Actual gross home product (GDP) elevated at an annual fee of two.8 p.c within the second quarter of 2024, in line with the “advance” estimate. Within the first quarter, actual GDP elevated 1.4 p.c. The rise within the second quarter primarily mirrored will increase in shopper spending, stock funding, and enterprise funding. Imports, that are a subtraction within the calculation of GDP, elevated.

The rise in shopper spending mirrored will increase in each companies and items. Inside companies, the main contributors to the rise had been well being care, housing and utilities, and recreation companies. Inside items, the main contributors to the rise had been motor autos and components, leisure items and autos, furnishings and sturdy family gear, and gasoline and different power items.

The rise in stock funding was led by will increase in wholesale commerce and retail commerce industries that had been partly offset by a lower in mining, utilities, and building industries.

The rise in enterprise funding mirrored will increase in gear and mental property merchandise that had been partly offset by a lower in buildings.

In comparison with the primary quarter, the acceleration in actual GDP primarily mirrored an upturn in stock funding and an acceleration in shopper spending. These actions had been partly offset by a downturn in housing funding. For extra particulars on the estimates, confer with the Technical Be aware.

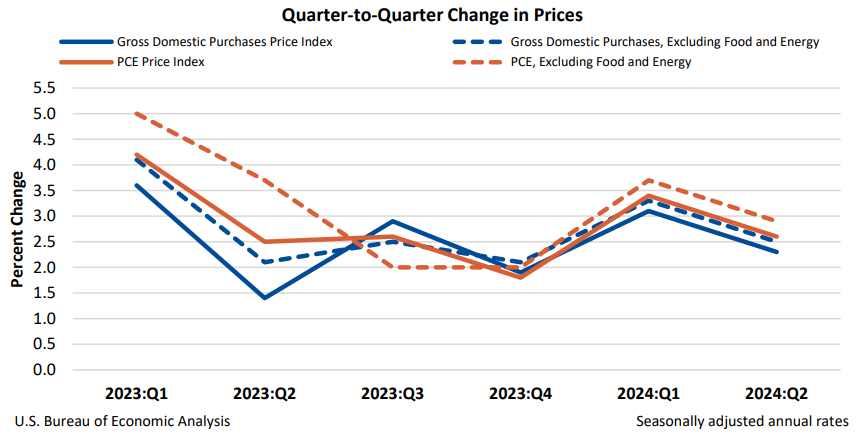

Costs

Gross home purchases costs, the costs of products and companies bought by U.S. residents, elevated 2.3 p.c within the second quarter, after rising 3.1 p.c within the first quarter. Excluding meals and power, costs elevated 2.5 p.c, after rising 3.3 p.c.

Private consumption expenditures (PCE) costs elevated 2.6 p.c within the second quarter, after rising 3.4 p.c within the first quarter. Excluding meals and power, the PCE “core” worth index elevated 2.9 p.c, after rising 3.7 p.c.

Private revenue and saving

Actual disposable private revenue (DPI)—private revenue adjusted for taxes and inflation—elevated 1.0 p.c within the second quarter after rising 1.3 p.c within the first quarter.

Present-dollar DPI elevated 3.6 p.c within the second quarter, following a rise of 4.8 p.c within the first quarter. The rise within the second quarter primarily mirrored will increase in compensation and authorities social advantages.

Private saving as a share of DPI was 3.5 p.c within the second quarter, in contrast with 3.8 p.c within the first quarter.

For extra data, learn the total launch.