Ethereum has seen some sideways motion this week, serving to the altcoin get away of an almost three-week-long downtrend. Regardless of dealing with bearish cues, together with whale promoting, Ethereum’s value has managed to carry regular.

This stability is elevating expectations of an upcoming breakout, probably setting the stage for an increase.

Ethereum Whales Transfer To Promote

Whale addresses are exhibiting bearish sentiment for the time being, as a number of giant holders have began to liquidate their positions.

Within the final 48 hours, addresses holding between 1 million and 10 million ETH offered over 1.06 million ETH price roughly $2.57 billion.

Whale promoting usually exerts downward strain on the worth, signaling potential bearishness. Nonetheless, on this case, Ethereum’s value has continued to maintain itself, which signifies market resilience.

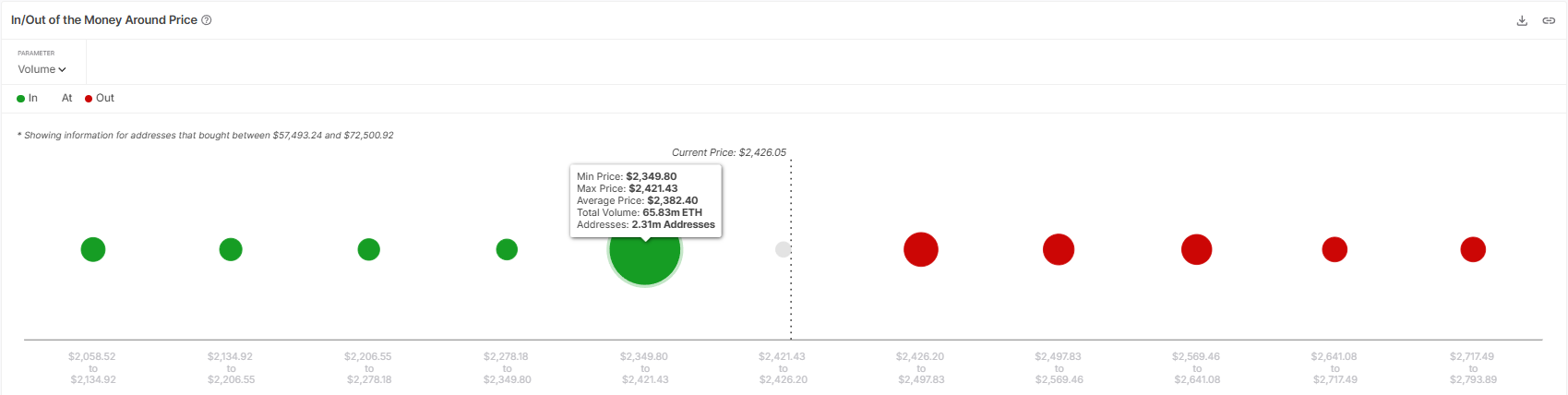

Ethereum’s macro momentum, the IOMAP (In/Out of the Cash Round Value) chart reveals a major demand zone for ETH. The zone holds 65.83 million ETH, valued at over $159 billion.

These holdings have been purchased between the $2,349 and $2,421 vary, establishing a robust assist space.

The big variety of buyers who bought ETH on this value vary are unlikely to promote at break-even or loss, making it tough for the worth to fall beneath this key assist.

This demand zone acts as a strong cushion for Ethereum’s value, defending it from any sharp declines. The assist from these buyers gives a basis for Ethereum’s value to stay steady regardless of the current promoting strain.

In consequence, the worth is much less more likely to drop sharply beneath the $2,344 mark, which might in any other case signify a extra important bearish development.

ETH Value Is Consolidating

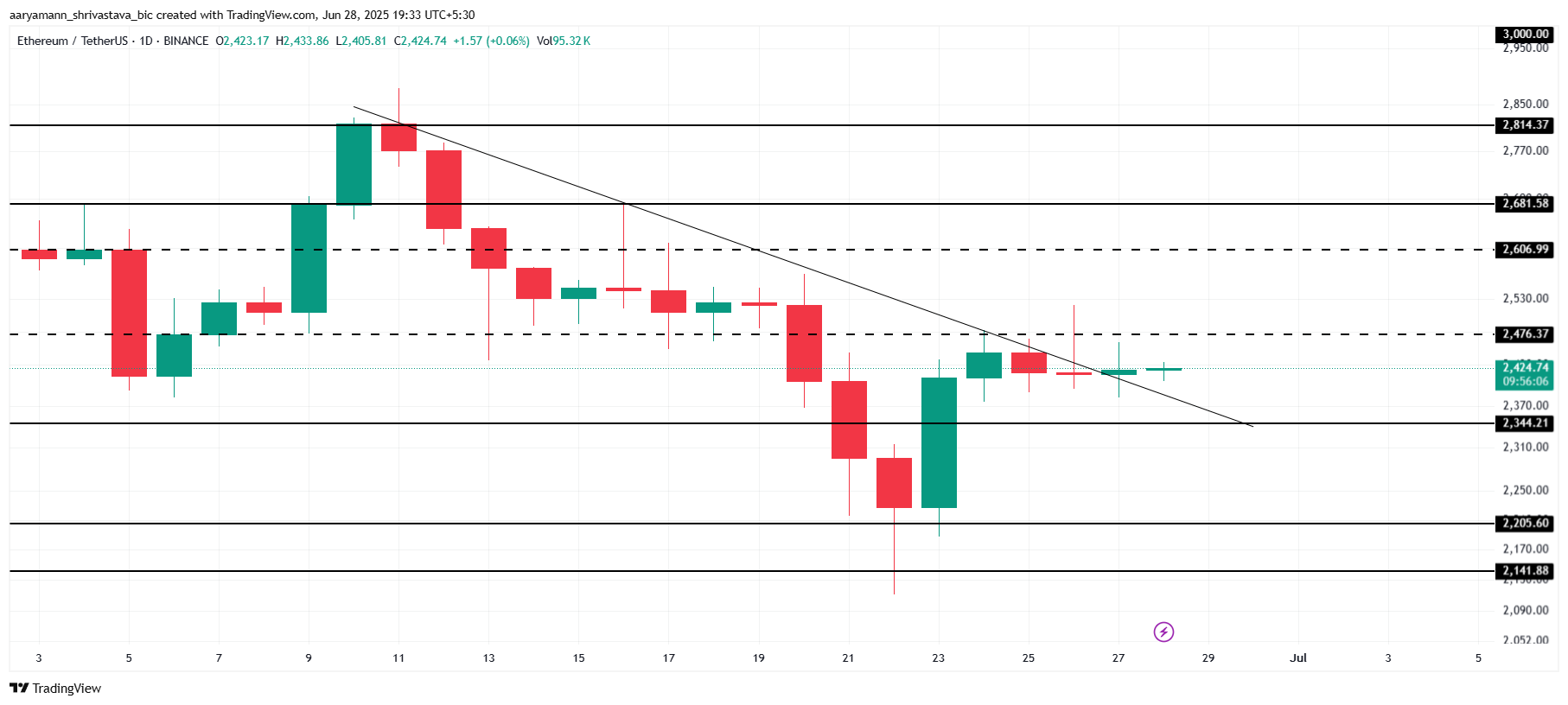

Ethereum’s value is at the moment buying and selling at $2,424, just below the vital resistance of $2,476.

Whereas there was no important rise, the sideways motion has allowed ETH to interrupt out of the three-week downtrend. This consolidation part is setting the stage for potential upward momentum.

The components mentioned earlier point out that Ethereum might proceed to consolidate between $2,344 and $2,476 or probably break by the resistance.

If Ethereum efficiently flips $2,476 into assist, an increase to $2,606 is probably going. This is able to mark a major breakout and will appeal to extra patrons into the market.

Alternatively, if broader market circumstances flip extraordinarily bearish, much like final week’s sentiment, Ethereum’s value may slip beneath $2,344 and fall to $2,205.

A drop beneath this assist would invalidate the present bullish thesis, probably signaling an additional decline.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.