HBAR famous a 20% rally throughout Wednesday’s intraday buying and selling session. This double-digit acquire was fueled by Nasdaq’s submitting of a 19b-4 kind with the US Securities and Alternate Fee (SEC) to listing and commerce Grayscale’s spot HBAR exchange-traded fund (ETF).

Nevertheless, the rally seems to be shedding momentum. Market indicators counsel that bearish sentiment is strengthening, placing HBAR prone to shedding latest positive factors.

HBAR Faces Downward Strain as Market Sentiment Turns Bearish

HBAR’s detrimental Steadiness of Energy (BoP) studying signifies weakening shopping for strain amongst its spot market contributors. At press time, this indicator, which compares the power of an asset’s bulls and bears, is beneath zero at -0.09.

When an asset’s BoP is detrimental, its sellers exert extra management over worth motion. This means weakening shopping for strain within the HBAR market and hints at a possible continuation of the bearish momentum.

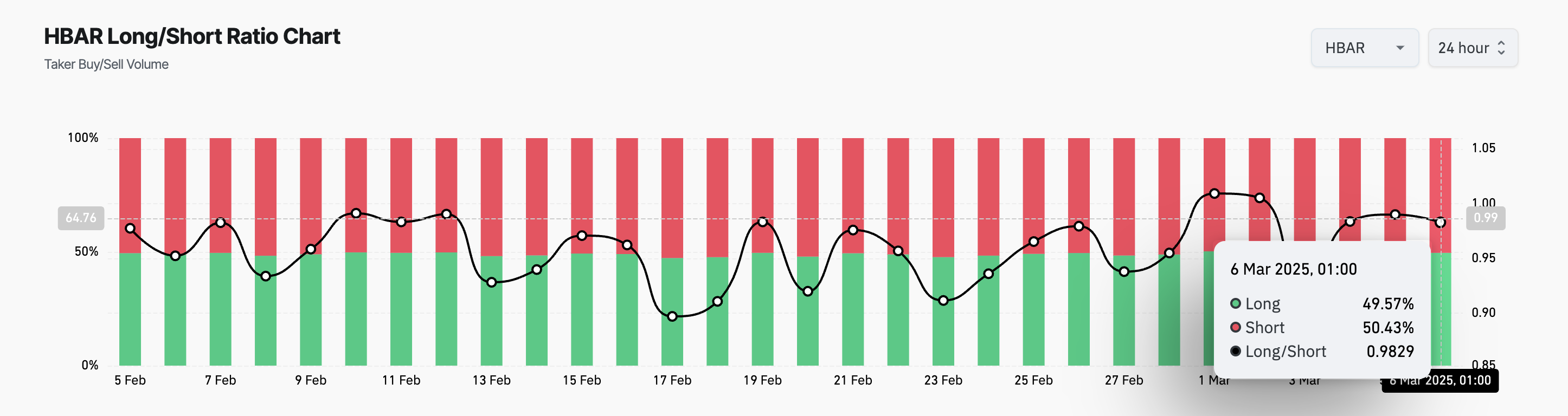

Furthermore, HBAR’s Lengthy/Brief ratio signifies an growing dominance of brief positions, confirming the bearish sentiment amongst its futures merchants. As of this writing, this stands at 0.98.

The Lengthy/Brief ratio measures the proportion of lengthy positions (bets on worth will increase) to brief positions (bets on worth declines) out there. When the ratio is beneath 1, it signifies that brief positions outnumber lengthy positions. It highlights the bearish sentiment amongst HBAR holders and will increase the downward strain on its worth.

HBAR’s Destiny Hangs within the Steadiness

HBAR exchanges palms at $0.24 at press time. On the each day chart, it trades above help fashioned at $0.22. If bearish strain positive factors momentum, this stage could fail to carry. HBAR’s worth might decline additional to $0.17 if the bulls can’t defend this help stage.

Conversely, a optimistic shift in market sentiment might forestall this. If new demand trickles into the market, HBAR’s worth might breach resistance at $0.26 and rally towards $0.31.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.