin Coinbase Prime Index, a key indicator of US institutional investor sentiment, additionally turned unfavorable.

‘The Coinbase Prime Index just flipped negative, showing that US institutional investors and whales suddenly turned bearish. Let’s see how this performs out within the quick time period, however there’s a brand new narrative unfolding proper now, simply because the “Trade War” theme was beginning to lose its affect,” an analyst wrote.

In the meantime, some even suspect the feud is a component of a bigger plan to govern markets.

“Elon Musk and Donald Trump have created a fake ‘beef’ to push the markets lower. This is manipulation of the highest order. It’s insane to think they would do this,” a market watcher acknowledged.

Will Bitcoin Profit from the Trump-Musk Fallout?

Past the short-term volatility, the fallout has raised considerations about longer-term financial impacts. Musk has publicly warned of a possible US recession within the second half of 2025, attributing it to Trump’s tariff insurance policies.

“The Trump tariffs will cause a recession in the second half of this year,” the put up learn.

This warning aligns with broader market fears, as Trump’s commerce insurance policies have already contributed to market instability earlier this 12 months. Regardless of this, some speculate that the breakdown within the Trump-Musk relationship may benefit Bitcoin.

“The downfall of Elon Musk and Trump’s relationship will be marked by the printing of money like we’ve never seen before. Bitcoin is going to fkn explode. Brace yourself,” a consumer claimed.

Kashif Raza, Founding father of Bitinning, additionally defined that the dispute might have a number of implications for Bitcoin. His put up explored varied situations, resembling Trump imposing sanctions or eradicating subsidies from Musk’s corporations, Musk probably being deported, or Musk choosing Bitcoin to bypass restrictions. It additionally considers the potential for Musk accepting Bitcoin donations if he runs for workplace.

“In all possible scenarios, Bitcoin is winning because censorship resistance is one of its strong features,” Raza famous.

Whereas it’s unsure whether or not these situations will materialize, one factor is for certain: Because the Trump-Musk feud continues, its ripple results will possible hold the crypto market on edge.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.