HBAR has skilled appreciable volatility over the previous month, struggling to get well latest losses and break the month-and-a-half-long downtrend.

Regardless of these challenges, the altcoin stays in a essential place as merchants stay optimistic about its potential breakout. Nevertheless, a failure to interrupt key resistance ranges may result in additional worth declines.

HBAR Merchants Are Bullish

All through this month, merchants have proven robust bullish sentiment towards HBAR. The funding fee has remained constructive persistently, indicating a dominance of lengthy contracts out there.

This implies that merchants are assured a few potential worth restoration and are positioning themselves to capitalize on an increase in worth. The constant optimism displays a perception that HBAR can rebound from its present downtrend.

Additionally, the constructive funding fee reveals that extra buyers are keen to position bets on the way forward for altcoin regardless of the continuing challenges.

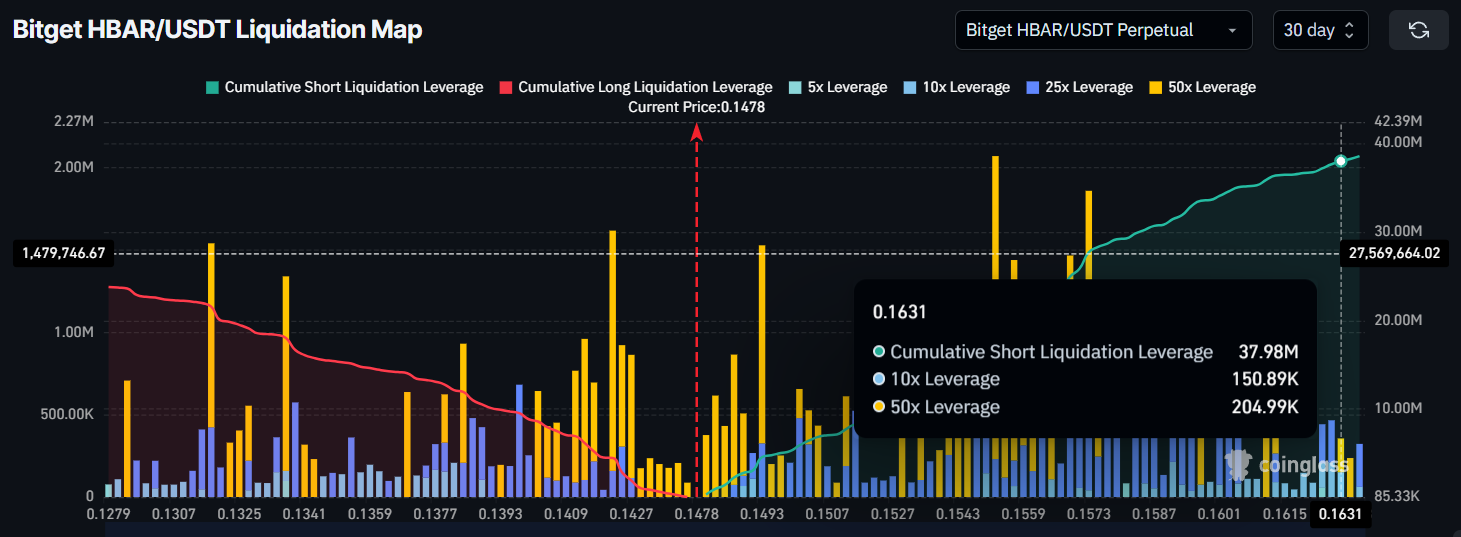

The macro momentum for HBAR reveals that brief merchants may face substantial losses if the worth rises. The liquidation map signifies that roughly $38 million price of brief contracts might be liquidated if HBAR breaks its present downtrend and rises to $0.163.

This might have a big influence in the marketplace, doubtlessly fueling additional shopping for momentum.

Brief merchants have been betting on continued worth declines, however a breakout above key resistance ranges may drive them to exit their positions. This might create extra shopping for stress, supporting the potential for a bigger upward transfer.

HBAR Value Is Awaiting A Increase

On the time of writing, HBAR is buying and selling at $0.148, just below the essential resistance stage of $0.154. The altcoin is seeking to breach this resistance and break the downtrend line that has been holding it again.

A profitable push previous this stage could be a key milestone in HBAR’s restoration.

The elements supporting a possible breakout point out that HBAR may rise to $0.163 if it manages to flip $0.154 into help. Reaching this stage may set off the liquidation of brief positions, additional driving the worth up.

This might assist HBAR achieve momentum and get well from its latest downtrend.

Nevertheless, if the broader market turns bearish, HBAR’s worth may fall to $0.139. Shedding this help could be a bearish sign, doubtlessly driving the worth additional all the way down to $0.133.

Such a decline would invalidate the bullish thesis and shift the market outlook again towards the bears.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.