Binance Coin (BNB) has dropped beneath $500 once more, regardless of a number of makes an attempt to remain above this degree. This decline has prompted merchants and the broader crypto market, which has been in a state of utmost worry, to change into more and more bearish on the coin.

As of this writing, BNB trades at $494. This evaluation explains what the members consider the cryptocurrency’s short-term potential and highlights the seemingly value development.

Binance Coin Merchants Have Modified Sides

In response to Coinglass, BNB’s Lengthy/Quick ratio initially rose within the early hours of September 7 however has since dropped to 0.85. This ratio, which measures investor sentiment, signifies that 53% of merchants anticipate the worth to say no.

Then again, 46% of BNB merchants are betting on a value improve. A Lengthy/Quick ratio above 1 means that extra merchants are taking lengthy positions, anticipating a value rise.

Nevertheless, the present drop beneath 1 alerts that many members doubt BNB’s capability to maintain an uptrend. Because of this, the damaging sentiment might make it more durable for the coin’s value to get well, doubtlessly dampening demand.

Learn extra: 9 Finest Crypto Desktop Wallets for 2024

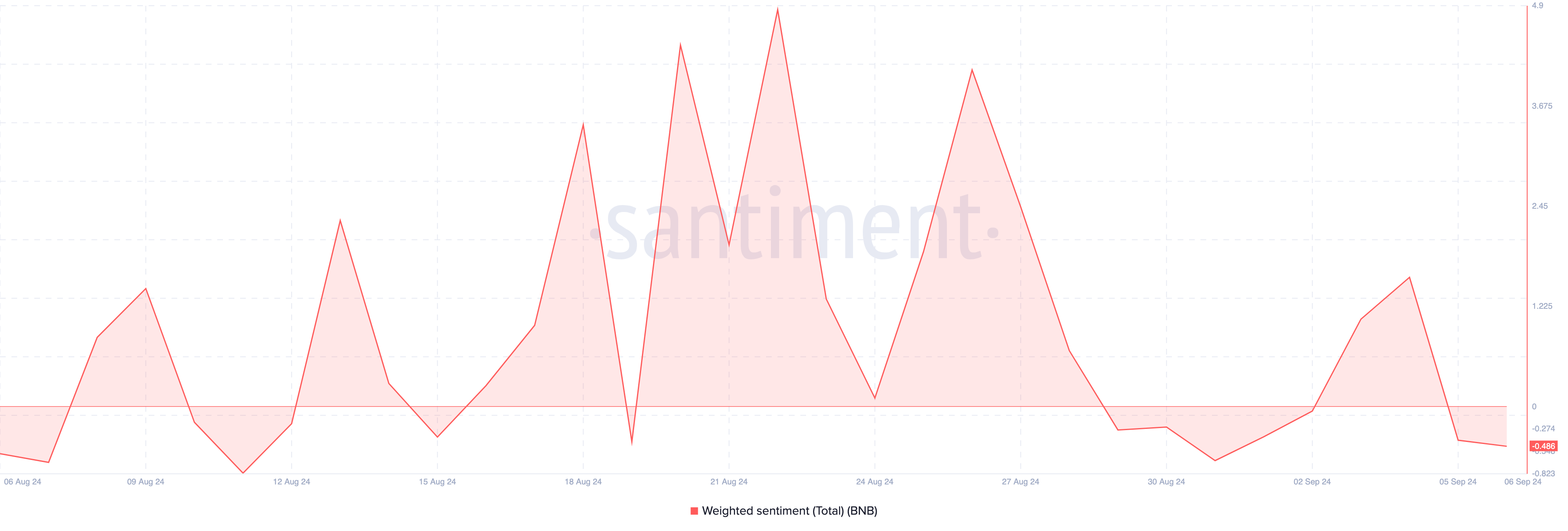

Nevertheless, merchants within the derivatives market should not the one ones with such a notion. In response to Santiment, the Weighted Sentiment climbed to $1.57 on September 4. At this time, the identical metric is right down to -0.46.

Weighted Sentiment reveals if the feedback on-line round a cryptocurrency are principally bearish or bullish. If the studying is constructive, then most feedback are bullish. Nevertheless, in Binance Coin’s scenario, most posts or messages round it tilt towards a damaging sentiment, reinforcing the notion that many members doubt a BNB value restoration.

BNB Value Prediction: Transfer to $464 Potential

On the day by day BNB/USD timeframe, bulls had tried to defend the assist at $503, however bears finally resisted it as the worth broke right down to $494. A take a look at the Exponential Shifting Common (EMA) displayed the formation of a dying cross.

A dying cross is a bearish sample that happens when a shorter Exponential Shifting Common (EMA) drops beneath an extended one. On this case, the 20-day EMA (blue) has crossed beneath the 50-day EMA (yellow), signaling that BNB’s value stays vulnerable to additional decline.

If bulls fail to defend the worth once more, the coin value may lower to $464. Whereas restoration seems to be unlikely, consumers should BNB wouldn’t drop beneath $487. As soon as this occurs, the bearish thesis is perhaps invalidated, and an upswing to $503 might come to cross.

Learn extra: Binance Coin (BNB) Value Prediction 2024/2025/2030

Concerning the attainable invalidation, Brian Quinlivan, Lead Analyst at Santiment, suggests that after aid seems, the market might absolutely assist the coin value.

“BNB has been relatively quiet over the past month, but there has been a steady, noticeable rise in social volume. The crowd will likely play a part in its next rise,” Quinlivan informed BeInCrypto.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.