Slowing inflation in each international locations anticipated to restrict fee hole and will buffer the Canadian greenback

Article content material

The divergence in rates of interest between Canada and the US turned a scorching subject and a percolating fear for economists when it seemed just like the Financial institution of Canada would feast on cuts whereas the U.S. Federal Reserve sat pat.

Now, some economists are beginning to consider there could also be much less want to fret about such a divergence, given the newest inflation knowledge launched in each international locations.

Commercial 2

Article content material

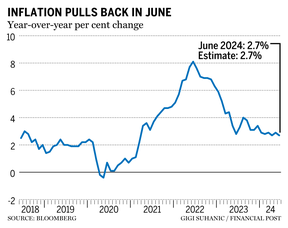

Statistics Canada on Tuesday mentioned inflation slowed to 2.7 per cent 12 months over 12 months in June from 2.9 per cent in Might, all however cementing expectations of a second 25-basis-point rate of interest reduce by the Financial institution of Canada on July 24.

U.S. inflation, launched final week, confirmed the core shopper worth index (CPI) rising at its slowest tempo in additional than three years, spurring markets to cost in a potential September fee reduce by the Fed. Beforehand, markets had anticipated it to chop solely as soon as in December.

“The BoC’s latest round of business and consumer surveys showed that inflation expectations are easing off on balance, which will also provide the BoC with more comfort to continue to cut rates,” Katherine Decide, a senior economist at CIBC Capital Markets, mentioned in a be aware. “And it’s also looking like they will have to worry less about policy divergence with the Fed that is set to cut in September.”

One other economist echoed Decide’s tackle divergence.

“Disinflation south of the border points to a Fed rate cut in September, which limits the divergence in the policy rates between the Bank (of Canada) and the Fed,” Tu Nguyen at assurance, tax and consulting agency RSM Canada LLP mentioned.

Article content material

Commercial 3

Article content material

Rate of interest divergence swept onto the financial radar within the spring because the U.S. economic system steamed forward of its northern counterpart and economists started to forecast that the Financial institution of Canada must reduce rates of interest many extra occasions than the Fed.

Economists nervous the ensuing chasm between the 2 benchmark lending charges would result in dire penalties for the loonie, since decrease charges would outcome within the Canadian forex dropping in worth, forcing buyers to show elsewhere for a greater return. In the meantime, a less expensive forex might feed inflation as a result of it might make buying items from outdoors the nation costlier.

Now that inflation is outwardly behaving, it might imply a narrower unfold between the the 2 central financial institution charges.

Nguyen expects a divergence of 100 foundation factors between the Financial institution of Canada and Fed charges at year-end, with their borrowing charges closing 2024 at 4 per cent and 5 per cent, respectively.

“The loonie will lose value in the short run as the bank’s policy rate diverges from the Fed,” she mentioned in an e-mail. “However, the U.S. June CPI report suggests that disinflation is underway south of the border, too, which means that both central banks will be cutting rates into 2025.”

Commercial 4

Article content material

CIBC is forecasting cuts totalling 100 foundation factors in Canada this 12 months, together with the one in June, and 50 foundation factors within the U.S. ought to the Fed provoke a primary reduce in September.

“Divergence is probably less of an issue from the (Bank of Canada’s) perspective now that we are getting closer to Fed cuts, which will work to limit policy divergence,” Decide mentioned in an e-mail. “That would leave the spread between the two banks within historical norms by the end of the year.”

Consequently, the loonie won’t be wanting as dangerous because it as soon as did, as some economists had been calling for it to fall as little as 69 U.S. cents at first of the 12 months.

As an alternative, Decide mentioned CIBC thinks the loonie might finish the 12 months not a lot weaker than the place it at present sits — round 73 U.S. cents — because the “overvalued” U.S. greenback begins to fall.

“We expect to see broad (U.S. dollar) softness, with the greenback starting from an overvalued position against other majors on trade fundamentals, and likely losing some of its earlier flight-to-safety gains as a global easing in monetary policy raises hopes for better global activity in 2025,” she mentioned.

Commercial 5

Article content material

CIBC is at present calling for the loonie to finish the 12 months at 72.5 U.S. cents.

Join right here to get Posthaste delivered straight to your inbox.

Canada’s annual inflation fee slowed to 2.7 per cent in June from 2.9 per cent a month earlier, forward of a Financial institution of Canada rate of interest choice subsequent week.

A slowdown in gasoline costs — which had been up 0.4 per cent year-over-year in comparison with a 5.6 per cent enhance in Might — was attributed to an announcement by the Group of the Petroleum Exporting Nations (OPEC) that it’ll re-open refineries for manufacturing following a spring upkeep shutdown. Excluding gasoline, inflation would have decelerated to 2.8 per cent.

One other sticky level was the price of meals purchased at shops, which rose year-over-year by 2.1 per cent in June, up from 1.5 per cent in Might. Over the previous three years, the value of meals bought in shops has risen by 21.9 per cent, however inflation on this class has been trending down since January of 2023. — Jordan Gowling, Monetary Put up

Learn the total story right here.

- Nova Scotia Premier Tim Houston hosts the 2024 summer time assembly of Canada’s premiers in Halifax

- Immediately’s knowledge: Canada worldwide securities transactions, U.S. constructing permits, housing begins and capability utilization. Federal Reserve releases Beige Ebook

- Earnings: Johnson & Johnson, Alcoa Corp., Equifax Inc., Kinder Morgan Inc., United Airways Holding Inc., FortisBC Inc., TransAlta Renewables Inc.

Commercial 6

Article content material

Beneficial from Editorial

-

Gloomy surveys recommend Financial institution of Canada might have left fee cuts too late

-

Companies and shoppers count on financial slowdown, Financial institution of Canada surveys present

There are various profitable Canadians who’re exploring or outright leaving this nation. Dependable statistics are onerous to return by, however tax practitioners have been stored very busy as a result of financial and taxation insurance policies matter, particularly the messaging surrounding such insurance policies. Tax professional Kim Moody argues that the most important explanation for profitable individuals leaving Canada is that they really feel that they’re being attacked in their very own nation and should not appreciated for all their contributions. Learn his full column right here

FP Solutions

Are you nervous about having sufficient for retirement? Do it’s worthwhile to regulate your portfolio? Are you questioning how you can make ends meet? Drop us a line at aholloway@postmedia.com together with your contact data and the overall gist of your drawback and we’ll attempt to discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, after all). If in case you have a less complicated query, the crack crew at FP Solutions led by Julie Cazzin or certainly one of our columnists may give it a shot.

Commercial 7

Article content material

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Put up column will help navigate the advanced sector, from the newest tendencies to financing alternatives you gained’t need to miss. Learn them right here

Immediately’s Posthaste was written by Gigi Suhanic, with extra reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material