Hedera (HBAR) has elevated by 3.3% within the final 24 hours, bringing its market cap to $8.06 billion and its buying and selling quantity to almost $127 million. Regardless of the short-term value bump, technical indicators current a blended image.

The BBTrend has turned sharply unfavorable once more, whereas the RSI has rebounded to a impartial zone after latest volatility. HBAR continues to commerce in a good vary, and its subsequent transfer might rely on whether or not it will probably break resistance at $0.193 or maintain help close to $0.184.

HBAR BBTrend Turns Unfavourable Once more: What It Means

Hedera BBTrend is presently at -3.67, signaling renewed bearish stress after a quick restoration.

The metric had climbed to 1.84 simply yesterday, reflecting short-term momentum earlier than reversing sharply again into unfavorable territory.

This volatility means that market sentiment round HBAR stays unstable, with fast shifts in dealer positioning and potential uncertainty round near-term value route.

BBTrend, or Bollinger Band Development, measures the power and route of value motion relative to Bollinger Bands. Values above +2 usually point out sturdy bullish momentum, whereas values under -2 replicate sturdy bearish tendencies.

A BBTrend studying of -3.67 means that HBAR’s value is considerably leaning towards the decrease Bollinger Band, typically interpreted as persistent draw back momentum.

If sentiment doesn’t shift quickly, this will indicate continued promoting stress or a attainable retest of latest help ranges.

Hedera RSI Recovers to Impartial Zone After Unstable Swing

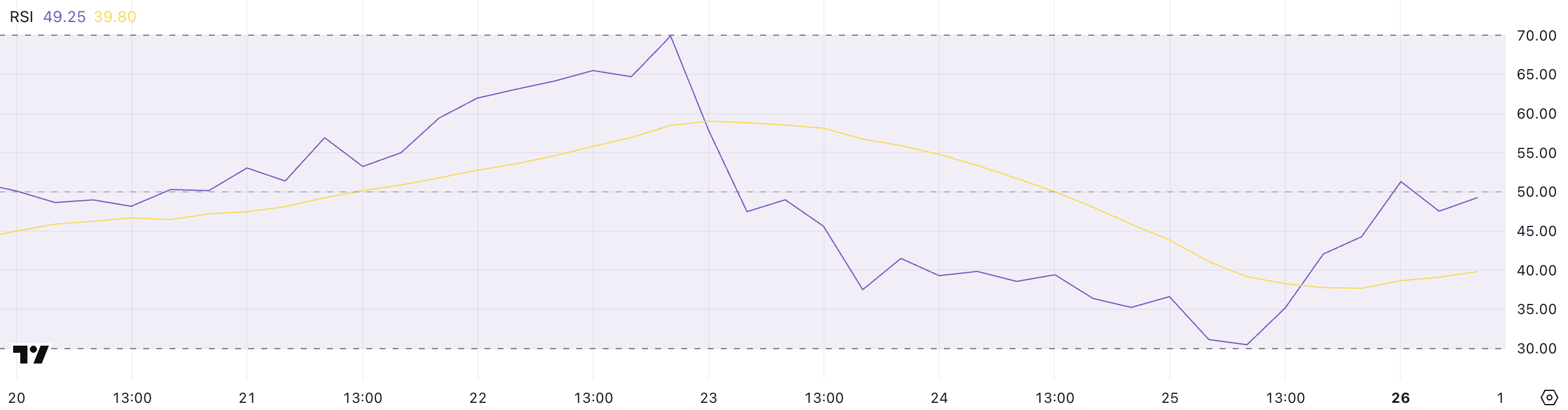

Hedera Relative Power Index (RSI) presently sits at 49.25, recovering from a low of 30.46 simply in the future in the past.

This rebound comes after the RSI almost hit overbought ranges at 69.91 4 days in the past, highlighting a unstable shift in momentum.

The latest bounce from near-oversold territory to a extra impartial zone means that bearish stress has eased, however conviction amongst patrons stays restricted for now.

RSI is a momentum oscillator that measures the velocity and alter of value actions on a scale of 0 to 100.

Readings above 70 sometimes point out overbought circumstances, whereas values under 30 counsel an asset is oversold and could also be due for a rebound.

HBAR’s RSI at 49.25 alerts a impartial stance available in the market—neither strongly bullish nor bearish—implying that the following directional transfer may rely on broader market cues or upcoming catalysts.

Hedera Worth Outlook: Can Bulls Break the $0.20 Barrier?

Over the previous few days, Hedera has been consolidating in a slim vary between $0.183 and $0.193, displaying restricted volatility however signaling a possible buildup for a breakout.

If bullish momentum returns, Hedera value may break above the $0.193 resistance stage, opening the trail towards $0.20.

A sustained rally may push the value additional to $0.209 and, in a stronger uptrend, presumably as excessive as $0.228—ranges which have beforehand acted as resistance zones.

Nonetheless, the EMA strains presently supply little directional perception, reflecting indecision in development power.

If promoting stress will increase and HBAR fails to carry the $0.184 help stage, the token may decline towards $0.169, a stage that may signify a deeper retracement.

Till a transparent breakout or breakdown happens, HBAR’s value motion is prone to stay range-bound, with merchants watching carefully for any affirmation of development route.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.