The worth of the main altcoin, Ethereum, has plunged to its lowest level since March 2023, signaling a steep decline in market confidence. This has occurred amid the broader market’s downturn, which was exacerbated by Donald Trump’s Liberation Day.

Compounding the bearish sentiment, the ETH/BTC ratio has now dropped to a five-year low, indicating that Bitcoin is gaining relative energy towards Ethereum.

ETH/BTC Ratio Hits 5-Yr Low as Merchants Flee

ETH’s value decline has pushed the ETH/BTC ratio to a five-year low of 0.019. This ratio measures ETH’s relative worth in comparison with BTC. When it rises, it signifies that ETH is outperforming BTC, both as a result of the altcoin’s value is rising sooner or the king coin’s value is falling.

Conversely, a decline like this implies that the main coin, BTC, is gaining energy relative to the highest altcoin, ETH. It means that merchants are transferring capital into BTC, seeing it as a safer or extra worthwhile funding for the time being regardless of its personal value troubles.

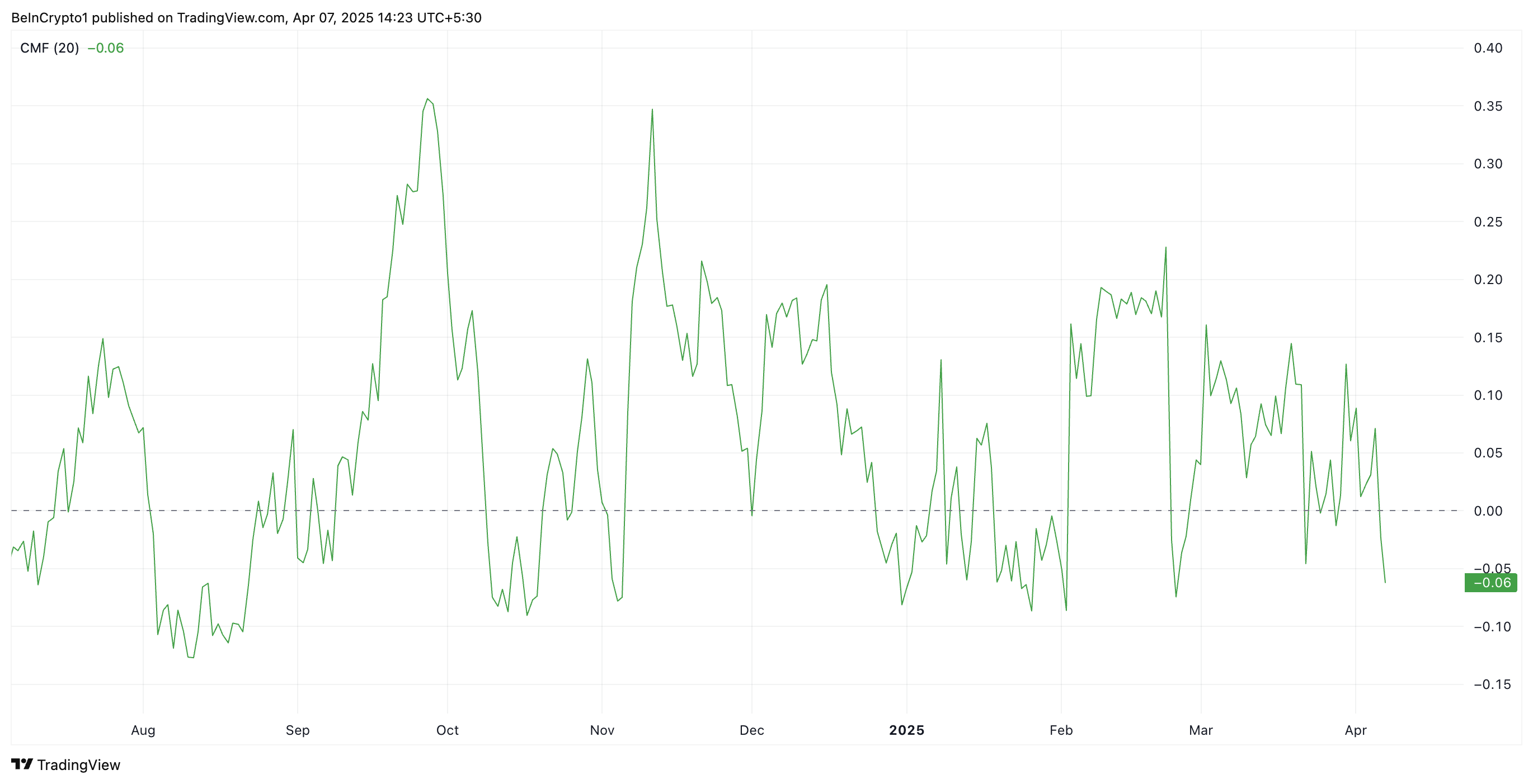

Additional, on the each day chart, ETH’s adverse Chaikin Cash Stream (CMF) confirms the coin’s plummeting demand. At press time, it’s at -0.07.

The CMF indicator measures the volume-weighted accumulation and distribution of an asset over a set interval, serving to gauge shopping for and promoting strain. When its worth falls beneath zero like this, it signifies that promoting strain is dominating.

ETH’s CMF readings counsel that extra merchants are distributing (promoting) the coin than accumulating it. This displays weakening demand and is a bearish sign for the asset’s value momentum.

ETH Flashes Oversold Sign: Is a Bounce Again on the Horizon?

ETH’s Relative Energy Index (RSI), noticed on a one-day chart, reveals that the altcoin is at present oversold. At press time, the momentum indicator is in a downtrend at 25.62.

The RSI indicator measures an asset’s overbought and oversold market circumstances. It ranges between 0 and 100. Values above 70 counsel that the asset is overbought and due for a value decline, whereas values beneath 30 point out that the asset is oversold and should witness a rebound.

At 25.62, ETH’s RSI indicators that the coin is deeply oversold. This presents a shopping for alternative, as such lows are normally adopted by a value rebound.

If this occurs, ETH’s value might regain and climb again above $1,589. If this help degree strengthens, it might propel ETH’s worth to $1,904.

Nonetheless, this rebound is just not assured. If ETH bears keep dominance and selloffs proceed, the coin might lengthen its decline and fall towards $1,197.

The submit Ethereum (ETH) Tanks to March 2023 Ranges as ETH/BTC Ratio Plummets to 5-Yr Low appeared first on BeInCrypto.