Ethereum’s worth has remained beneath vital strain over the previous month, but staking exercise has surged.

On-chain information reveals a notable enhance within the quantity of ETH locked in staking contracts, even because the altcoin struggles to regain upward momentum.

ETH Staking Grows Whereas ETF Outflows Hit $524 Million

Since plummeting to its year-to-date low on February 16, the quantity of staked ETH has risen. With 33.98 million ETH at present locked in staking contracts, this determine has gone up by 1% over the previous month.

This has occurred regardless of the numerous drop in ETH’s worth prior to now 30 days. Buying and selling at $1,897 at press time, ETH’s worth has plummeted by 30% since February 16.

The divergence means that many traders proceed to see the coin as a long-term asset fairly than a short-term buying and selling alternative. They display confidence in ETH’s future worth efficiency by locking up their cash as an alternative of promoting amid current headwinds.

Furthermore, this elevated staked ETH might point out rising institutional and retail curiosity in passive yield, whilst short-term worth motion stays unimpressive.

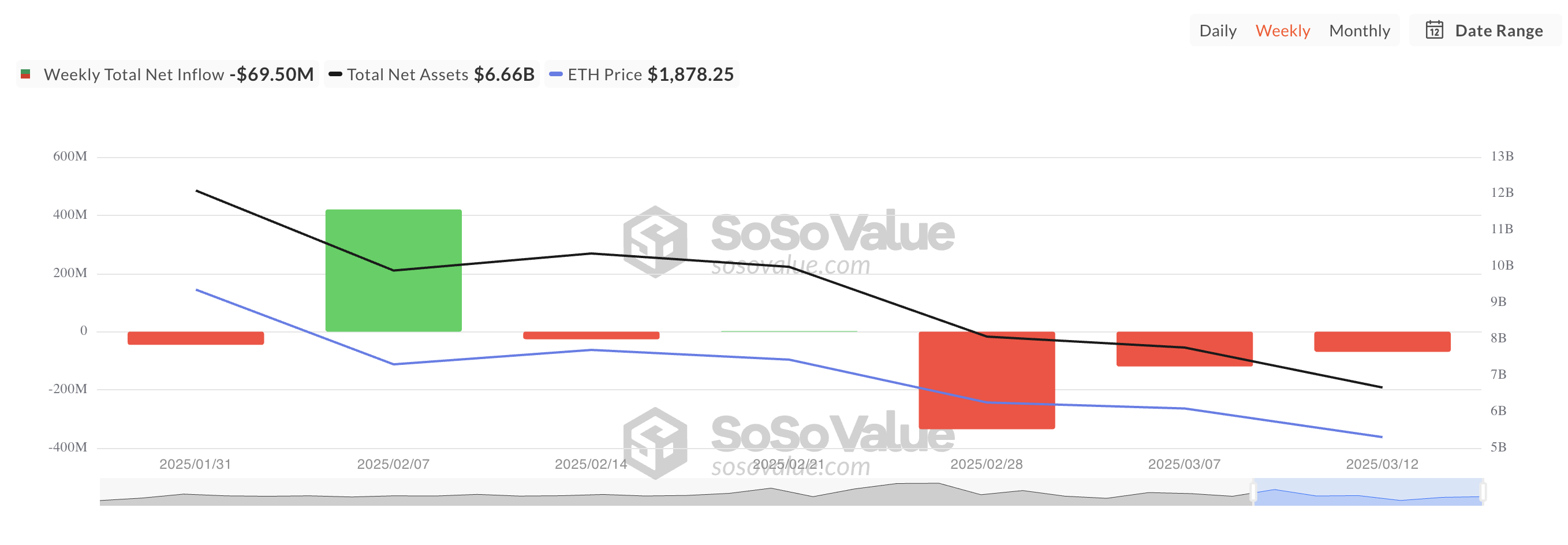

Nonetheless, this bullish stance contrasts with the current decline in spot ETH exchange-traded fund (ETF) inflows, elevating questions on broader market sentiment. Knowledge from SosoValue reveals that these funds have recorded outflows totaling $524.68 million prior to now three weeks.

When ETH ETFs see internet outflows like this, traders are withdrawing extra funds than they’re placing in. This means a bearish sentiment towards the coin and places extra downward strain on its worth.

Ethereum’s Eyes Deeper Pullback—Or a Bullish Reversal?

ETH trades at $1,897 at press time, breaking under the important thing assist fashioned at $1,924. The adverse readings from its Stability of Energy (BoP) mirror the continuing promoting exercise amongst ETH holders.

As of this writing, this indicator, which compares the power of the bulls towards the bears, is under zero at -0.27. When an asset’s BoP is adverse, its sellers exert extra management over worth motion, confirming the downward strain on worth.

If this pattern persists, ETH might proceed its decline to commerce at $1,758.

Alternatively, if sentiment flips and turns into absolutely bullish, it might drive ETH’s worth above the $1,924 resistance and towards $2,224.

Disclaimer

According to the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.